Often described as Bitcoin’s younger sibling, Litecoin is a source code fork that shares similarities with Bitcoin but offers some unique features. While it lacks smart contract support and has less visibility, LTC remains in the top 20 cryptocurrencies by market cap. But what is Litecoin, and how does it manage to remain resilient among thousands of competing digital assets?

How is it different from Bitcoin, and how exactly does it work? This comprehensive guide explores the Litecoin ecosystem, its history, utility, and relationship with Bitcoin to help you make an informed Litecoin investment decision.

What Is Litecoin (LTC)?

Litecoin (LTC) is a decentralized digital asset that utilizes the proof-of-work consensus mechanism and was designed to serve as a lighter version of Bitcoin (BTC). Litecoin’s creator, Charles Lee, a former engineer at Google, aimed to address existing issues like scalability with the flagship cryptocurrency, primarily focusing on facilitating lower transaction fees and faster transaction confirmation.

What Makes Litecoin Unique?

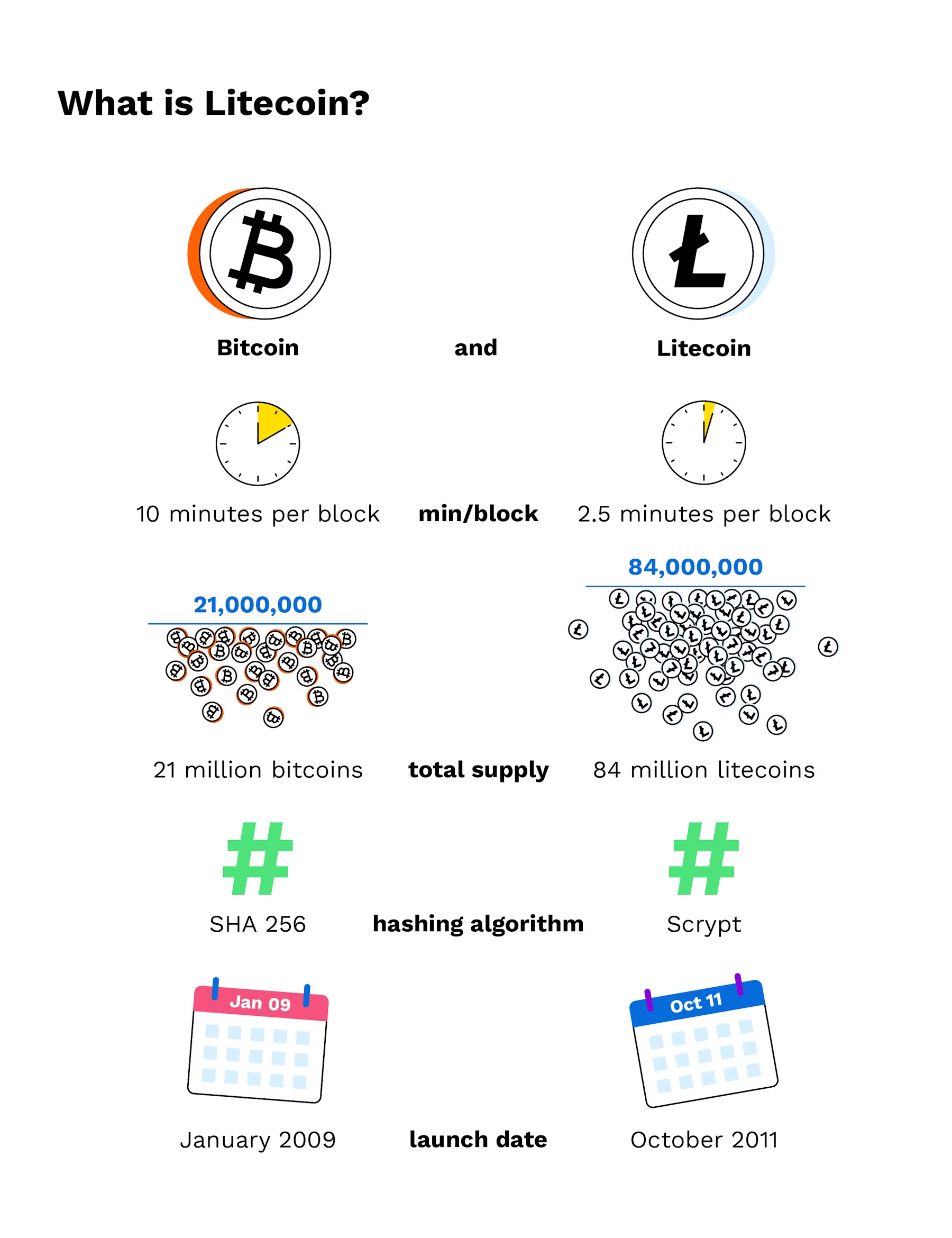

Unlike Bitcoin, which uses the SHA-256 algorithm for mining, Litecoin uses the lighter Scrypt algorithm. This becomes one of the main differences between Bitcoin and Litecoin, ensuring that Litecoin mining can be performed using standard hardware, thus making it more accessible to a broader audience. Several other factors make Litecoin a unique digital asset, including the following:

- Faster Transaction Speeds: Among the main differences between Litecoin and Bitcoin is the former’s speedier block generation time, which is 2.5 minutes compared to Bitcoin’s 10 minutes. As a result, Litecoin can confirm transactions at least four times faster than Bitcoin, making it an ideal choice for making real-time payments as a result of using Scrypt, an alternative proof-of-work algorithm.

- Lower Transaction Fees: Litecoin’s transaction fees are lower than Bitcoin’s, meaning users don’t have to worry about fees eating into their balance when making smaller transactions.

- Build Differences: While they’re often called siblings, they are not twins. Where Bitcoin uses the SHA-256 algorithm, Litecoin uses the lighter Scrypt algorithm, which makes Litecoin mining easier than BTC mining.

- Supply: Bitcoin capped its maximum supply at 21 million coins compared to Litecoin’s 84 million coins.

History of Litecoin (LTC)

