We see that the emergence of exchange-traded funds (ETFs) tied to crypto assets has reshaped how institutional and retail investors engage with the market. Following the success of Bitcoin and Ethereum spot ETFs, Solana is poised to become the next major blockchain asset to enter the ETF spotlight. But beyond the regulatory milestones, the question remains: what impact could a Solana ETF have on the price of SOL and the liquidity of its market?

Understanding ETF Dynamics in the Crypto Market

Crypto ETFs allow investors to gain exposure to digital assets without directly managing wallets, private keys, or on-chain transactions. Spot ETFs, in particular, track the real-time price of an underlying asset, with the issuing fund custodian required to hold actual units of the token. This structure introduces new demand from traditional investors and institutions who prefer regulatory safeguards and ease of access via brokerage accounts.

Source: The Block Research

In the cases of Bitcoin and Ethereum, spot ETF approvals in the U.S. led to significant inflows and rapid appreciation in asset prices. For example, in the month following the January 2024 approval of spot Bitcoin ETFs, BTC saw over $7 billion in net inflows and a 40% price surge. Ethereum followed a similar pattern in May 2025. Analysts and investors now expect Solana to experience a similar trajectory—though the effects may vary based on structural and ecosystem differences.

For more: Solana ETF: VanEck, REX-Osprey & the Road Ahead

Anticipation and Inflows of Short-Term Price Impact

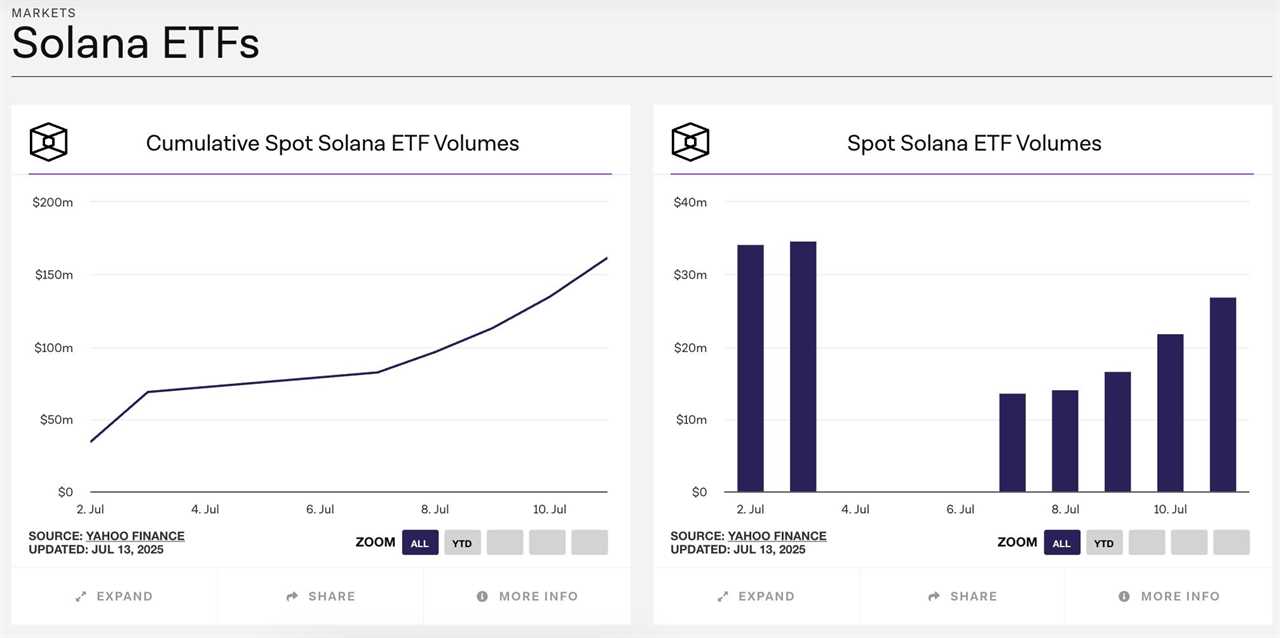

A key dynamic in ETF markets is the “buy the rumor, buy the news” phenomenon. Speculation around ETF approval tends to drive price appreciation before a decision is finalized, with further upside upon confirmation. In Solana’s case, the filing of multiple ETF applications in June and July 2025 has already contributed to a 25% increase in SOL price over a two-week period.

