Crypto gas fees are the fee required to process transactions or execute smart contracts on blockchain networks like Ethereum, Polygon, and Binance Smart Chain (BSC). It is paid as an incentive to validators for providing the computational resources needed to verify transactions and secure the network.

In this article, we’ll decode gas fees, their significance, usability, calculation methodology, and impacts on the blockchain ecosystem. We’ll also run you through the best tools to track gas prices and ways to minimize transaction charges.

Understanding Crypto Gas Fees

Source: Chainmyne

Blockchain transactions are often promoted as a free or cheaper alternative to traditional banking services. However, these transactions are never truly costless or nominal. All blockchains, ranging from Bitcoin and Ethereum to Solana and Cardano, charge transaction fees for both simple and complex operations conducted on their networks.

Examples of simple transactions include making payments for products and services or transferring cryptocurrencies to friends. Conversely, running intelligent contracts, interacting with dApps, and minting tokens are examples of more complex transactions.

Gas Fees vs. Transaction Fees: What’s the Difference?

In the context of blockchains, Ethereum was the first network to popularize the terminology “gas fees” to describe transaction costs.

Blockchains such as Ethereum, Polygon, Arbitrum, and BSC commonly refer to these charges as gas fees. In contrast, Bitcoin uses the term “mining fees,” while others like Solana and Cardano simply address them as “network fees” or “transaction fees”.

In essence, the costs you incur to conduct transactions on Ethereum and Ethereum-compatible networks are known as gas fees. Contrarily, the charges you pay to process transactions on other blockchains are called mining costs or transaction fees.

Additionally, transaction or gas costs vary across blockchains because not all networks are created equal. For example, Solana has a processing speed of 65,000 transactions per second (TPS), whereas Ethereum is much slower with an average block time of around 12 seconds.

Furthermore, these costs fluctuate frequently. They depend on the size and complexity of the transaction and the demand and supply conditions of the network. Typically, gas prices are impacted by various factors. These include consensus mechanism, nature of operations, network capacity, validator availability, and demand for block space at transaction time.

Why Crypto Networks Charge Gas Fees?

Transaction verification requires computing power and resources like large virtual computers and electricity. These resources incur costs, which are borne by validators.

In crypto networks like Ethereum that follow the proof-of-stake model, validators must stake at least 32 Ether (ETH). This allows them to participate in the consensus process and verify transactions. The higher the amount they stake, the greater their chances of being chosen as a validator for creating new blocks.

Moreover, networks are vulnerable to unauthorized access or hacks without validators. Consequently, scammers may steal user assets or tamper with blockchain records.

Therefore, validators are an indispensable part of the blockchain ecosystem. They must be adequately compensated to remain motivated in verifying transactions and actively contributing to the network’s security.

Thus, blockchains charge gas fees to incentivize and compensate miners and validators for their work in maintaining the network. These fees also shield a blockchain from Sybil attacks by making it expensive for malicious actors to control the network.

How Do Gas Fees Work on Blockchain Networks?

Gas is a unit for measuring the computational power required to perform transactions on blockchains. All on-chain transactions, including interacting with dApps, executing intelligent contracts, or deploying NFTs, are subject to a gas fee.

Gas also serves as an incentive for validators. It rewards them for providing resources, authenticating transactions, staking tokens, adding new blocks, and managing network security.

Moreover, gas charges also deter spam attacks. In its absence, a large number of bad actors could trigger a massive number of transactions, clogging the network and jeopardizing its sustainability.

Who Pays Gas Fees?

Users pay gas fees when they submit their transactions for verification. It is also the fees users must incur when bidding for a block space to record their transactions on blockchains.

Typically, simple transactions, such as making payments for online purchases, consume less energy and require lower fees. Conversely, complex operations like launching decentralized finance (DeFi) protocols or minting NFTs utilize more gas and incur higher costs.

Who Receives Gas Fees?

A decentralized network of computers, especially the validator nodes, receives a portion of the gas fees as a reward. Since these validators consume energy to verify transactions, they must be compensated for their computational power.

In proof-of-work (PoW) blockchains such as Ethereum Classic and Bitcoin, gas charges are paid to miners, who solve complex mathematical puzzles using intensive computational resources. In proof-of-stake (PoS) chains, the gas fee is rewarded to validators who stake their cryptocurrencies to secure the network.

