When you properly understand what is staking crypto, you can confidently make smarter decisions about how you grow your digital assets. Staking has become a core part of the crypto space because it gives you a way to earn rewards while staying involved in how blockchain networks run. As more people look beyond trading, interest has expanded into areas like bitcoin staking, even among beginners who want long term participation rather than short-term moves. In your journey with crypto, staking represents a shift toward earning through contribution, not speculation.

In this article, we discuss how staking works at a high level, the different ways you can stake crypto, the benefits and risks involved, and how to get started step by step. We also highlight common mistakes that can cost you rewards or limit your flexibility. If you want a clear foundation to help you decide whether staking aligns with your goals, continue reading.

What Is Staking Crypto?

Staking crypto gives you a way to participate in blockchain networks while earning rewards for your involvement. Instead of relying on constant buying and selling, you lock up your assets to support how certain networks stay secure and process activity. When you stake crypto, you commit your coins to the system, which allows the network to function smoothly and remain trustworthy. In return, you get rewards that reflect your contribution and commitment.

From your perspective, staking feels similar to putting money into an interest earning account, but with more responsibility and control. You decide which network to support, how long to commit your assets, and how actively you want to manage the process. Some networks require you to stake coin directly, while others let you participate through pools or platforms that simplify the experience. This flexibility explains why staking continues to grow among beginners and experienced crypto users alike.

Proof of Stake (PoS)

Proof of Stake, commonly called PoS, is the system that makes staking possible. Networks using this model choose participants to validate activity based on how much crypto they commit and how long they keep it staked. The more you stake, the more influence you can have, although many networks balance this to keep things fair.

PoS focuses on efficiency and accessibility. It uses far less energy than older systems and opens the door for everyday users to take part without specialized hardware. Ethereum staking follows this model, which marked a major shift toward a more energy conscious and community driven approach to securing a blockchain.

Proof of Work (PoW)

Proof of Work, or PoW, uses a very different approach. Instead of staking assets, participants compete to solve complex problems using computing power. This process secures the network, but it demands significant energy and equipment, which limits participation for many people.

PoW played a major role in shaping early crypto networks, but it does not support staking in the way PoS does. You cannot earn staking rewards through PoW systems because they rely on computational effort rather than committed assets. Understanding this difference helps you see why staking only applies to specific cryptocurrencies and why newer networks continue to move toward PoS models.

How Does Staking Crypto Work?

Staking crypto is a process where you lock up your cryptocurrency to actively support a blockchain network. This involves validating transactions, maintaining the network’s security, and ensuring its smooth operation. In return for your contribution, you earn staking rewards, which are typically distributed in the same cryptocurrency you’ve staked. This makes staking an attractive option for growing your holdings while playing a vital role in the blockchain ecosystem.

Unlike Proof of Work, which relies on miners solving complex mathematical problems using significant computational power, staking operates on the Proof of Stake mechanism. This system selects validators based on the amount of cryptocurrency they stake, rather than their ability to solve problems. This approach is not only more energy-efficient but also allows for faster transaction processing. For instance, Solana – a popular blockchain platform, uses Proof of Stake to achieve high-speed and low-cost transactions.

When you stake your crypto, you can do so through various methods. Some prefer staking directly through a dedicated wallet, while others join staking pools to combine resources and increase their chances of earning rewards. Additionally, many exchanges offer staking services, simplifying the process for beginners. Regardless of the method, staking provides a practical way to grow your assets while contributing to the network’s overall health and efficiency.

Benefits and Risks of Staking on Crypto Platforms

Staking meaning on crypto platforms offers a unique opportunity to grow your digital assets while supporting blockchain networks. However, like any investment, it comes with its own set of advantages and challenges. Here are the benefits and risks you should consider before you stake your coins.

Benefits

- Earn Passive Income. Staking allows you to earn rewards without selling your assets. Whether you’re using cryptocurrency exchanges or dedicated wallets, staking provides a steady way to grow your holdings over time.

- Strengthen Blockchain Networks. When you stake, you actively contribute to the security and efficiency of the network. This is especially true for staking pools, where participants combine resources to validate transactions and maintain the blockchain.

- Energy Efficiency. Unlike mining, staking is far less resource-intensive. Crypto staking platforms that use Proof of Stake are designed to be environmentally friendly, making them a sustainable choice for blockchain investors.

- Accessibility. Staking is straightforward and doesn’t require expensive equipment. Many platforms, including exchanges, offer user-friendly options to get started, making it accessible to both beginners and experienced users.

Risks

- Market Volatility. The value of assets you stake may change considerably over time. Even as rewards are earned, a sudden drop in the cryptocurrency’s value could offset your gains.

- Lock-Up Periods. Some platforms require you to lock your assets for a specific period. During this time, you won’t be able to access or trade your staked coins, which could be a drawback in volatile markets.

