As DeFi has evolved recently, the battle for dominance in the derivatives space has intensified. With the surge in on-chain perpetual trading, platforms like dYdX, Aevo, and GMX have carved out niches—but none have reshaped the market as aggressively as Hyperliquid. Since its mainnet debut in 2023 and the launch of HyperEVM in early 2025, Hyperliquid has emerged as the new standard for on-chain performance, transparency, and user alignment.

Architectural Differences: The Battle Between Speed and Decentralization

Hyperliquid operates a custom Layer-1 blockchain, designed from scratch for high-frequency trading. At its core is the HyperBFT, a Byzantine Fault Tolerant PoS consensus mechanism enabling sub-second block finality and ~100,000 TPS throughput. Combined with its native HyperCore and HyperEVM, it delivers fully on-chain execution for all trades, orders, and liquidations.

With its custom L1 capable of ~100k+ orders per second, it significantly outpaces competitors. For context, most decentralized perps protocols can handle on the order of only a few thousand operations per second or less. For example, GMX (an AMM-based perps DEX on Arbitrum) and Vertex (orderbook on Arbitrum) are constrained by Ethereum L2 speeds – they can process perhaps ~2,000 orders per second at best.

Hyperliquid’s purpose-built chain, in contrast, doesn’t have to share blockspace or throughput with other dApps, allowing it to scale much higher. Even dYdX v4, which launched its own app-chain on Cosmos blockchain in late 2023, has lower throughput on paper; dYdX relies on the Cosmos SDK and Tendermint consensus, typically yielding block times ~1–2 seconds.

While fast, that’s still slower than Hyperliquid’s sub-second finality, and dYdX’s throughput is limited by its need for global blockchain consensus on each batch of trades. Hyperliquid’s pipelined HotStuff consensus and optimized networking give it an edge in pure speed. This shows in volumes: by Q4 2024, Hyperliquid was already handling 5× the trading volume of its nearest on-chain competitor (dYdX and GMX).

Source: OAK Research & GL Research

In December 2024 alone, Hyperliquid facilitated ~$160B of perp trading volume, whereas dYdX (used to be the leader) was far behind in market share. Hyperliquid also boasts higher leverage (up to 50× vs dYdX’s 20× and GMX’s ~50× on major pairs but effectively less liquid at extremes) and more markets (130+ vs ~30–40 on dYdX at the time and a similar range on GMX/Aevo). Aevo, which is built as an Optimism-based L2, also targets high throughput, but as an optimistic rollup its latency is tied to Ethereum’s pace and it currently allows up to 20× leverage.

In short, Hyperliquid offers the closest performance to a centralized exchange, which has been a decisive advantage in attracting active traders from slower platforms.

For more: Hyperliquid Deep Dive: Understand HYPE and HLP Model

Trading Experience and Liquidity Depth

When it comes to trading experience, Hyperliquid and dYdX both strive to emulate top-tier CEX platforms. Both exchanges offer professional web interfaces with TradingView charts, advanced order types, and features like cross-margining. Hyperliquid’s UI and matching engine deliver instant order execution and smooth order book updates thanks to the fast L1 – something users often notice when coming from other DEXs that feel laggy.

A major UX win for Hyperliquid is zero gas fees on trades. Neither dYdX’s new chain nor Aevo can fully match this; on dYdX (Cosmos), users must hold some $DYDX or other tokens to pay transaction fees when placing orders. Aevo, being an Optimism rollup, requires ETH for gas on each transaction, which adds friction and cost. GMX users on Arbitrum also pay gas for each trade or collateral adjustment, and GMX’s web app is simpler with fewer order types. Hyperliquid’s model of no gas and low trading fees makes it extremely cost-efficient, especially for high-frequency strategies that submit many orders.

