Airdrop farming involves strategies used by individuals to qualify for and maximize the number of free tokens they can earn through airdrops. Airdrops are marketing tactics employed by Web3, DeFi, crypto, NFT, and blockchain projects to raise awareness by distributing free tokens to eligible wallets.

This article explores airdrop farming, detailing its advantages and disadvantages, offering a step-by-step guide, tips for improving eligibility, strategies to identify reliable projects, and an outlook on its future.

What Is Airdrop Farming?

Airdrop farming involves actively seeking and participating in multiple airdrops organized by the founders and creators of various crypto startups or projects. The prime objective of airdrop farmers is to collect as many free crypto assets as possible and clock profits from their rising prices when the project gains traction.

Depending on market conditions, personal goals, and the project’s popularity, users can sell, hold, or stake the airdropped tokens to make financial gains or win exclusive benefits in an ecosystem.

In essence, when you farm airdrops, you gain exposure to new projects without investing your hard-earned money. You also get an opportunity to potentially earn high returns if the project becomes widely adopted.

What Does Airdrop Mean in Crypto?

In general, airdrops aim to reward the loyal customers of a product or service and acquire new users. However, customers must fulfil certain conditions to qualify for these campaigns.

Similarly, crypto airdrops serve as a marketing tool to enhance a project’s visibility and expand its user base. Some airdrops distribute free tokens to existing community members, while others work like a referral program to attract fresh participants. They primarily aim to incentivize users to actively adopt and engage with a new protocol.

To choose eligible participants, project teams monitor and record the wallet activities of all their registered users during a predetermined timeframe. They keep the token distribution mechanisms and qualification criteria under wraps to ensure the process is fair and transparent.

Typically, blockchain projects earmark a portion of the total token supply for free distribution. Once users complete the designated tasks within a prescribed duration and meet all the eligibility criteria, the airdropped coins are credited to their wallets directly. Some protocols require users to manually claim these rewards through a decentralized application (dApp).

Source: Waivio

If you want to become eligible for airdrop rewards, you must be an active user of a platform or protocol. Since most airdrops follow similar patterns, you must analyze and perform those tasks that have better-than-average odds of qualifying for these promotional events.

Common eligibility criteria include following the project’s social media accounts, bridging funds to a new blockchain, providing liquidity, staking specific tokens, holding NFTs, generating high transaction fees, and finishing quests to accumulate points.

The difficulty level of these tasks depends on the number of participants and the hype surrounding the projects. The more popular and competitive it gets, the tougher the challenges.

Types of Crypto Airdrops

- Standard airdrops: They encompass distributing free tokens to a broad user base with minimal effort.

- Bounty airdrops: These require users to complete specific tasks like creating blogs, translating content, retweeting posts, subscribing to newsletters, or joining a mailing list.

- Holder airdrops: They are the easiest to qualify as users must simply buy and hold a specified quantity of a cryptocurrency or NFT to win the airdrop rewards.

- Exclusive airdrops: These are special rewards or bonuses given to a protocol’s top contributors, supporters, beta testers, participants of bug bounty programs, and voters.

- Raffle airdrops: These are distributed by project teams to build liquidity provisions. They require users to complete a set of challenges to win tokens, raffle tickets, or a single blockbuster prize.

- Locked or vested airdrops: They allow users to claim the free giveaways after a stipulated period has elapsed. Projects offer them to disincentivize users from immediately selling off their airdropped assets and prevent token dumping.

Why Airdrop Farming Is Trending in 2025?

- No upfront investment: Users don’t need to invest capital to farm airdrops. They just need to invest time and energy in researching, identifying, and qualifying for potential airdrops with lucrative returns.

- Successful past airdrops: The massive success and jaw-dropping profits generated by airdrop campaigns like Uniswap (UNI), Arbitrum(ARB), and Bonk (BONK) have drawn many crypto enthusiasts to this evolving landscape.

- Rapid growth of blockchain projects: With the widespread adoption of distributed ledger technology, Web3, and DeFi, many crypto asset projects utilize airdrops to bootstrap their blockchain networks. They no longer wait or rely completely on venture capital to keep their operations running. The emergence of cross-chain interoperability has further fueled the crypto community’s excitement for airdrop farming.

- Rising popularity of meme tokens: Airdrops have been particularly helpful for promoting meme coins as they derive their value from viral marketing, social media trends, and community hype.

- Saves marketing costs: For crypto projects, airdrops serve as a cost-efficient advertising strategy to encourage early adoption, democratize their governance, attract new users, and build communities.

- Stimulates trading: NFT and cryptocurrency airdrops play a pivotal role in driving trading activity, especially when these assets are officially launched or listed through an initial NFT offering (INO) and initial coin offering (ICO).