Since its launch in 2021, Litecoin has had an eventful journey full of turns and twists that have made it one of the most popular and widely used digital assets in the cryptocurrency market. The crypto asset boasts strong community support and dedicated developers who continue to introduce new features to enhance the network’s functionality. Some of the most notable milestones in Litecoin’s history include:

- October 2011: Litecoin is launched as an open-source project, becoming a Bitcoin alternative that offers a faster and lighter option rather than a replacement.

- 2017: Segregated Witness (SegWit) gets the nod: In 2017, Litecoin became the first major crypto network to adopt the Segregated Witness (SegWit) upgrade, which frees up more space and helps blockchains faster by separating signatures from data.

- 2017: Lightning Network Activation: Soon after SegWit, Litecoin joined the Lightning Network movement, a Layer 2 (L2) solution that enables transactions to occur off-chain, resulting in faster, almost fee-free transactions, making it ideal for micro-payments.

- 2019: Litecoin Halving Events: Litecoin has halving events similar to Bitcoin’s, but for LTC, it occurs every 840,000 blocks. During halving events, the rewards miners get for confirming transactions are reduced by half, thereby reducing the rate at which new coins are created and adding more scarcity into the mix.

- Latest development: MimbleWimble Upgrade – Litecoin’s updates are progressive, with the latest one being the MimbleWimble Development Blocks, a privacy-focused upgrade that further improves scalability while keeping transactions more private.

Who Created Litecoin?

Source: Happycoin

Litecoin is the brainchild of Charles Lee, formally an engineer at Google, who already had some experience in cryptocurrency issues by the time of creating LTC. Besides seeing the potential that Bitcoin had, Lee also discovered there were nagging issues, such as slow transaction speeds and high transaction fees, which could have been improved.

Instead of competing directly with Bitcoin, Lee sought to create an alternative that would address Bitcoin’s perceived shortcomings and introduce a digital asset that would be less prone to centralization and more accessible to the average user. Beginning with Bitcoin’s open-source code, Lee made several tweaks and adjustments to the original code, ultimately creating a faster and more efficient cryptocurrency.