Source: The Block Research

Should the SEC formally approve a spot Solana ETF in Q4 2025, most analysts anticipate an immediate spike in demand. Bloomberg projects net inflows of $1–2 billion in the first month, with SOL potentially rallying 30–50% as new capital enters the market. This influx would come primarily from institutional allocators, wealth managers, and retail investors who had previously been unable or unwilling to hold native SOL tokens.

Unlike Bitcoin, which is often held as digital gold, or Ethereum, which is central to DeFi infrastructure, Solana also has strong narratives around high-speed consumer applications. A spot ETF would provide broader validation for these narratives and attract investor classes focused on growth and scalability plays.

For more: Altcoin ETFs After Solana – XRP, ADA, AVAX Next in Line

Liquidity Expansion from Crypto Natives to Traditional Finance

ETF approval has broader implications for market liquidity. By converting off-chain demand into on-chain custodial flows, ETFs tighten the connection between TradFi and crypto markets. The fund issuer (e.g., VanEck or Fidelity) must acquire real SOL tokens to back issued shares, typically sourcing from exchanges or OTC desks. This increases baseline demand and reduces available float.

We could see that when applying an ETF on any types of assets, it encourages more efficient arbitrage across venues. Market makers and authorized participants (APs) balance price discrepancies between ETF shares and the underlying SOL spot price, smoothing volatility and improving depth. At the core, ETF infrastructure creates an additional layer of liquidity routing that connects U.S. capital markets to decentralized trading ecosystems.