- Fosters decentralization: Legitimate airdrops stabilize token releases, create natural trading activity, and prevent whale wallets from controlling the distribution system. The higher the number of wallets holding airdropped tokens, the greater the decentralization of a blockchain protocol.

How to Farm Airdrops?

Step 1: Set Up a Crypto Wallet

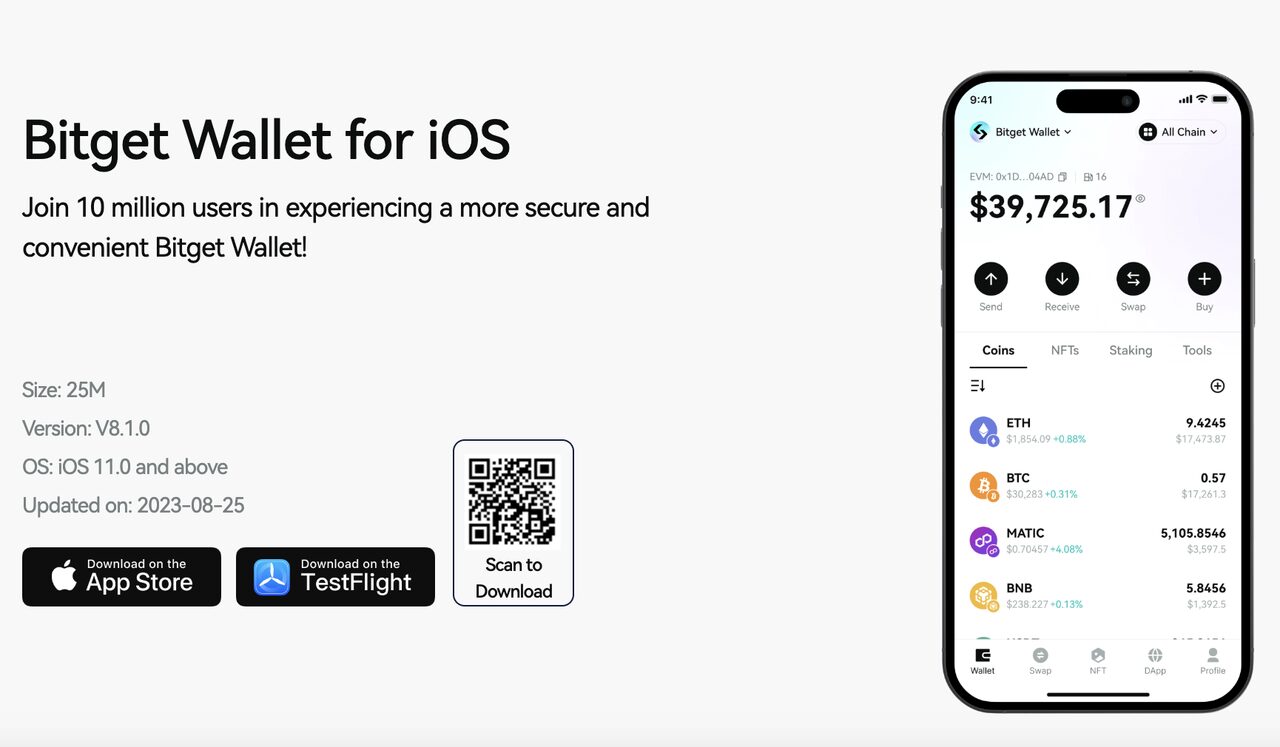

To farm airdrops, you must first select a crypto wallet that is compatible with the project’s blockchain. While Metamask is the most preferred wallet for Ethereum-based protocols, Phantom is the top Solana wallet for projects hosted on Solana. For a multi-chain experience, you can consider the Coinbase or Bitget wallets.

Most importantly, preserve your private keys, seed phrases, and digital assets in cold storage or hardware wallets like Ledger or Trezor for enhanced security. Additionally, it is advisable to maintain separate wallets for airdrops.