How Does Litecoin Work?

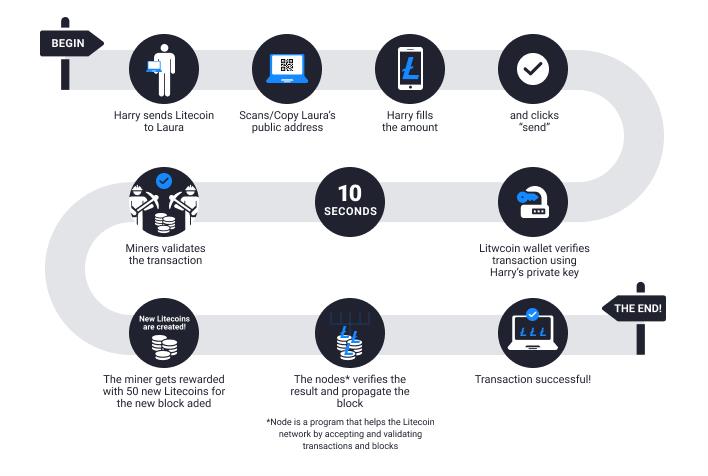

Primarily, Litecoin uses a distributed ledger, also known as a blockchain, to track all transactions. The blockchain is permanent and transparent, meaning that all transactions recorded cannot be erased. The network groups transactions into blocks and links them together before creating a chain of blocks. Since the system is decentralized, no single entity can control it, which makes it resistant to fraud.

Blockchain Fundamentals

- The Decentralized Ledger: The LTC Blockchain is maintained by a network of computers (nodes) running the software worldwide, which checks and stores transaction data, ensuring everything remains intact across the network.

- Proof-of-Work (PoW) Consensus Mechanism: Just like Bitcoin, Litecoin uses the PoW consensus mechanism to secure the blockchain. Miners compete to solve a challenging mathematical problem where the first person to crack the code adds a new block to the chain and is rewarded with newly minted Litecoin tokens.

- The Scrypt Algorithm: Litecoin separates its operation from Bitcoin by using the Scrypt algorithm instead of Bitcoin’s SHA-256. The memory-intensive algorithm ensures anyone with standard equipment can mine Litecoin, unlike Bitcoin mining, which requires fancy and expensive ASIC miners. This makes Litecoin mining more of a DIY operation.

Source: Exmo

Litecoin MimbleWimble Upgrade

MimbleWimble is a protocol upgrade that introduces strong security, privacy, and scalability features, creating a distinctive way of storing and structuring blockchain-based transactions. The upgrade presents an interesting development in the blockchain space, as it’s a robust standalone protocol that can seamlessly integrate with other protocols.

Litecoin integrated MimbleWimble into its operations via the MimbleWimble Extension Block (MWEB) following a research period into its functionality until a Litecoin Improvement Proposal (LIP) authorized it in 2019. The LIP proposed that implementing the MWEB would enhance the performance of the Litecoin blockchain.

As a result of the MimbleWimble Upgrade, Litecoin users can opt-in whenever they want to make privacy-focused or anonymous transactions, as long as they have a wallet or use an exchange that supports MimbleWimble. Apart from anonymity and privacy, the MimbleWimble upgrade also promotes scalability and fungibility within the Litecoin blockchain.

The MimbleWimble Upgrade positions Litecoin as a privacy-focused option among other cryptocurrencies, with the potential to attract more users who prefer privacy and could enhance its adoption for both individual and commercial use. The increased scalability could also make LTC more efficient for day-to-day use, thereby strengthening the token’s utility while also offering faster speeds and lower transaction fees.

How Is the Litecoin Network Secured?

One of the primary advantages of Litecoin’s network is the use of encryption to protect transactions and user data. By using cryptography to secure its network, the blockchain makes it impervious to fraud or hacking attempts. Moreover, the blockchain’s core technology facilitates immutability and transparency, enabling users to verify transactions independently of any central authority.