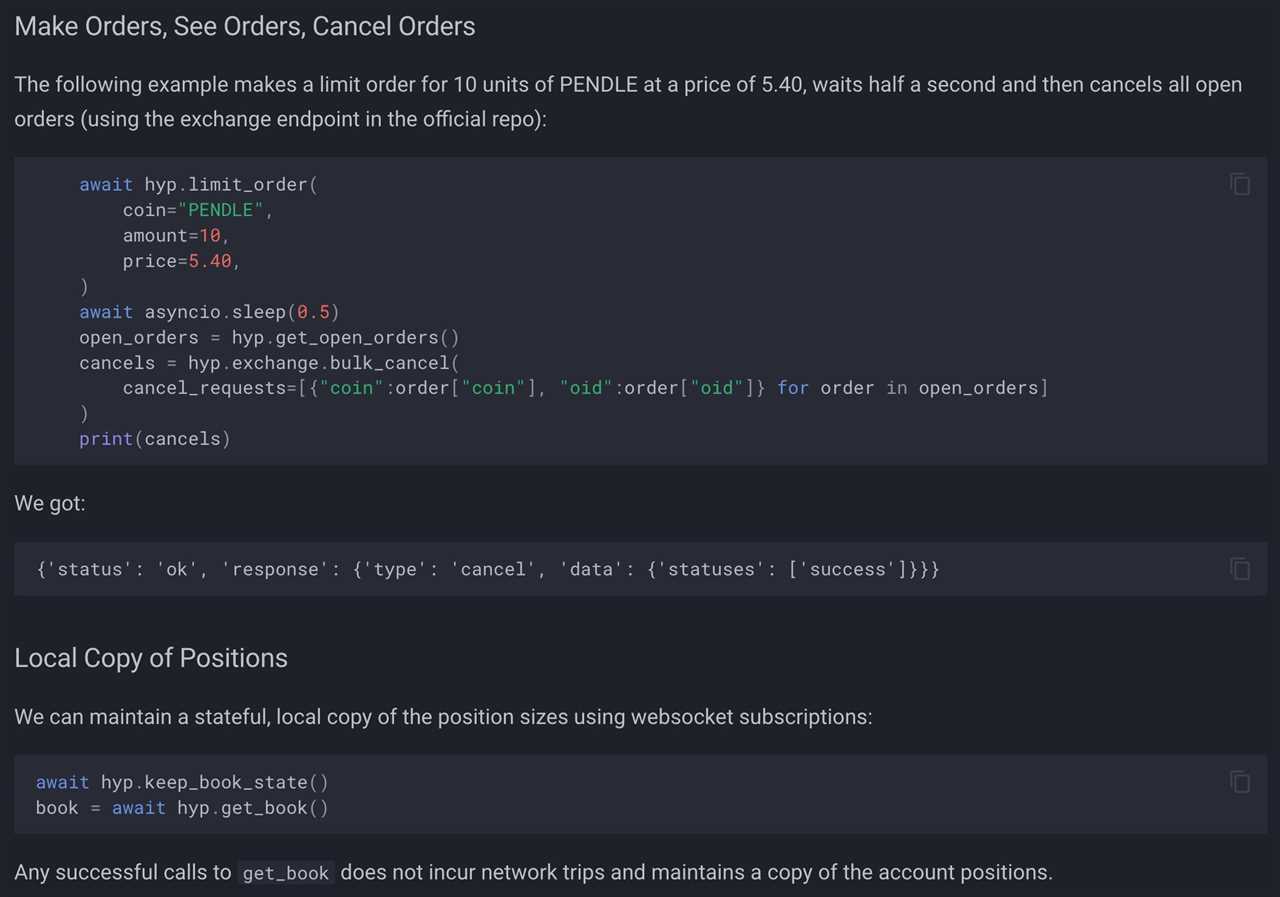

Source: Hyperliquid SDK Release – HangukQuant’s Newsletter

Additionally, Hyperliquid supports features like conditional orders, partial fills, and an API/WebSocket for algorithmic traders – aligning with what dYdX offers, and going beyond the basic functionality of AMM-based competitors.

Another differentiator is asset support: Hyperliquid’s flexible listing framework (HIP-1 auctions) allowed it to list a long tail of assets, including very new tokens, much faster than dYdX.

For example, during memecoin season, Hyperliquid quickly listed popular meme coins on its perp exchange, whereas dYdX and others lagged. Aevo’s unique offering is that it also offers crypto options trading, which Hyperliquid currently does not have – so Aevo appeals to options traders with products like crypto options vaults. However, in the perpetuals arena, Hyperliquid’s experience is widely regarded as more polished and “smoother for smaller markets and diverse assets”.