- Validator Risks. If you’re staking through a validator or pool, their performance directly impacts your rewards. Poorly managed validators could lead to penalties or reduced earnings. Understanding these benefits and risks will help you make informed decisions about staking and maximize your potential rewards.

Which Cryptocurrencies Can Be Staked?

Staking has become a popular way to grow your crypto holdings while supporting blockchain networks. Many cryptocurrencies now allow you to stake coins, offering rewards in return for your participation. Below is a list of some of the most commonly staked cryptocurrencies:

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Polkadot (DOT)

- Avalanche (AVAX)

- Tezos (XTZ)

- Cosmos (ATOM)

- Algorand (ALGO)

- Tron (TRX)

- Binance Coin (BNB)

Crypto Staking Options

Once you understand how staking works, the next step involves choosing the option that fits your goals, experience level, and available resources. Each option comes with trade offs around effort, flexibility, and potential staking rewards, so it helps to know what to expect before you commit your assets. Here are the staking options:

1. Solo Staking

Solo staking gives you full control over your crypto and how you participate in the network. You run your own setup and stake directly without relying on a third party. This option appeals to users who want independence and are comfortable managing technical requirements. While solo staking can increase your sense of ownership, it also demands time, reliable systems, and enough funds to meet network minimums.

2. Staking Pool

A staking pool lets you combine your crypto with other users to increase the chances of earning rewards. Rather than staking alone, you contribute to a shared pool that handles validation on behalf of the group. Rewards are then split based on each participant’s contribution. This option lowers entry barriers and works well if you want consistent returns without managing everything yourself.

3. Delegated Staking

Delegated staking allows you to keep ownership of your crypto while assigning validation duties to a trusted participant. You choose a validator and delegate your stake to them, which helps secure the network and generate returns. This option suits users who want involvement without running their own setup. Careful validator selection matters since performance and reliability affect outcomes.

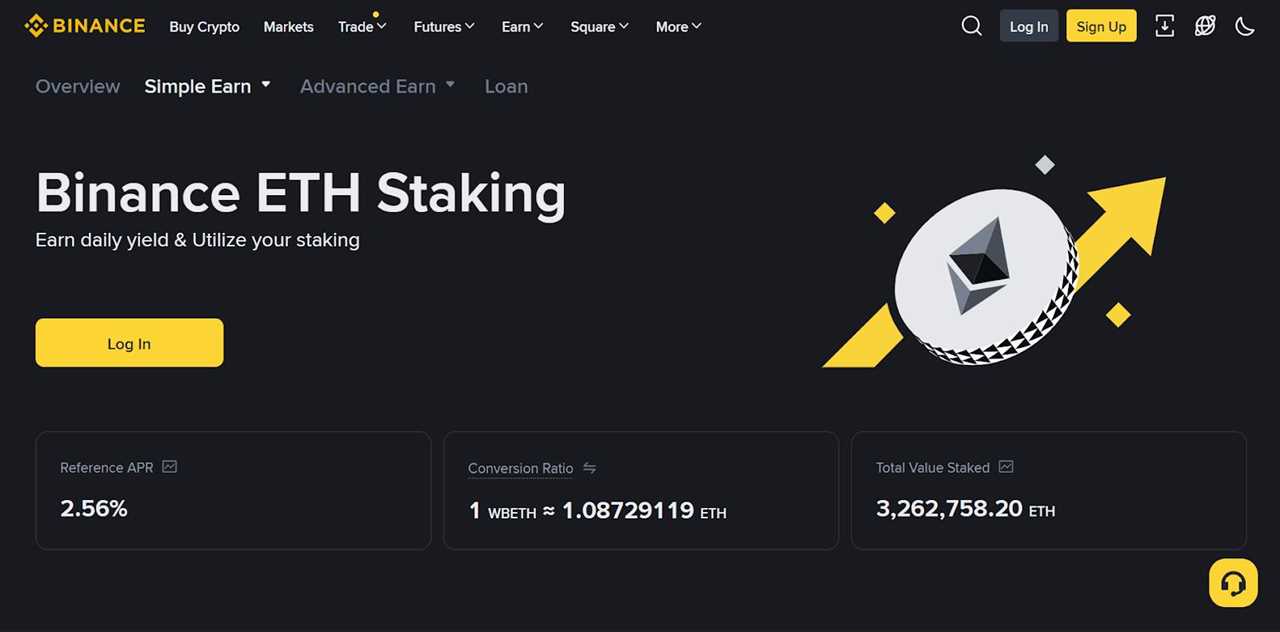

4. Exchange Staking

Exchange staking offers a simple way to get started through platforms that already manage the technical side. You stake your crypto directly within an exchange account and earn rewards without extra setup. Many beginners explore this route and choose the best crypto staking platform to avoid complexities. The trade off comes with reduced control and reliance on the exchange’s policies.