In addition to blockchain technology and encryption, Litecoin also benefits from a dedicated community of cybersecurity experts and developers who continually work to monitor and enhance the network’s security features. The experts are available 24/7 to identify and resolve any vulnerability in real time, thereby strengthening the blockchain against cyber threats and attacks.

Since the blockchain utilizes the proof-of-work consensus mechanism, the Litecoin network is also secured by miners who actively participate in the block validation process, making it more resistant to attacks such as 51% attacks or any form of fraud. Due to its vast team of a decentralized network of participants playing different roles, LTC seems unlikely to become a victim of any malicious network attacks.

What Is the Litecoin Halving?

Past halving price performance

Working like clockwork, Litecoin halving is designed to occur after every 840,000 blocks, which is roughly every four years, based on the blockchain’s 2.5-minute block time. Whenever the halving occurs, the rewards offered to miners are cut in half, which can be compared to slowing down the drip of new coins.

The primary purpose of Litecoin halving is to reduce the process of creating coins over time, thereby mimicking the scarcity of precious assets. The idea behind halving is that the fewer coins there are in circulation, the scarcer they become and potentially the more valuable they become. The effects of Litecoin halving include:

1. Reduce Block Rewards

At the launch of Litecoin, miners received 50 LTC for every block they added to the chain. However, after each halving, the reward is cut in half, and the cycle is intended to continue until all 84 million coins are mined. To see how it has played out in the past halvings: in 2015, It reduced to 25 LT; in 2019, It reduced to 12.5 LTC; and in 2023, It reduced to 6.25 LTC.

2. Reduce mining profitability

Miners get fewer rewards with each mining, meaning that mining could get less profitable if LTC’s price doesn’t increase or mining costs don’t reduce.

3. Reduce the supply of Litecoin

Halving controls the supply of LTC, leading to scarcity, which can help support its value over time.

4. Bullish price trend

Historically, halving events have consistently led to price surges, as the reduction in the supply of coins excites investors who believe that the limited supply could drive up prices.

Since the total supply of Litecoin is capped at 84 million coins, halving events guarantees that the token’s supply grows slowly and predictably without ever exceeding the limit. The controlled deflationary process lends LTC a gold-like appeal, which ultimately makes it a potential store of value.

How Is Litecoin Mined?

Litecoin mining works by organizing blockchain transaction data into blocks, which system participants known as miners can access at any time. Miners in the ecosystem run mining software to verify each block by solving complex mathematical puzzles. When a miner successfully confirms a block, they add it to the blockchain and earn a reward in the form of newly generated LTC coins.

How to Set Up Mining Equipment

Users interested in mining can do so using ASIC mining devices that come with pre-installed mining software. Alternatively, you can use the standard CUP or GPU, but you need to install your mining software. However, be careful not to install mining software containing malware or other malicious software.

Choice of Mining

After setting up mining equipment, you must choose whether you will work solo or join an existing group of miners. While mining alone could be potentially more lucrative, you risk taking a long time without ever finding a block due to competition from miners with stronger mining rigs. While it was possible to mine using a standard CPU or GPU at the beginning, there’s almost no chance currently that you can make any money. Most miners today join mining pools where they end up dividing the mining rewards based on the hash power everyone contributed.

Does Litecoin Have Staking?

For users interested in earning passive income through staking, the good news is that Litecoin staking is possible, but this happens indirectly since LTC uses the proof-of-work mechanism instead of the proof-of-stake mechanism associated with staking. Users can still earn staking rewards on their Litecoin tokens by using third-party or Decentralized Finance (DeFi) platforms like Nexo, where you can lend LTC and earn interest on your Litecoin investment.

How to Stake Litecoin?

The following is a step-by-step process for staking Litecoin:

1. Step 1: Set up a Litecoin Wallet

Start by setting up a wallet, such as Exodus, Ledger Live, or Atomic Wallet, that supports LTC and transfers some coins into it.

2. Step 2: Start Staking

As long as you have at least 1 LTC in your wallet, you can start staking by navigating to the staking section and following these steps:

- Click “Stake” and specify the amount of LTC you want to stake

- Set the staking period and click “Confirm.”