Both Hyperliquid and dYdX have comparable charting and analytics, but Hyperliquid’s integrated vaults add a social investing dimension (copy trading via vaults) that dYdX and Aevo lack. On the other hand, some beginners might find Hyperliquid’s interface and features complex, whereas a platform like GMX is relatively straightforward. Still, for any experienced trader, Hyperliquid delivers the richest feature set in a DEX – essentially matching a Binance or Bybit in functionality, which has been a critical differentiator.

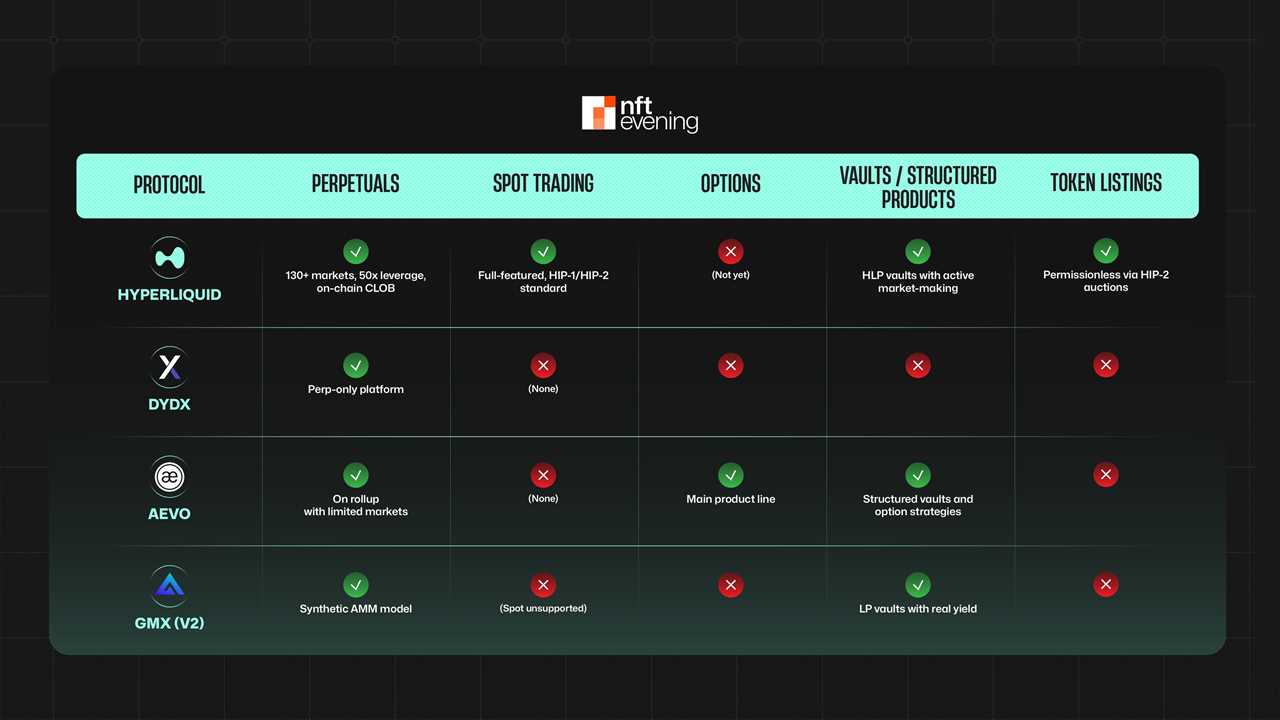

Product Scope: Beyond Perps

While all four protocols began operating as perp DEXs, their evolution has differed from each others:

- Hyperliquid has added many other features such as spot trading, staking vaults, and permissionless token listings (via HIP-2 auctions as advanced).

dYdX remains perp-only. - Aevo has expanded to options, structured products, and vault strategies, positioning itself as a DeFi options suite.

- GMX continues to focus on perps but launched V2 with improved pool mechanics.

In conclusion, we can see that Hyperliquid and Aevo are diversifying fast. Hyperliquid’s combination of spot, perps, and vaults positions it as the most complete DeFi trading suite.