Ethereum Gas Fees Explained

Gas is an integral part of the Ethereum blockchain and represents the costs of executing Ethereum transactions. Ethereum gas fees are priced in small fractions of Ether (ETH), the network’s native cryptocurrency, and denominated in Gwei (10-9 ETH). The Ethereum network distributes a portion of these fees to validators as a reward for staking their ETH and validating transactions.

As Ethereum is the most preferred platform for deploying smart contract-enabled non-fungible tokens (NFTs) and dApps, it attracts numerous users. This results in network congestion and high demand for computing power. Thus, Ethereum gas fees are higher, though the network has transitioned to a PoS consensus system from the PoW model.

How Gas Works on the Ethereum Virtual Machine?

The Ethereum ecosystem is designed to enable individuals, businesses, and developers to create novel use cases of cryptocurrencies and blockchains. Thus, it is often referred to as the Ethereum Virtual Machine (EVM) because you can build and deploy applications on it.

The EVM is a decentralized virtual environment akin to a cloud app that enables other blockchain-based applications to run within it. It also executes smart contract codes across all Ethereum nodes in a secure manner. Since the Ethereum blockchain is a part of the EVM, the crypto assets, coins, NFTs, and dApps developed on EVM-compatible networks require gas fees.

For example, the Pepe meme coin and Cryptopunks NFT collection were minted on Ethereum. Similarly, AAVE, the native crypto of the Aave protocol, is also Ethereum-based. So, when you want to buy, sell, trade, or transfer AAVE, PEPE, or Cryptopunks, you must pay gas costs for using the Ethereum blockchain.

Gas Fee Denominations Explained: Gwei, Wei, and Ether

- Wei: It denotes the smallest fraction of gas fees and is named after Wei Dai, a well-known computer scientist recognized for his valuable contributions to the fields of cryptography and cryptocurrencies.

- Gwei: It is an acronym for “gigawei” and the unit of measurement for gas fees on platforms like Ethereum, BNB Chain, Polygon, etc. The term combines “giga”, which means a billion, with “wei” to signify billions of tiny fractions. One gwei equals 0.000000001 or 10-9 ETH.

- Ether: Ether or ETH is the native cryptocurrency of the Ethereum blockchain. As of June 2025, Ethereum is the second-largest virtual currency after Bitcoin, as per market capitalization. One ETH is equivalent to 109 Gwei.

When Are ETH Gas Fees Lowest?

Usually, ETH gas fees are low when network traffic is less on the Ethereum blockchain. They decrease further during post-market or off-peak hours, like after midnight or early mornings. Gas prices are also nominal on weekends or public holidays, due to reduced market activity and transaction volumes. However, Ethereum gas fees are highly volatile. Even during off-peak hours, transaction processing may be delayed due to limited network capacity.

Why Are Ethereum Gas Fees So High?

Ethereum gas fees were relatively low before 2020. But as adoption surged—driven by DeFi, NFTs, and play-to-earn games—network congestion increased, causing fees to spike, often exceeding $20–$30 per transaction.

Before the London Hard Fork in 2021, gas fees were fixed, regardless of transaction complexity or network load. The upgrade introduced a two-part model:

- Base fee: Adjusts dynamically and is burned to reduce ETH supply.

- Priority fee: An optional tip to incentivize validators for faster processing.

In late 2021, Ethereum transitioned to Proof of Stake via The Merge, reducing energy use by over 99%. Still, it didn’t fully address gas fees spikes during peak activity.

Major fee spikes were triggered by:

- ICO Boom (2017–2018): Massive influx of users overwhelmed network capacity.

- DeFi Summer (2020–2022): Complex transactions like lending and liquidity provision increased demand.

- NFT Craze (2021): Heavy activity on NFT marketplaces like OpenSea clogged the network, pushing fees over $100.

While Ethereum continues evolving, scalability upgrades like sharding and Layer 2 solutions are expected to reduce gas fees in the future.