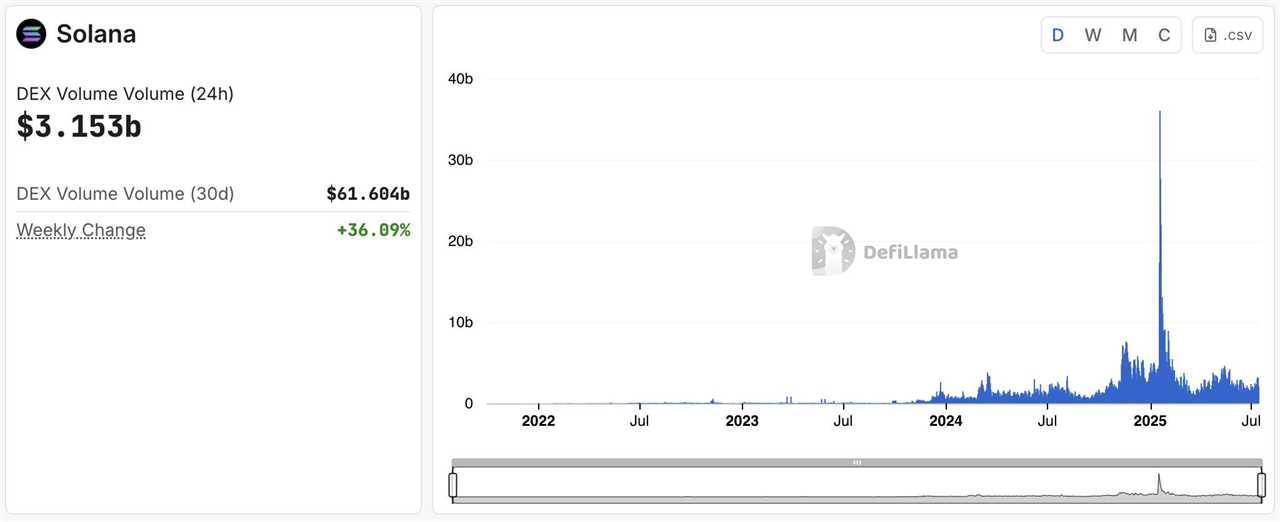

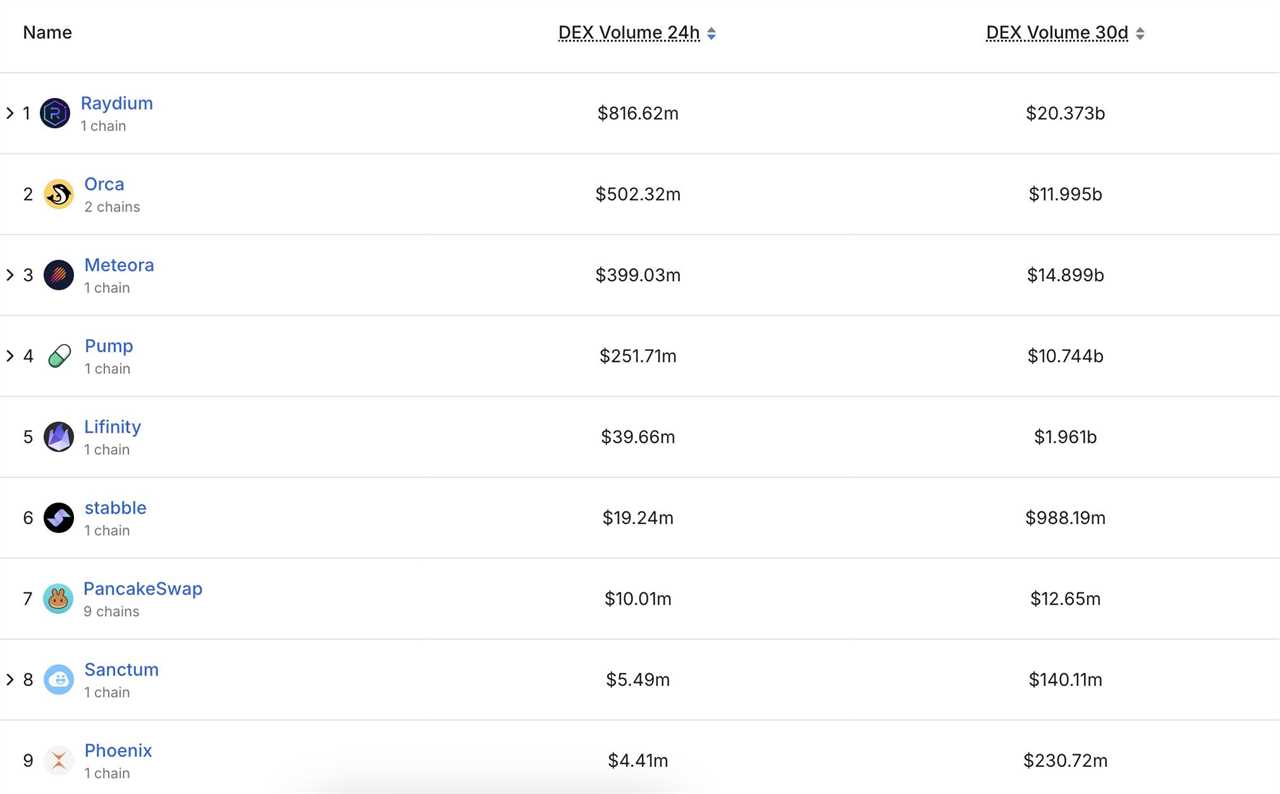

Source: DefiLlama

Moreover, as ETF trading scales, it can indirectly impact decentralized exchanges (DEXs) and DeFi protocols built on Solana. Protocols like Jupiter, Orca, and Drift could see higher volumes as on-chain activity increases in response to broader market participation. Similarly, staking participation might fluctuate if ETF issuers offer yield-inclusive products that influence supply dynamics.

For more: Tokenized Stocks vs ETFs: Which One Wins in the Long Run?