- Wait for staking rewards to begin rolling in.

3. Step 3: Monitor Your Staking Rewards

As the period progresses, you will begin earning additional LTC coins, which you can confirm by checking your transaction history and wallet balance.

What Is Litecoin Used For?

1. Everyday Payments: Thanks to its low fees and fast transaction speeds, Litecoin has become the go-to alternative for making crypto-based payments, among other uses, as the number of merchants accepting it grows gradually. Whether you’re paying for an online service or some items you bought at a store, LTC offers a fast and affordable way to complete your transaction. Since the number of merchants and stores accepting LTC is on the increase, it’s now easier to use it to complete transactions.

2. Investment Opportunities: Investing in Litecoin is now a valuable alternative for those seeking to diversify their portfolio in the cryptocurrency market. Thanks to its strong community and advanced technological foundation, they increasingly add LTC to their holdings in hopes of boosting returns.

3. Cross-Border Transactions: Litecoin has become a cost-effective and efficient alternative for cross-border money transfers, particularly for individuals seeking to avoid the lengthy waiting times and high fees associated with traditional methods of sending money abroad. With LTC, users only need a Litecoin wallet to send and receive funds worldwide within minutes without worrying about expensive foreign exchange conversions. The lower fees make it an appealing choice for cross-border transfers.

How to Use a Litecoin Wallet

After knowing Litecoin meaning and its use cases, it is now time to understand how to use Litecoin. Before you can acquire LTC coins from a reputable cryptocurrency exchange, you need a compatible Litecoin wallet where you can store your coins. From there, you can easily send and receive LTC payments, participate in staking and DeFi activities, or store long-term for its value.

There are different types of LTC wallets available on the market, each serving a different purpose. These include hardware, software, and mobile wallets. Always choose a wallet based on its security, functionality, and whether it aligns with your goals and intentions for holding cryptocurrency.

- Hardware Wallets: Hardware wallets, such as Ledger Nano X and Trezor, are considered the safest Litecoin wallets since they store your private keys offline, meaning they are not susceptible to hackers.

- Software Wallets: Software wallets, such as Exodus, Electrum-LTC, and others, can be installed on your laptop or PC and offer greater convenience than hardware wallets. Nonetheless, they are less secure due to their internet connection. If you choose to use software wallets, take extra precautions, such as using a strong password or enabling two-factor authentication (2FA).

- Mobile Wallets: Mobile wallets, such as Coinomi and Trust Wallet, are apps designed to store private keys on mobile phones. While you can use them on the go, they carry a relatively higher risk since mobile phones can be stolen or lost. You can secure your mobile Litecoin wallet with a strong password and avoid downloading it from questionable sources.

How to Buy and Sell Litecoin

After learning how to use Litecoin, our guide now shows you the process of buying and selling LTC, so you become equipped to navigate the crypto landscape, especially if you’re new to this space. The avenues for buying and selling Litecoin may differ from apps like PayPal to centralized and decentralized cryptocurrency exchanges.

Buying Litecoin

Buying Litecoin from a centralized exchange is a straightforward process, as most exchanges offer intuitive and user-friendly interfaces. While every exchange could have a few nuances, the process remains mostly consistent.

- Step 1: Create an Account: Start by signing up for the exchange – you’ll be asked to provide some necessary personal details.

- Step 2: Complete KYC: Next, you need to complete a Know Your Customer (KYC) process to verify your identity.

- Step 3: Deposit Funds: Transfer money from cryptocurrency to the exchange wallet you just created.

- Step 4: Search for Litecoin: Navigate through the site and locate the appropriate Litecoin trading pair (for example, LTC/USDT) on the platform.

- Step 5: Place your Order: Choose between buying immediately at the current price (Market Order) and setting a preferred price (Limit Order).

- Step 6: Execute the Transaction: Review your details, and if everything is correct, proceed with executing your order to buy Litecoin.

- Step 7: Secure Your Litecoin: Once you receive your LTC, consider transferring your coins to a personal Litecoin wallet for added security.