Source: Bitget

Step 2: Find Airdrop Opportunities

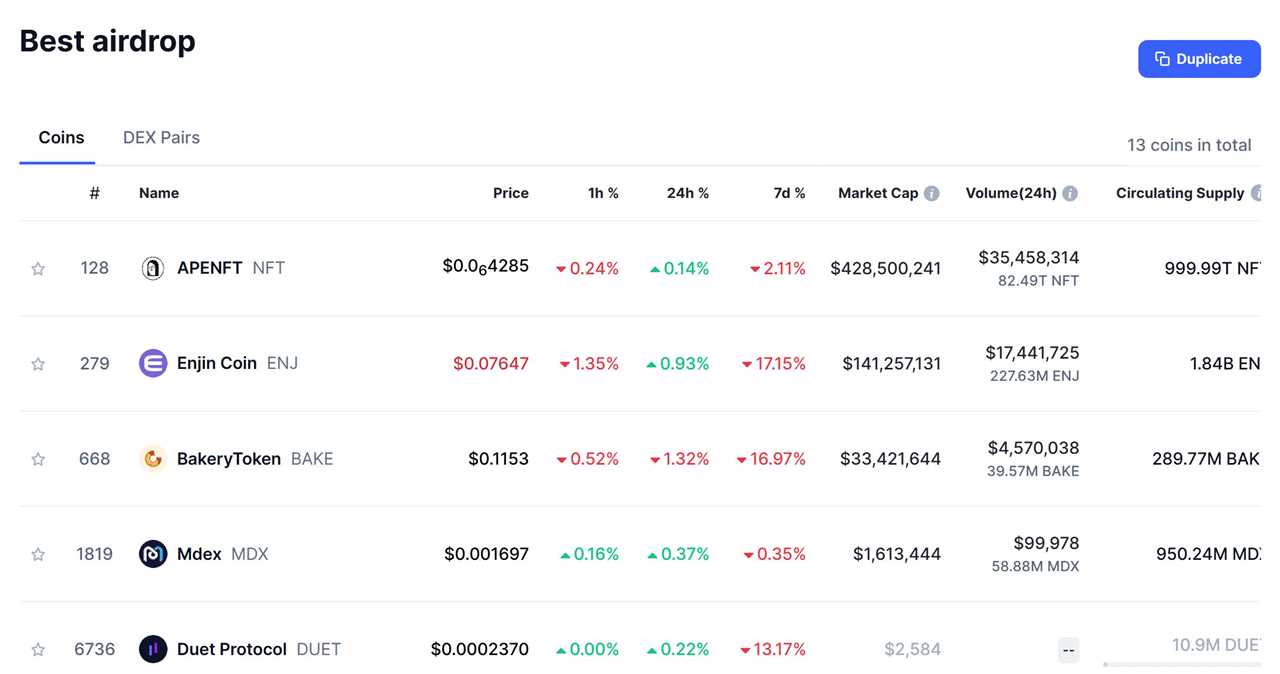

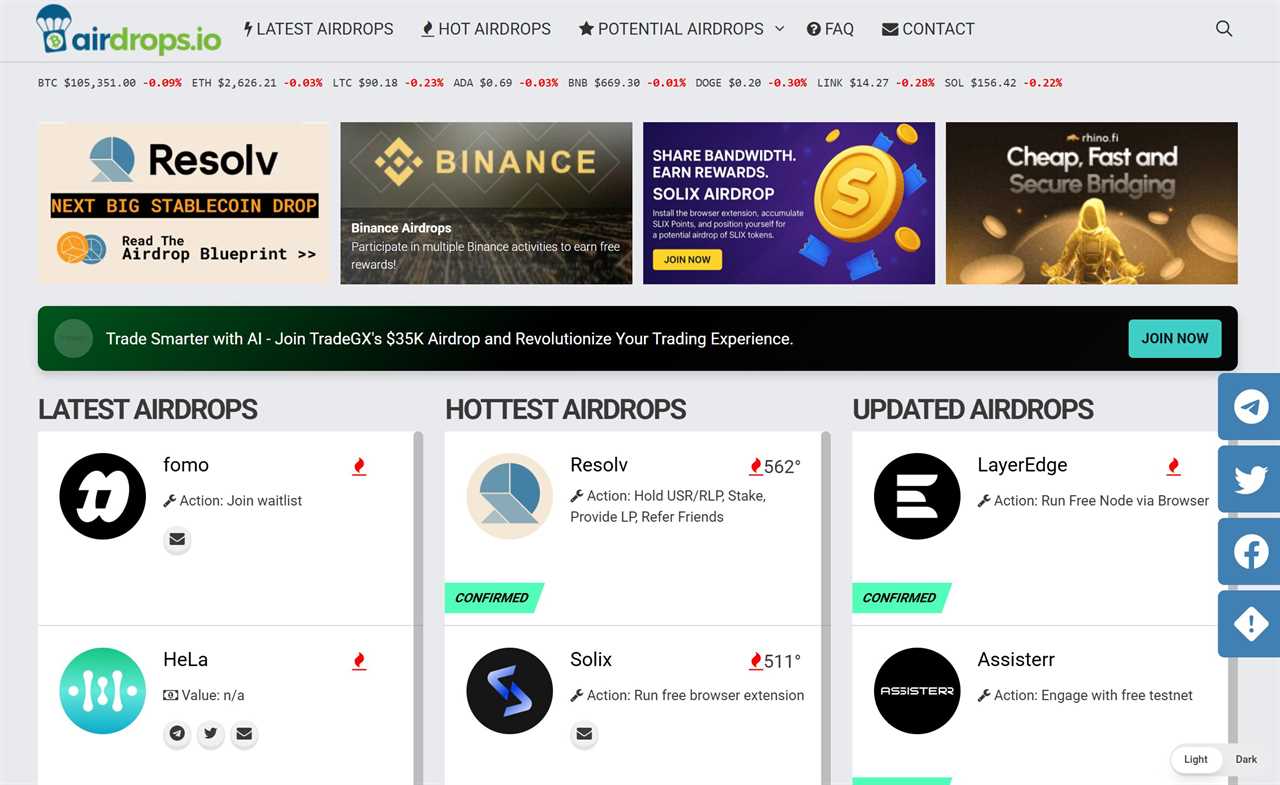

Regularly check social media platforms such as Telegram and Twitter, community channels like Discord or Reddit, and websites such as airdrops.io or CoinMarketCap, to discover and stay updated on upcoming airdrops. These platforms provide complete details about the total token supply, eligibility conditions, and deadlines.

For deeper insights into airdrop strategies, lesser-known projects, crypto market updates, and yield farming, follow some top accounts on X, such as Chase, Olimpio, or NFTevening, and subscribe to well-known crypto news sites.

Source: CoinMarketCap

Step 3: Interact With Protocols

Active engagement with the protocol is a prerequisite for improving your chances of qualifying for airdrop opportunities. Though different projects have varying eligibility norms, below are a few common airdrop tasks you must complete to get crypto assets for free.