Solana’s Unique Liquidity Profile

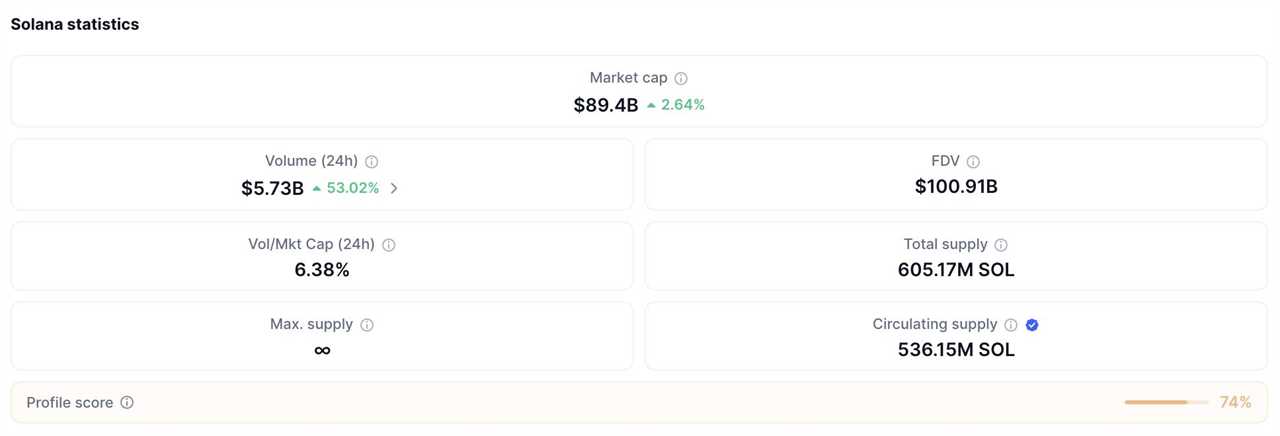

We see the reason why Solana stands out in the altcoin landscape is based on its exceptional liquidity characteristics, which are both seen on centralized and decentralized platforms. As of July 2025, Solana maintains an average daily trading volume exceeding $5.7 billion, positioning it as the third most liquid cryptocurrency after Bitcoin and Ethereum. This liquidity is distributed across major centralized exchanges such as Binance, Coinbase, and OKX, but also heavily represented on-chain through DEXs like Jupiter, Orca, and Raydium, where Solana consistently leads in Layer 1 on-chain trading volume.

Source: Coinmarketcap

Its fast finality, approximately at 400ms block times and low transaction fees enable high-frequency trading and arbitrage across venues. Besides, it also improves price discovery — a core metric regulators use when evaluating ETF readiness.

Moreover, the unique architecture of Solana blockchain allows for order book-based DEXs (like Phoenix and OpenBook), offering a trading experience comparable to traditional finance while maintaining decentralization. This composability and deep liquidity across multiple venues not only strengthen the case for a Solana ETF but also set a benchmark for other altcoins aspiring to follow its path.

Source: DefiLlama

Comparative Lessons from BTC and ETH ETFs

Let’s take Bitcoin and Ethereum as examples to clearly consider Solana. Looking at these historical data, ETF approval has both an impact on price-driven and narrative-driven. Launched in January 2024, Bitcoin spot ETFs saw $10 billion in assets under management (AUM) within six weeks. Ethereum, upon approval in May 2025, quickly absorbed over $3.5 billion in inflows.

SOL, with a current market cap of ~$65 billion and daily volumes averaging $5.7 billion, could absorb ETF-driven inflows while maintaining price stability, especially if launched during a bullish macro cycle. Analysts forecast that if SOL ETFs follow similar adoption curves, SOL could reach $250–$300 in early 2026 from its current ~$140 base, assuming 2–3% of total U.S. crypto AUM shifts toward Solana.

However, volatility remains a factor. Both BTC and ETH experienced temporary drawdowns after their ETF launches due to profit-taking, broader market conditions, or regulatory headlines. Solana is not immune to such corrections, particularly given its smaller size and historical network outages, which could resurface as investor concerns.

User Score

9.9

Promotion

-10% Trading Fees

Get 10% Lifetime Cashback on Every Trade

Risks and Considerations

While a Solana ETF opens the door to broader capital flows and mainstream recognition, it clearly shows some range of structural and regulatory risks that require careful examination.

The one and foremost concern is regulatory overhang. Although Solana has avoided classification as a security thus far, the SEC’s position remains fluid. In 2023, the SEC named SOL as a potential security in lawsuits against Coinbase and Binance, raising the spectre of post-ETF enforcement or reclassification. Should regulatory sentiment shift, the ETF could face sudden delistings or forced divestments.