Selling Litecoin

- Step 1: Choosing Your Selling Method: Decide whether you want to sell Litecoin on a P2P platform, centralized exchange, or direct sales.

- Step 2: Set Up an Account: For a centralized exchange, create a verified account by completing the Know Your Customer (KYC) process and setting up two-factor authentication (2FA) for an added layer of security.

- Step 3: Transferring LTC to the Exchange: Transfer the LTC you want to sell from your wallet to the exchange. Double-check the receiving address to ensure there’s no mistake.

- Step 4: Create a Sell Order: Choose between a Marker Order (best available price) and a Limit Order (set your preferred price.)

- Step 5: Manage the Transaction: Wait for the order to be executed and wait for your cash based on the preferred payment method you entered.

What to consider before buying Litecoin?

Before you buy Litecoin or any other cryptocurrency, you must remember that crypto assets are a new form of money and can be highly volatile or become illiquid at any moment, making them a high-risk investment. However, they are also considered the future of money and have the potential to yield a good return on investment.

Educate yourself about Litecoin and the broader cryptocurrency industry so you can effectively explain blockchain technology and decentralization to family and friends. You should be familiar with the basics of cryptography so you can understand what’s happening in the industry at any given time. Once you have understood the cryptocurrency industry and how its economics work, ask yourself if you genuinely believe in the value of digital assets and choose whether it is the right thing for you.

Since there’s still some level of uncertainty surrounding crypto trading, consider diversifying your portfolio to include other cryptocurrencies apart from Litecoin and, as much as possible, limit your Litecoin investment to an amount you can afford to lose. Lastly, remember that crypto trading is subject to capital gains tax in many jurisdictions.

How to Store Litecoin

If you’re new to crypto investing, knowing how to store your Litecoin safely is one of the most important steps to consider. You need to have a clear understanding before pressing the “Buy” button to avoid your investment journey ending in a setback. Always choose a secure and accessible method to keep your assets safe—one simple mistake can result in the loss of your crypto holdings. There are important factors to always keep in mind to secure your Litecoin.

- Be Skeptical of Unsolicited Messages: Never respond to any messages asking about your wallet information. Always verify the source and never click on any suspicious links, as they could be phishing attempts to steal your funds. No cryptocurrency exchange will ever ask you about you’re the secret phase of your wallet or private keys.

- Please back up your Wallet: Create multiple backups of your Litecoin wallet and store them in a safe, secure location. Consider encrypting your purse for an added layer of protection.

- Never Share Your Private Key: Your seed phrase is the master key to your crypto wallet. Sharing it with anyone is akin to handing over control of your crypto assets to other people. Keep your secret phrase confidential and never disclose it via text or online to safeguard your cryptocurrency.

- Keep Your Device and Wallet Software Updated: Install regular updates for both your device and wallet, as outdated software is susceptible to hackers and other cybercriminals.

Litecoin vs. Bitcoin: Key differences

Source: Bitpanda

1. Speed of Transaction: Transaction speed remains one of the key differences between Litecoin (LTC) and Bitcoin (BTC). Where an average Bitcoin transaction takes 10 minutes, Litecoin will take 2.5 minutes.

2. Mining Algorithms: Bitcoin employs the secure and intensive SHA-256 hashing algorithm, while Litecoin uses the Scrypt algorithm, which is lighter and faster, meaning it is possible to mine Litecoin using standard CPUs or GPUs.

3. Supply Limits: The total supply of Bitcoin is capped at 21 million, while Litecoin is capped at 84 million.

4. Performance and Adoption: In terms of performance, BTC leads in market capitalization and adoption, while Litecoin still struggles with adoption, although its low fees make it ideal for day-to-day use.

Benefits of Using Litecoin

- Faster transaction times: Compared to BTC, Litecoin generates blocks more quickly, allowing users to confirm transactions faster and complete payments with ease.

- Scalability: Litecoin’s larger maximum supply processes more transactions efficiently. Its scalable design makes it a strong candidate for mainstream adoption.