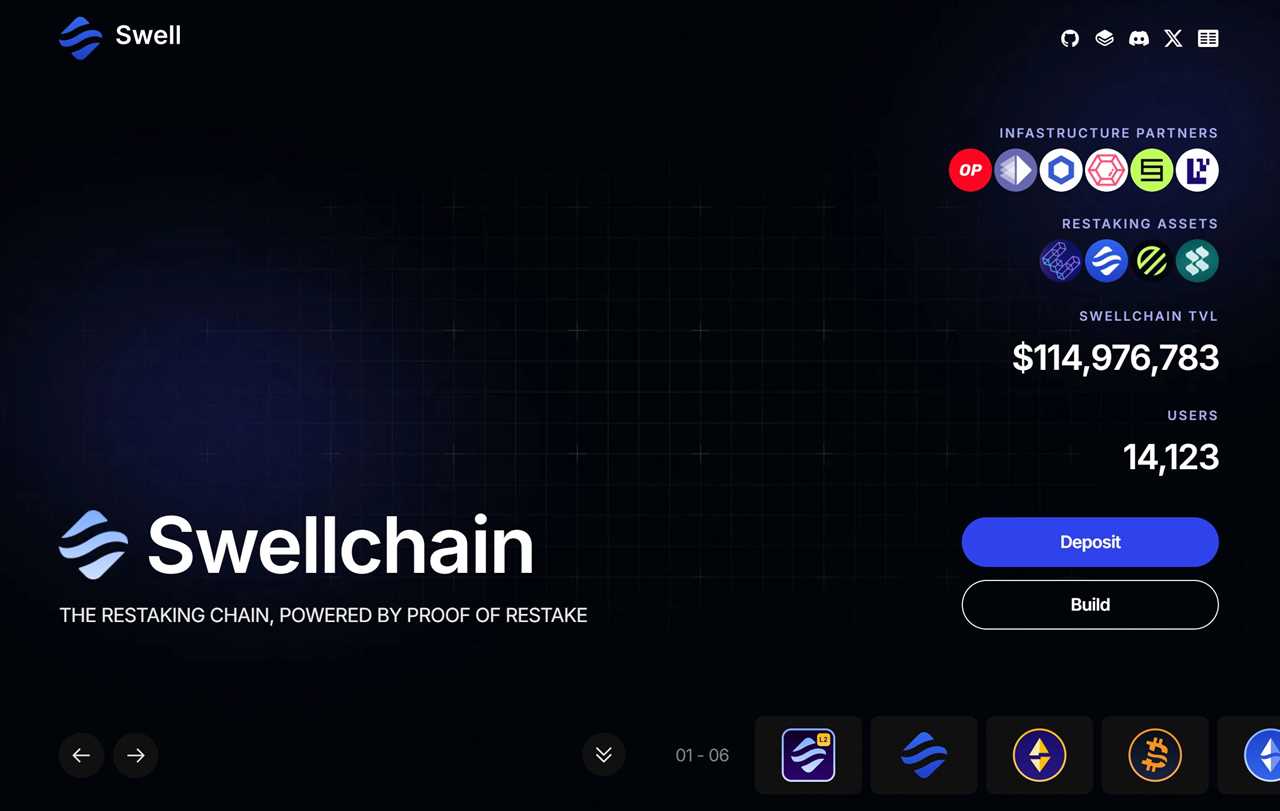

- Staking: Many projects require users to stake specific tokens for securing the network or lock them in smart contracts. For example, Swell Network, a liquid staking protocol, rewards users with 30 pearls per ETH (Ethereum) staked and an additional 30 pearls for staking swETH (Swell Ethereum) on Eigenlayer. These pearls were converted into SWELL tokens at the network’s token generation event.

- Swapping: Some airdrop campaigns, like ZKsync, required users to swap ERC-20 tokens on decentralized exchanges.

- Providing liquidity: Offering specific tokens to liquidity pools on decentralized exchanges or to crypto lending protocols is often a required task to qualify for certain events.

- Voting: If you vote with governance tokens, you can qualify for a project’s secondary airdrops as a reward for your active participation. For example, Neutron distributed 30% of the NTRN token’s total supply for free to accounts that voted on proposal 72.