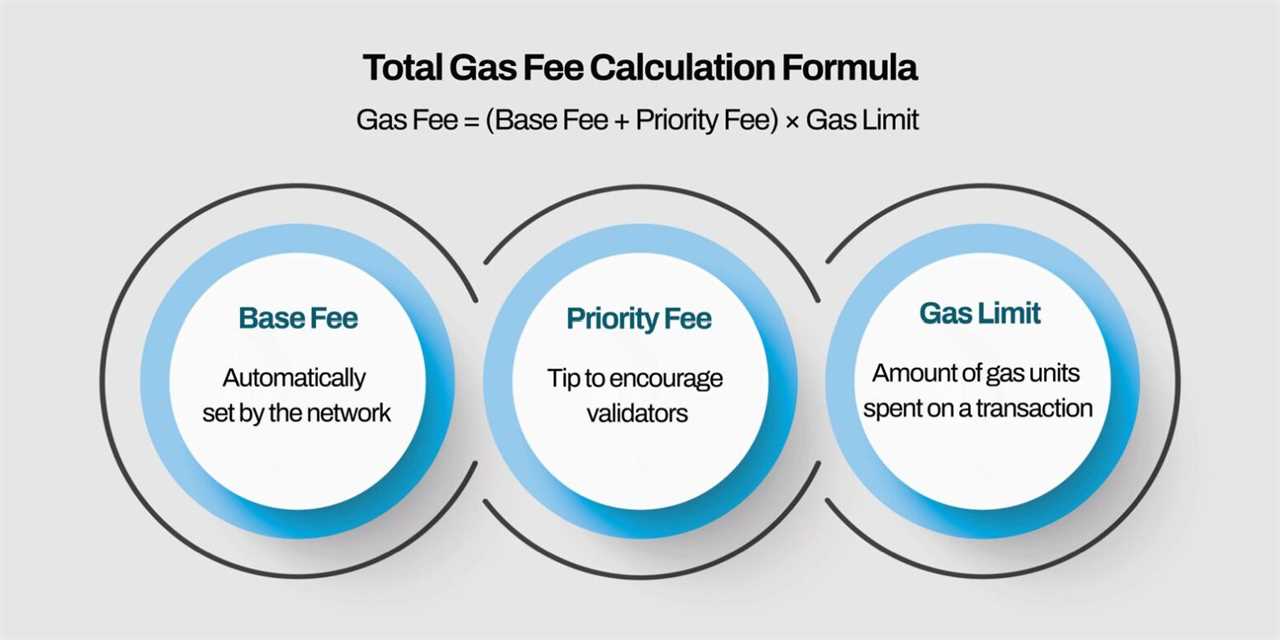

How Are Gas Fees Calculated?

Source: Obiex

Originally, gas fees were computed as a product of gas price per unit and gas limits. In August 2021, Ethereum modified the calculation method to include base fees, total gas units required, and priority charges. Base fees are the fixed charges set by the network for a transaction.

For instance, imagine you want to transfer 5 ETH to a friend and you believe it will need 3 units of gas. The base charge is 15 gwei, and you offer a tip of 5 gwei. In this case, gas fees are calculated using the following formula: Units of gas required X (Base fee + priority fee). After substituting values in the above formula, the cost of gas comes out to 60 gwei [3 X (15 + 5)] or 0.00000006 ETH. So, you must initiate a transfer of 5.00000006 Ether.

What is a Gas Limit?

The gas limit refers to the maximum price a user is willing to pay when sending transactions for verification or running token contracts. It is denominated in gas units and caps the maximum value a transaction or function can collect from a user. It also acts as a defence mechanism by preventing high fees from being wrongly charged due to bugs in underlying contracts.

You can define gas limits as the maximum amount of computational effort users are willing to expend for executing transactions. If it is too low, the set gas will be consumed, but the transaction will fail. In this way, gas limits restrict resource and energy consumption.

Total transaction costs = Gas limits X (Base fee + Priority fee).

For example, assume the base charge of a transaction is 50 gwei, and you are willing to spend an extra 10 gwei for faster processing. With the gas limit set at 20,000, your transaction fees will be 120,000 [20,000 X (50 + 10)] gwei.

How to Use Gas in Ethereum Transactions?

Every action on Ethereum requires gas or computational work. Since gas isn’t free, users must pay for it using Ether(ETH), the blockchain’s native cryptocurrency and governance token.

Conducting a transaction on Ethereum involves three crucial steps:

- Setting a gas limit: Users must specify the maximum computational effort they are willing to expend before submitting their transactions for processing. The more complex the transaction, the greater will be the limits. Transaction failures can occur if you set limits lower than the stipulated minimum.