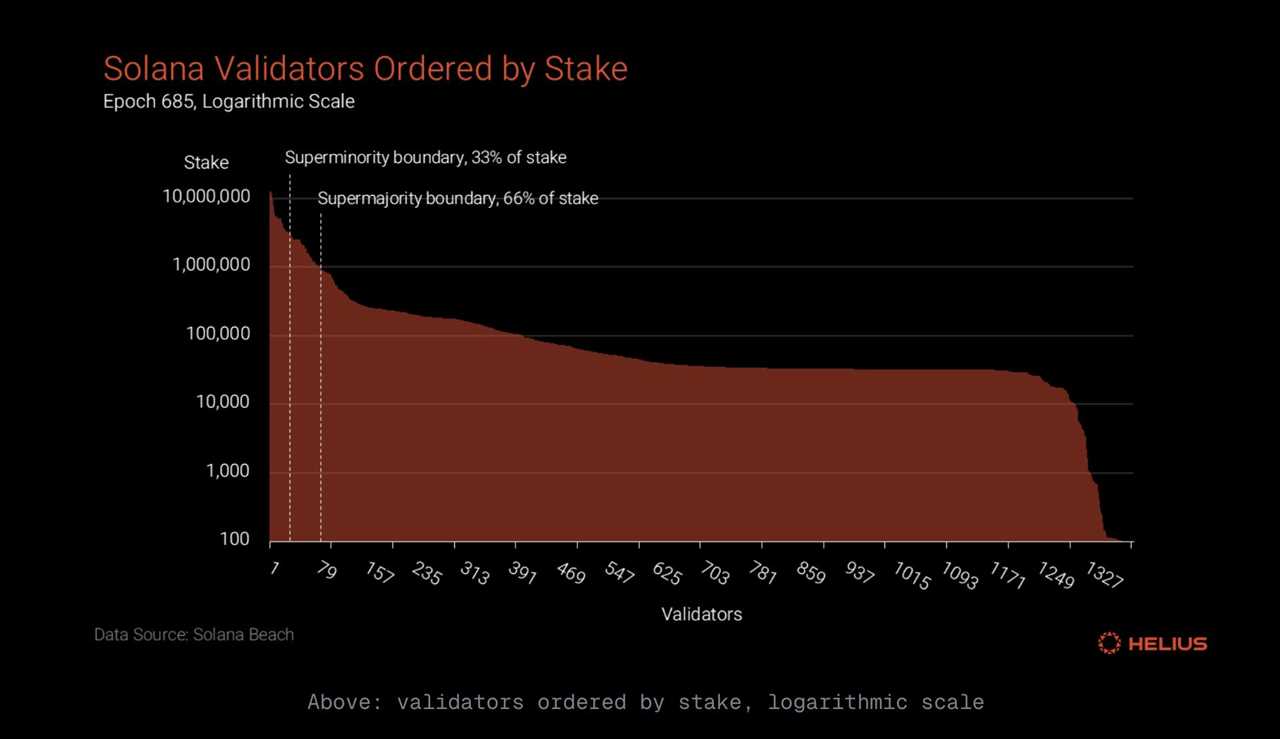

Furthermore, centralization critiques persist. As of mid-2025, more than 32% of Solana’s staked tokens are delegated to the top 10 validators, with several linked to large infrastructure providers. This concentration contrasts with Ethereum’s broader validator set and raises questions about Solana’s resilience under stress. The Solana network also experienced two major outages in 2022 and downtime incidents in early 2024, highlighting operational risks that institutions may weigh heavily.

Source: Helius

Additionally, overheating remains a real possibility. Historical precedent shows that assets receiving ETF approval often experience a sharp pre-listing rally followed by a post-launch selloff. For example, the Bitcoin spot ETF in January 2024 saw BTC surge to $48K before retracing 20% within two weeks. If SOL’s market cap spikes from ETF inflows without corresponding organic growth, liquidity squeezes or volatility may follow.

Finally, ETF design may alter staking dynamics. If large institutional ETFs like the VanEck Solana ETF choose not to stake tokens due to legal or operational constraints, the overall staking ratio (currently ~64%) could drop. This not only reduces network security but also affects the average staking yield, which has hovered around 6.8% APR. A decline in yield or validator participation could reverberate across DeFi protocols dependent on staked SOL.

In short, while ETF approval is a bullish milestone, the downstream effects introduce both market risks and systemic questions that require close monitoring.

The post The Impact of a Solana ETF on SOL Price and Market Liquidity appeared first on NFT Evening.

Read MoreBy: Liam Miller

Title: The Impact of a Solana ETF on SOL Price and Market Liquidity

Sourced From: nftevening.com/solana-etf-impacts/?utm_source=rss&utm_medium=rss&utm_campaign=solana-etf-impacts

Published Date: Mon, 14 Jul 2025 09:13:38 +0000

----------------------------

.png)