- Bridging: Some projects, like the Arbitrum airdrops, needed users to bridge funds to the Arbitrum One chain, a layer 2 (L2) scaling solution for Ethereum.

Source: Swell

Step 4: Complete Tasks and Stay Active On-Chain

Many projects track user activity for prolonged periods of 3, 6, or 9 months before shortlisting wallet addresses eligible for token rewards. So, staying active on-chain for longer durations and completing multiple tasks increases your likelihood of receiving airdrops. You may also need to furnish basic information via a Google form or the official website to join the distribution list.

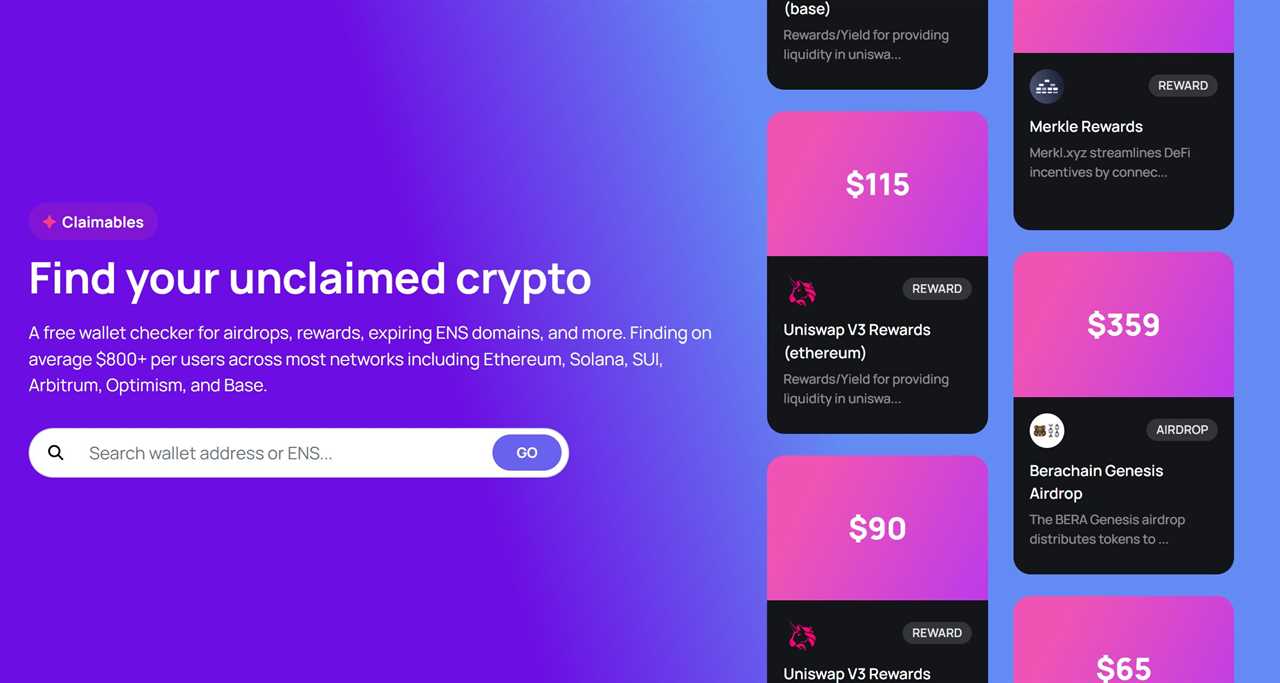

Step 5: Keep Track of Your Airdrops

Once the airdrop event is over, verify whether you have received the tokens in your wallet. If you have applied to many airdrops, use tools like Airdrop Alert, Bankless and Drops , or spreadsheet software such as Microsoft Excel and Google Sheets to organize and monitor your submissions.