- Choosing the gas price: Depending on the network’s demand and supply conditions, users can fix lower prices to save costs, or pay higher rates to incentivize validators to prioritize the processing of their transactions.

- Confirming and sending: Once validators process transactions, the final gas fees are deducted from the users’ wallets.

Wallets like Metamask and Trust Wallet provide live gas predictions and fee adjustment options, making the process simpler and more convenient. Moreover, the Ethereum network itself updates periodically to improve transaction processing speeds. For instance, the Ethereum Improvement Proposal (EIP) 1559 implemented automatic base fee adjustments based on network congestion.

How to Set Gas Prices?

You can decide how much gas fees you wish to pay. While you cannot modify the base charges, as they are automatically set by the network, you can quote an optional tip to incentivize validators to process your transactions faster. The higher the priority fees you offer, the more likely your transaction will be validated and appended to the blockchain ahead of others.

Ethereum wallets such as Metamask allow you to customize gas settings. Depending on your circumstances, you can specify gas limits and the maximum global amount (Base + priority charges) you are willing to pay for your EVM operations.

To set gas speeds, Metamask allows you to choose any of the options mentioned below:

- Low – Pay less gas and wait longer for your transaction to process.

- Market – Set the gas to reflect the current market rates.

- Aggressive – Pay more to get your transactions processed in the shortest possible time.

Additionally, Metamask enables you to customize other parameters, enjoy a personalized experience across multiple blockchains, and save and reuse configured settings.

In general, setting very low gas prices or limits is not recommended, as your transaction may be ignored or dropped by validators. It may even fail, and you will lose the gas spent as it is non-refundable. If you are unable to set prices yourself, choose the dynamic gas fee estimates your wallet recommends based on network load.

Ethereum vs. Bitcoin Gas Fees

| Bitcoin gas fees | Ethereum gas fees |

| Bitcoin (BTC) is the largest cryptocurrency in terms of market capitalization (over $2,141 billion as of June 16, 2025) | Ethereum (ETH) is the second-largest cryptocurrency as per market capitalization (over $318 billion as of June 16, 2025) |

| Follows the proof-of-work (PoW) consensus mechanism. | Follows the proof-of-stake (PoS) consensus system. |

| Transaction costs are called network or mining fees. | Transaction costs are called gas fees. |

| Under PoW, new blocks are added to blockchains through mining, a process that requires miners to solve complex math equations. | Under PoS, transactions are verified and approved by validators. They are chosen based on the amount of ETH they have staked to secure the network. |

| Mining fees are high, as miners require specialized software, expensive hardware, and electricity to decode the mathematical puzzles. | Though Ethereum has reduced energy consumption by 99.95% after transitioning to PoS, it charges high gas fees. The prime causes for the exorbitant costs are heavy network traffic, smart contract capabilities, and numerous transaction verification requests. |

| The first ones to solve the complex puzzles get a percentage of the mining fees as a reward for their hard work and computational power. | Those who have staked large amounts of ETH stand a higher chance of being chosen as a validator. Once chosen, they receive a portion of the gas fee as a reward for verifying transactions, protecting the network, and incurring resource costs (e.g, computers, electricity, etc.) |

How to Reduce Gas Fees?

Each blockchain is different in terms of speed, efficiency, affordability, popularity, scalability, energy usage, security, and other characteristics. While some networks get congested faster due to a large user base and high demand, many others process thousands of transactions per second (TPS) at a much lower cost.

If you buy, sell, trade, or transfer crypto assets regularly, choosing an energy-efficient blockchain with a higher TPS and lower fees, like Solana, is essential.

You should also monitor gas price movements using tools like Etherscan before submitting your transactions on blockchains like Ethereum, which are highly prone to congestion. As gas fees rise during peak demand periods, trading in off-peak hours, like early mornings or holidays, helps you minimize transaction costs.

You can also explore layer-2 (L2) solutions such as Arbitrum, Polygon, Starknet, and Base to avoid paying high gas charges. These networks charge only a fraction of Ethereum’s gas fees because they perform computational processes off-chain, meaning outside the Ethereum mainnet. By offloading this work, L2 chains significantly reduce computational demands, making transactions up to 99% cheaper. You can also consider investing in crypto indices, a basket of assets with automatic rebalancing functionality, to lower your transaction fees.