- Active development team: The Litecoin Foundation has a team of developers constantly working to detect and fix any issues as they appear, in addition to continually enhancing the network’s performance by implementing new features.

- Widespread acceptance: Many new merchants are accepting LTC as a form of payment for goods and services, which make it an ideal choice for those who intend to spend cryptocurrency.

Risks of Investing in Litecoin

Less secure: The downside of the faster block time is that it makes the Litecoin network susceptible to double spending and poses a security risk to users.

- Market volatility: Litecoin, like all other cryptocurrencies, is subject to market fluctuations, which often lead to significant price swings, making it a relatively risky investment.

- Competition: Other altcoins, such as XRP and Ethereum, are giving Litecoin stiff competition, which could have a negative impact on its growth potential.

- Limited use cases: Litecoin has limited use cases compared to other cryptocurrencies, which could hinder its widespread adoption in the future.

- Regulatory Uncertainty: While positive changes are emerging in the crypto regulatory landscape, the existing regulatory environment can impact the LTC’s use and adoption.

Does Litecoin Have a Future?

Litecoin has presented itself as a faster and more accessible cryptocurrency, competing with Bitcoin. Despite the challenges, such as the lack of smart contracts and reduced relevance, that LTC currently faces, it has remained resilient as a fast and cost-effective alternative to more established cryptocurrencies. Litecoin strikes a balance between efficiency and decentralization while promoting interoperability, positioning itself as a strong contender in the competitive crypto market.

Luckily, the Litecoin community and development team remain steadfast in pushing the project’s agenda of making cryptocurrency use practical and accessible to everyone, in addition to its potential as a viable store of value. Unfortunately, the coin’s limited presence on decentralized finance (DeFi) and decentralized exchanges (DEXs) has limited its utility and made it unavailable to emerging applications.

However, given the strong development team behind the project, it is likely to continue innovating, potentially leading to widespread adoption of Litecoin soon.

FAQs

Is Litecoin a good investment?

Litecoin offers lower transaction fees, faster speeds, and a proven track record. Nonetheless, it scores low on adoption and unique features despite being one of the oldest altcoins. However, many experts believe LTC has a strong future in the cryptocurrency market even though it may not be able to compete with Bitcoin.

How Many Litecoin (LTC) Coins Are There in Circulation?

According to CoinMarketCap, as of June 28, 2025, Litecoin currently ranks 20th and has a live market capitalization of $6.5 billion. The token’s current circulating supply is 76.01M LTC and a maximum supply of 84 million LTC coins.

How much is $1 LTC to USD?

According to CoinGecko, the current price of 1 LTC is LTC in June 28, 2025.

Where Can You Buy Litecoin (LTC)?

There are several cryptocurrency exchanges where you can buy, sell and trade Litecoin. However, you need to conduct some research to find a platform that suits your goals and trading preferences so you can enjoy a smooth trading experience. Consider factors such as fees, robust security, and user-friendly features when looking for a place to buy LTC.

Will Litecoin reach $100?

LTC has recently closed near the $100 resistance level, and it appears to have rejected that price for the last two years, preferring to stay near the $91 to $95 area that previously pushed the price much lower. Analysts believe the push toward the $100 remains low unless the price moves above the current order block.

Is Litecoin a Fork of Bitcoin?

Litecoin is an altcoin and a fork of Bitcoin. It is builds on the same underlying blockchain and verification method as Bitcoin, but introduces a few minor differences.

What Will Litecoin Be Worth in 5 Years?

According to several analysts and the consensus ratings from Binance Exchange users, experts predict Litecoin could climb to at least $123.29 within the next 5 years.

The post What Is Litecoin (LTC)? How It Works, Use Cases appeared first on NFT Evening.

Read MoreBy: Olivia Chen

Title: What Is Litecoin (LTC)? How It Works, Use Cases

Sourced From: nftevening.com/what-is-litecoin/?utm_source=rss&utm_medium=rss&utm_campaign=what-is-litecoin

Published Date: Sat, 28 Jun 2025 10:25:51 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/otherside-reveals-bathroom-blitz-as-first-otherside-experience

.png)