Source: Bankless

Best Practices for Farming Airdrops

1. Choose the right blockchains

Although airdrops distribute crypto assets for free, completing the requisite challenges involves transaction charges. While Ethereum is a popular blockchain for minting NFTs and deploying smart contracts or dApps, it consumes high computational power due to network congestion and transaction complexity. Consequently, users must incur high gas costs on Ethereum for all transactions.

Therefore, you should choose a more cost-effective blockchain network to maximize your profits from airdrops. Solana has emerged as a hotspot for airdrop farming due to its nominal fees, energy efficiency, and fast transactions.

2. Manage Multiple Wallets

Users often connect multiple wallets to improve their likelihood of qualifying for more airdrops and earning higher potential rewards. It is also a good practice in terms of safety, because even if one of your wallets’ security is compromised, others remain intact. To manage multiple wallets efficiently, you can even automate the process by running scripts.

However, using multiple wallets may not be the best strategy in the long run. Nowadays, many blockchains are equipped with advanced detection systems to spot wallet addresses associated with a single entity and disqualify all of them in one go. Simply put, if you farm airdrops with multiple wallets, your risk of getting disqualified increases. If your account is flagged, you will not only lose the opportunity to participate in a campaign, but also lose the transaction fee amount you paid for bridging or engaging with smart contracts.

3. Use Bots Cautiously

Always choose well-known bots to automate repetitive operations such as retweeting posts and signing up for testnet activities. You should also run them on secondary wallets or testnets before using them for airdrop tasks, and avoid closed-source bots needing excessive permissions.

4. Stay Updated on Project News

Follow crypto news platforms and experts’ social media accounts regularly to remain updated on upcoming airdrops, associated eligibility criteria, and timelines. You can also go through community discussions on Discord, Reddit, or Bitcointalk to gather more information on past, ongoing, and forthcoming events and airdrop farming strategies.

5. Enable Anti-Detection Tools

Projects often disqualify users with more than one wallet address or bot-like footprints. So, if you use bots or multiple wallets, enable anti-detection browsers like AdsPower and Incogniton to prevent disqualification.

6. Avoid Scams and Phishing

Many scams or phishing attempts masquerade as genuine airdrops to trick users into disclosing their private keys, recovery phrases, or sensitive information. If you feel any red flags in a project, don’t register for or participate in any of its campaigns.

7. Join Testnet Airdrops

Testnet airdrops allow you to engage with a platform before its official release. They offer a beta environment where developers can identify and resolve bugs or cosmetic issues, while users can test real-world utility.

Since testnets offer paper tokens, you can test a protocol and provide feedback without spending money. Active testnet participation also makes you eligible to acquire generous mainnet airdrops once the project goes live.

8. Diversify Your Airdrop Activities

DeFi projects often prioritize wallets actively engaged in staking when selecting recipients for airdrop initiatives. Some even reward users for simply holding the ecosystem’s native or utility tokens. Additionally, interacting with multiple ecosystems boosts your chances of receiving profitable coins.

For instance, 50% of Solana’s pioneer dog coin, BONK’s total supply, was distributed to users with a history of buying or staking SOL, Solana’s native token.

Source: Airdropaler

Benefits of Airdrop Farming

1. Free Token Accumulation

The principal benefit of airdrop farming is the opportunity to collect free tokens from a variety of forthcoming projects or network upgrades. It enables you to claim ownership over tokens without investing upfront. You can sell or trade these assets on secondary marketplaces to garner profits. You can even stake or use them on the corresponding platform to avail of special advantages.

Moreover, you get a smooth entry point into a new ecosystem and an avenue to grow your wealth, in case the project becomes widely adopted.

2. Early Access to Promising Projects

Airdrop farming helps users secure early access to new projects before they are officially launched. It also enables you to become a part of the testnet phase of various blockchain protocols.

Most airdropped tokens start growing in value once they are listed on secondary marketplaces. Their prices soar when the associated project becomes increasingly popular. Thus, as an early adopter, you get a chance to witness, participate, and contribute to a project’s growth and potentially profit from its success.