Best Tools to Track and Estimate Gas Fees

- Blocknative gas estimator: It shows real-time updates on every component of the legacy as well as the EIP-1559 gas fees. It enables you to monitor and forecast gas prices for 40+ blockchains and analyze average transaction cost heatmaps and trends. You can also download its Chrome extension or use the dashboard widgets to study advanced visualizations of transactions awaiting verification.

- Crypto Wallets: Many blockchain wallets, such as Metamask or Trust Wallet, have built-in calculators to auto-calculate gas fees in real time.

- Etherscan: It is a blockchain explorer and analytics platform for Ethereum that enables you to monitor live gas prices, view wallet balances, track transactions, and access on-chain data. It is one of the key tools for forecasting gas fees and verifying network activity.

Conclusion

Without gas fees, validators have no incentive to validate transactions or stake their digital tokens to secure a blockchain. A shortage of validators poses significant risks to the network’s security, transparency, efficiency, and long-term sustainability. Thus, gas is a vital component that ensures the smooth functioning of blockchain networks, especially Ethereum.

However, if you trade across multiple blockchains simultaneously, hefty gas charges may lower your profits considerably. Choosing low-cost blockchains or layer 2 solutions, transacting during non-peak hours, and leveraging tools like Etherescan to predict gas price movements are some ways to reduce transaction costs.

High gas fees can even work in your favour if you are willing to lock up your crypto holdings to support a network. Staking larger amounts increases the likelihood of being chosen as a validator. As a portion of the transaction fees paid by users is allocated to validators, a higher gas fee increases your earnings.

FAQs

How do I avoid gas fees on crypto?

Gas fees rise and fall based on a blockchain’s demand and supply conditions at the time of the transaction. If the network is congested, gas charges increase, and vice versa. Though it is impossible to avoid gas fees altogether, you can minimize your outgo by trading during non-peak hours.

Tracking tools like Etherscan that display the day’s highest, lowest, average, and live gas prices can help you identify an opportune time to transact. You can also lower your gas expenses by utilizing L2 chains or dApps for transactions, instead of the Ethereum mainnet.

What is the gas limit in Ethereum?

Gas limit is the maximum price a user is willing to pay when submitting transactions for validation on Ethereum. Recently, Ethereum increased the limits to approximately 32 million units for the first time since 2021.

Are gas fees refundable if the transaction fails?

Due to the fundamental architecture of blockchains, it is impossible to refund gas fees, even when the transaction fails. These fees are paid directly to the validators on the Ethereum network. Hence, they are non-refundable, whether your transaction is successful or unsuccessful.

Do all crypto transactions require gas?

No. Only transactions conducted on Ethereum and EVM-compatible chains require gas. Other blockchains like Bitcoin, Solana, and Polkadot also charge transaction fees, but they follow distinct fee structures and are fundamentally different from Ethereum.

How much does gas cost to ETH?

Gwei is a subunit of ETH, and 1 gwei is equivalent to 0.000000001 or 10-9 ETH. Thus, if the estimated gas fee for your transaction is 2,500,000 gwei, you must shell out 0.0025 ETH.

Are gas prices predictable?

With Ethereum’s L2 upgrade, gas fees have become fairly predictable. However, network demand is a critical determinant of the gas charges. While simple fund transfers incur nominal costs, interactions with token contracts and DeFi protocols command higher charges. For example, Uniswap is the top gas guzzler that consumes considerable amounts of computational power due to the complexity of its version-3(V3) contracts and additional processes involved. Therefore, you need to incur a steep gas fee while engaging with Uniswap.

The post What Are Gas Fees In Crypto? ETH Gas Fees Explained appeared first on NFT Evening.

Read MoreBy: Zander Brown

Title: What Are Gas Fees In Crypto? ETH Gas Fees Explained

Sourced From: nftevening.com/what-are-gas-fees-in-crypto/?utm_source=rss&utm_medium=rss&utm_campaign=what-are-gas-fees-in-crypto

Published Date: Tue, 19 Aug 2025 09:16:25 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/kucoin-spotlight-launches-akedo-token-sale-bringing-aipowered-gaming-to-web3

.png)