Composability and Developer Ecosystem

With the launch of HyperEVM, developers can now deploy smart contracts directly on Hyperliquid exchange, using existing Solidity code and accessing native trading features via HyperCore. Projects can:

- Compose with live trading data (e.g., liquidations, price feeds, API)

- Launch vaults, automation tools, and structured products

- Earn revenue through builder codes, which share protocol fees

So far, ~170 projects have been deployed, and TVL has grown to $1.7B by mid-2025 according to some reports. This likely counts user collateral (USDC deposits) on the platform. VanEck’s December analysis noted Hyperliquid amassed ~$2.2B in TVL within 15 months, far above GMX’s ~$600M over a similar period. That indicates a huge influx of liquidity providers and traders trusting the platform with funds. User growth has also been exceptional – Hyperliquid more than doubled its user base after the HYPE airdrop, onboarding over 170,000 new users practically overnight.

The average $HYPE airdrop is now worth $109,568. https://t.co/YGcl27Nko0

— Riley

(@interchainriley) June 26, 2025

By contrast:

- dYdX has limited EVM compatibility and a smaller ecosystem. dYdX, which dominated the space in 2021–2022, saw its volumes stagnate or decline as it transitioned chains – and Hyperliquid swooped in.

- Aevo supports composability within its rollup but lacks Hyperliquid’s native liquidity engine.

- GMX, the other big player, still boasts large TVL in its GLP pool and is popular for zero-price-impact swaps, but it primarily attracts a different segment (lower frequency, more passive LP earning via GLP)

Hyperliquid leads in on-chain composability, incentivized builder programs, and integration flexibility.

Tokenomics and User Alignment

The HYPE token serves multiple roles:

- Gas token for HyperEVM

- Governance via HIP proposals

- Validator staking for network security

- Trading fee discounts (up to 40%)

- Collateral and speculative asset on Hyperliquid

Importantly, Hyperliquid issued HYPE with no VC allocations. The 2024 airdrop distributed 31% of supply to users, while 38.8% is reserved for emissions. This design eliminates venture overhang and fosters organic community growth.

| Protocol | VC Allocation | Fee Rebates | Real Yield | Governance | Token Utility |

| Hyperliquid | None | Up to 40% | Yes (via HLP) | Yes | Gas, staking, discount |

| dYdX | High | None | No | Yes | Governance only |

| Aevo | Moderate | Yes | Partial | Yes | Fee discounts |

| GMX | Low | Minor | Yes (via GLP) | Yes | Staking, governance |

Market Share and Metrics July 2025

| Metric | Hyperliquid | dYdX | Aevo | GMX |

| Daily Perp Volume | $8–12B+ | ~$1.5B | ~$300M | ~$700M |

| TVL | ~$1.7B | ~$420M | ~$160M | ~$630M |

| Perp Market Share | ~70% | ~9% | ~2–3% | ~5% |

| Unique Users | 400K+ | 150K+ | <50K | ~100K |

Hyperliquid has absorbed a lion’s share of the decentralized perps market, aided by:

- Real-time execution

- Fully on-chain transparency

- Vault-generated yield

- Deep spot + perp liquidity

No other DEX currently matches Hyperliquid in volume, retention, or ecosystem velocity.

Final Thoughts: Why Hyperliquid Leads in 2025

Hyperliquid isn’t just another derivatives DEX—it’s a high-performance Layer 1 platform that has redefined what’s possible for on-chain trading. It merges:

- The speed and precision of centralized trading

- The transparency and fairness of DeFi

- A community-first model without VCs

While dYdX and Aevo offer strong alternatives for niche traders or ecosystems (Cosmos, options), and GMX continues to serve passive LPs, Hyperliquid stands alone as the leading protocol in scale, innovation, and alignment.

As of mid-2025, it is not only dominating volume but also building a sticky, composable DeFi stack—with HYPE at the center.

For traders, builders, and long-term investors alike, Hyperliquid represents the most compelling on-chain trading platform of the year.

The post Hyperliquid vs. dYdX, Aevo, GMX: Into the Future of Derivatives appeared first on NFT Evening.

Read MoreBy: Liam Miller

Title: Hyperliquid vs. dYdX, Aevo, GMX: Into the Future of Derivatives

Sourced From: nftevening.com/hyperliquid-dydx-aevo-gmx/?utm_source=rss&utm_medium=rss&utm_campaign=hyperliquid-dydx-aevo-gmx

Published Date: Wed, 02 Jul 2025 17:43:46 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/google-cloud-to-assist-somnia-with-ai-agents-security-and-more

.png)