Recently, Hyperliquid airdrops registered phenomenal success in the crypto world due to its generous 31% token allocation for the genesis airdrop, high-performance, speed, and a decentralized trading environment.

At the time of the initial distribution, the price of the HYPE token was between $2-$3. As soon as it hit the secondary market, its value skyrocketed to $32 at one point, enabling early supporters to earn whopping returns of over $200,000.

3. Governance and Staking Opportunities

Most projects distribute governance or utility tokens through airdrops, helping users obtain voting rights. This decision-making power enables them to shape the direction and growth of the projects they support, while enjoying exclusive benefits. Many blockchains also offer staking and re-staking opportunities to help you earn passive income by locking your assets in staking pools.

4. Potential for Large Returns

In the recent past, DeFi projects such as Uniswap and dYDX have delivered staggering profits to early patrons. These success stories continue to attract crypto buffs to airdrop farming and stimulate the conception and growth of innovative Web3 projects.

Risks of Airdrop Farming

1. Fake airdrops and scams

When you farm airdrops, one of the biggest dangers you may encounter is fraudulent projects posing as high-quality profit-generating avenues. Furthermore, phishing scams often disguised as legitimate airdrops are commonplace on social media. The goal of such projects is usually to steal participants’ private keys, seed phrases, and confidential data.

Thus, you must do thorough research, apply due diligence, exercise caution, and assess community feedback before expressing interest in any project that helps you earn crypto for free.

2. Low-quality and low-value projects

Many airdrops distribute coins with low or no value. Despite initial hype, these projects fail to find patrons or supporters once launched publicly, especially after the excitement surrounding them fades away.

Without widespread adoption, both the demand for and the prices of their assets drop sharply. Many coins lose their value completely and become worthless, resulting in the projects shutting down forever.

According to Coingecko, 1.8 million tokens collapsed in the first quarter of 2025, constituting a whopping 49.7% of recorded defunct projects. 52.7% of all cryptocurrencies listed on the Geckoterminal failed between 2024 and early 2025.

One of the major causes of such failures can be attributed to the rise of platforms like pump.fun that have simplified token production, giving birth to low-effort projects, particularly in the meme coin category. Hence, assessing the potential worth of a project is imperative.

3. Tax & Legal Implications

As crypto laws differ from country to country, you must be aware of the tax implications of accumulating cryptocurrencies and NFTs via airdrop farming. Many jurisdictions view airdropped assets as taxable income. Moreover, when you sell your tokens at a higher value than their purchase prices, you may have to incur taxes on the capital gains.

4. Token Dumping and Price Volatility

Airdrops are susceptible to token dumping, especially when a large number of coins are distributed, as a few actors may sell their holdings immediately, causing the asset price to plummet. This price volatility proves detrimental to airdrop farmers hoping to rake a mollah. The overall crypto market volatility also adds to their woes.

5. Getting Flagged as a “Sybil Attack”

As individual wallet addresses are selected for airdrops based on their qualifying activities, a single person or a small group of users can use multiple accounts, addresses, or identities to seize control of the protocol. Such an act is called a Sybil attack, which threatens the decentralized nature of DeFi projects.

Many protocols are equipped with sophisticated fraud detection systems to spot spurious wallet accounts and flag them as a potential Sybil attack. While such security features safeguard user assets, participants with many wallet addresses can be disqualified from airdrops.

Strategies for Successful Airdrop Farming

Source: Tokenmetrics

1. Focus on Reputable Projects

To avoid low-quality coins and crypto fraud, focus on well-known projects with proven track records. Select cryptocurrencies, DeFi products, or NFTs hosted on popular networks such as Bitcoin, Ethereum, Polkadot, Solana, etc. Ensure the chosen project provides complete details of the founders’ and creators’ credentials, vision, community, and roadmap to help you gauge its trustworthiness, long-term viability, and sustenance.

2. Automate Your Search

Discovering and remaining up-to-date on new airdrop opportunities is both daunting and time-consuming. By using automation tools or platforms like Airdrop Alert and CoinGecko, you can streamline your search, save time, and ensure you don’t miss lucrative deals.

3. Hold for Long-Term Gains

Resisting the temptation to offload your airdropped crypto immediately can render considerable profits in the long run, if the project becomes successful. The wider the project’s adoption, the greater the value of its assets, and the higher your potential gains.

4. Diversify Across Blockchains

When you participate in airdrops across multiple blockchains, you enhance your chances of finding a high-value project. Diversification also helps minimize risks and offset losses.

5. Follow the Trends

The thumb rule to achieving substantial gains from airdrop farming is to analyze crypto market trends and become the early bird that catches the worm. Following platforms that send you instant notifications of prospective airdrops or the latest happenings in the cryptoverse prevents you from missing the bus.