5. Staking-as-a-Service

Staking as a service provides professional management for users who want a hands off approach. These providers handle setup, maintenance, and monitoring while you retain ownership of your crypto. This option works well for people who value convenience and stability over direct involvement. Service fees apply, so you’ll want to weigh cost against saved time and effort.

6. Liquid Staking

Liquid staking gives you flexibility by allowing you to stake your crypto while still keeping access to its value. When you stake, you receive a token that represents your staked assets, which you can use in other parts of the crypto ecosystem. This option appeals to users who want to earn rewards without locking up their funds. Interest in liquid staking has grown alongside conversations about bitcoin staking, even though availability depends on the network and platform.

How to Start Staking Crypto

Getting started with staking is a straightforward process that allows you to grow your assets while supporting blockchain networks. Whether you’re new to staking or looking to refine your approach, follow these steps to start staking:

Step 1: Select a Cryptocurrency

Start by selecting a crypto that offers staking, such as Ethereum, Solana, or Cardano. Research the staking requirements and potential rewards for each to find the best fit for your goals.

Step 2: Choose Your Staking Method

Decide how you want to stake your coins. Options include staking directly through a dedicated wallet, using an exchange or joining a staking pool. Each method has its own benefits, so select one that aligns with your preferences and resources.

Step 3: Set Up Your Staking

Set up your crypto wallet to securely store your assets. If you’re using a staking pool or exchange, follow their specific instructions to delegate your coins. Ensure you understand any lock-up periods or fees associated with the platform.

Step 4: Earn Rewards

Once your staking is active, you’ll start earning rewards based on your contribution to the network. Monitor your staking progress regularly and stay informed about any updates or changes to the platform.

Common Crypto Staking Mistakes to Avoid

Staking can be a rewarding way to grow your cryptocurrency holdings, but it’s important to avoid common pitfalls. Here are some mistakes to watch out for:

- Not Researching the Platform. Using unreliable platforms or validators can lead to poor rewards or even loss of funds.

- Ignoring Lock-Up Periods. Overlooking lock-up terms can leave you unable to access your assets when you need them.

- Staking Without Diversification. Putting all your assets into one cryptocurrency or validator increases your risk.

- Choosing Unreliable Validators. Validators with poor performance or high slashing rates can reduce your rewards.

- Overlooking Fees. High fees from staking pools or exchanges can eat into your earnings.

- Failing to Monitor Your Staking. Neglecting to check your staking progress can result in missed opportunities or issues.

Conclusion

Staking crypto offers a practical way to grow your assets while supporting blockchain networks. It provides rewards and promotes network security, but it also comes with risks like market volatility and lock-up periods. Evaluate your goals, research platforms, and understand the staking process before committing. Diversify your investments and monitor your staking progress to minimize risks. With careful planning, staking can be a valuable addition to your cryptocurrency strategy.

FAQs

Staking crypto can be a good idea if you’re looking to earn passive income while contributing to the security of blockchain networks. It’s essential to evaluate your financial goals, research reliable platforms, and understand the risks involved, such as market volatility and lock-up periods.

How much you can make staking crypto depends on the cryptocurrency you stake, the platform you use, and the staking method you choose. Rewards are typically calculated as a percentage of your staked assets and can vary widely. Researching reward rates and fees will help you estimate potential earnings.

You can lose your crypto if you stake it with unreliable platforms or validators. Risks include slashing penalties for validator misconduct, platform failures, or a significant drop in the value of the assets you staked. Picking reliable platforms and diversifying your staking can help mitigate these risks.

You cannot stake Bitcoin (BTC) because it operates on a Proof of Work mechanism, which relies on mining rather than staking. If you’re interested in staking, consider cryptocurrencies like Ethereum, Solana, or Cardano that use Proof of Stake.

If you stop staking, your assets are no longer locked, and you will stop earning rewards. Depending on the platform or staking method, there may be a waiting or unbonding period before you can access your coins. This period can range from a few days to several weeks, so it’s important to plan accordingly.

Staking can be safe for beginners if you use trusted platforms and start with a small amount to minimize risk. Beginners should research the staking process, understand the terms and conditions of the platform, and be aware of potential risks like slashing penalties or market volatility. Starting with user-friendly platforms or cryptocurrency exchanges that offer staking services can make the process easier and more secure.

The post What Is Staking Crypto? A Beginner’s Guide appeared first on NFT Plazas.

Read MoreBy: Michael Sacchitello

Title: What Is Staking Crypto? A Beginner’s Guide

Sourced From: nftplazas.com/what-is-staking-crypto/

Published Date: Sat, 03 Jan 2026 01:31:44 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/what-is-an-ico-decoding-the-fundamentals

.png)