6. Learn How to Trade

When you farm airdrops, learning the tips and tricks of trading comes in handy. For example, you must avoid selling the tokens when their price is upswinging and wait for an opportune time when prices hit their maximum and start stabilizing.

If technical indicators warn you of an impending fall in, say, Ethereum prices, you should unstake ETH and park it in stablecoins to battle the storm.

Key Tools for Farming Airdrops

- Airdrop Alert, Airdrops.io, Coingecko, and CoinMarketCap: These platforms provide complete details of the current and forthcoming airdrop opportunities.

- QuestN: It is an AI-powered platform offering airdrop services to Web3 projects and fostering community development and engagement. It helps launch airdrop campaigns, provides information on upcoming events, and bridges Web2 users to Web3.

- Airdrop tracker: This application organizes and monitors the airdrops you have participated in and displays payout schedules.

- Adspower – It is an anti-detect browser with multi-login functionality that helps you manage multiple browser profiles and wallets seamlessly. It also bypasses detection tools, enabling you to use bots or more than one wallet without fear of disqualification.

The Future of Airdrop Farming

As the DeFi, Web3, virtual currency, and NFT ecosystems continue to expand, more and more blockchain-based projects will continue to harness airdrops as a marketing, advertising, and user acquisition tool. For both amateur and veteran traders, airdrop farming is a means to grow their crypto portfolios without investing capital. It is particularly helpful for newcomers intending to step into and explore the Web3 universe. With the advent of airdrop aggregator platforms like DappRadar, spotting the best airdrops has also become simpler.

However, increased user awareness has also made these opportunities more competitive, leading to stringent qualification criteria verified by oracles in the future. Therefore, in-depth research coupled with the ability to grasp the dynamics of airdrops will help you maximize your rewards and minimize losses and tax liabilities.

FAQs

Is airdrop farming legit?

Though airdrop farming is often criticized for thwarting the organic distribution of tokens and putting genuine users on the back foot, it is 100% legit. However, you must beware of scam projects attempting to get hold of your confidential data to steal your crypto wealth.

How to earn money from airdrops?

You can earn money, lower opportunity costs, and free funds for other investments by selling off your airdropped tokens immediately. You can convert them into stablecoins to get instant value and liquidity or stake them to earn passive income. If the project gains popularity worldwide, the value of its assets will skyrocket, enabling you to clock substantial profits. Lastly, airdrops may also offer exclusive benefits like free dApp access, voting and governance rights, product discounts, etc.

What is the time farm airdrop?

Time Farm is a lightweight Telegram mini-app with 17 million registered users and hosted on the TON blockchain. Through the time farm airdrops, active participants can get tradeable SECOND coins – the primary token of the ecosystem that is used for making payments, DAO governance, and integration with Chrono.tech products. Once you complete the initial setup and connect your TON wallet, you can receive 250,000 SECOND tokens and an additional 30,000 as a bonus. You can also win exciting rewards by completing the challenges listed in the Task tab.

How to get crypto airdrops?

Qualification criteria and wallet activity monitoring periods vary across projects but follow similar patterns. Therefore, the best way to get airdrops is by actively interacting with new protocols or chains. You also need to complete required tasks such as staking, copytrading, content creation, testnet participation, swapping, liquidity deposits, bridging, holding certain assets during the snapshot, etc., based on an airdrop’s eligibility conditions.

Is Crypto Airdrop Farming Worth It?

Airdrop farming entails no initial investment. You just need to actively support and engage with a new project, follow its social media handles, and complete a few tasks to make it to the airdrop list. Moreover, if the project has robust community backing and gains traction globally, the market prices of its tokens will soar, rendering considerable profits to users. Farming on a cost-efficient blockchain reduces your transaction fees, increasing your profitability. Thus, airdrop farming is worthwhile even if it carries some risks.

How to Spot Legitimate Airdrops?

For successfully farming airdrops, differentiating between real deals and potential scams is essential. Usually, legitimate projects will have a clear vision, mission, roadmap, a strong social media presence, an official website, and a burgeoning community backing it.

The post What is Airdrop Farming and How to Farm Airdrops in 2025 appeared first on NFT Evening.

Read MoreBy: Zander Brown

Title: What is Airdrop Farming and How to Farm Airdrops in 2025

Sourced From: nftevening.com/airdrop-farming/?utm_source=rss&utm_medium=rss&utm_campaign=airdrop-farming

Published Date: Thu, 05 Jun 2025 09:10:33 +0000

----------------------------

Always check our latest articles at...

https://trendingincrypto.com/nft-news

.png)