While demonstrating remarkable progress, Sui navigates inherent challenges, including intense market competition, adoption hurdles, and evolving regulatory uncertainties. This analysis provides an in-depth examination of these facets, offering a balanced perspective on Sui’s current standing and future trajectory.

Into the Sui Network

Sui, a decentralized, permissionless Layer-1 blockchain, launched in 2023, developed by Mysten Labs. The team, composed of former Meta engineers from the Diem (formerly Libra) project, gained invaluable R&D experience in addressing scalability, security, and regulatory compliance for global financial systems. This background provided Sui a substantial head start in technological maturity and robustness, shaping its design philosophy towards enterprise-grade solutions and mass adoption. Their prior exposure to stringent regulatory scrutiny also equips Sui with a proactive approach to the complex regulatory landscape, accelerating its mainstream integration with an institutional-first mindset.

Sui’s core aim is to enable efficient, low-latency, and rapid digital asset management, fundamentally reshaping blockchain infrastructure. It’s built for high-performance, minimal-fee real-world applications in gaming, Decentralized Finance (DeFi), commerce, and Non-Fungible Tokens (NFTs). This deliberate market positioning and pragmatic, user-centric approach are designed to foster sustainable growth and attract a wider user base beyond mere speculation, aiming for deep integration into broader economic and social activities.

Sui homepage

Sui’s Foundational Technology

Object-Centric Data Model

Sui’s core innovation is its object-centric data model, where every digital asset is a distinct, mutable object with a unique owner. This granular approach allows for significantly faster ownership transfers and instant updates, often bypassing global consensus.

This redefinition enables parallel transaction execution, leading to exceptionally high throughput, ultra-low latency, truly dynamic NFTs, and simplified composability. It provides an intuitive “physical world” representation of assets, reducing friction for developers and users, particularly in high-interaction applications like gaming and DeFi.

The Move Programming Language

Move is the revolutionary smart contract language powering Sui, originally developed for the Diem blockchain. It’s designed to be “secure by default,” “intuitive by design,” and “expressive by nature,” mirroring physical world asset ownership and scarcity.

Move’s inherent security features prevent malicious attacks and reduce developer cognitive load, accelerating dApp development and attracting top talent. Its succinct tagline, “less code, more secure,” encapsulates this value.

Move on Sui features enhancements like its unique object-centric global storage model, module initializers, and specific use cases for the entry keyword. It encourages formal verification and auditing, significantly enhancing security.

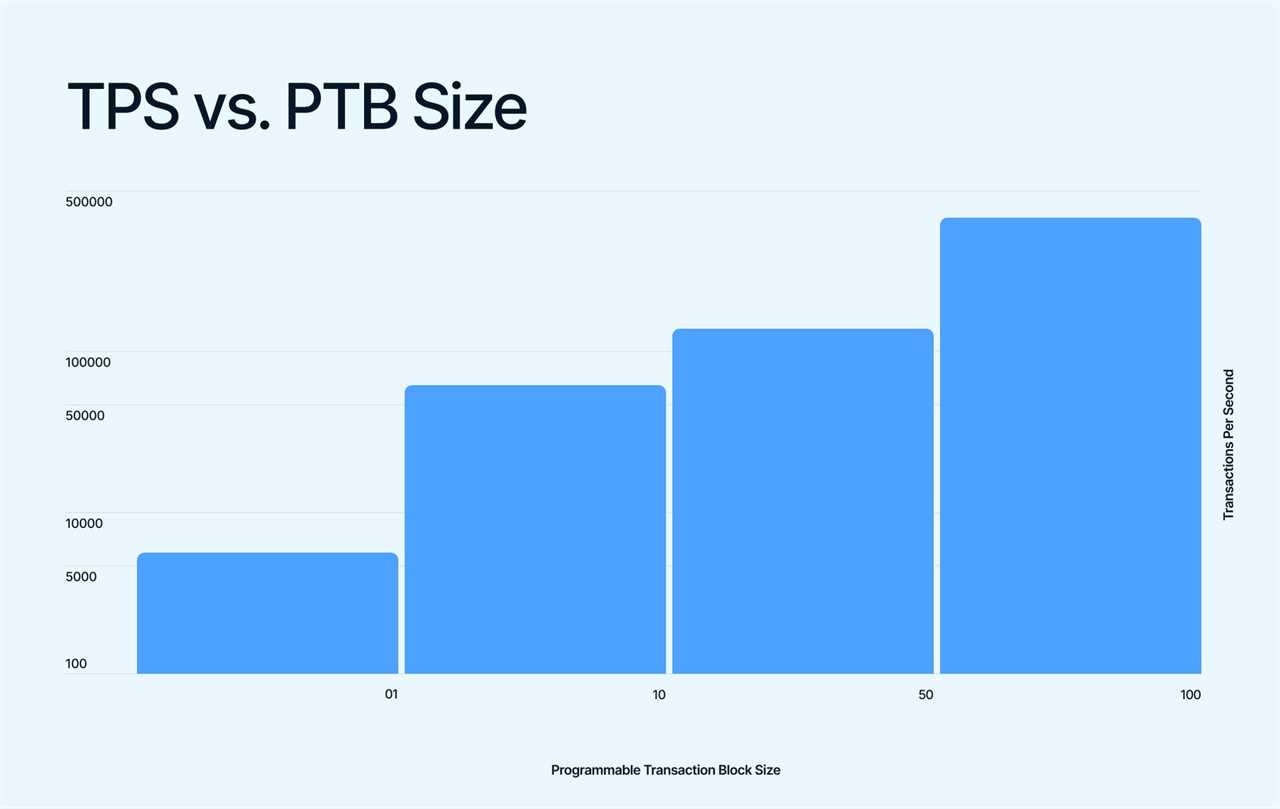

Programmable Transaction Blocks (PTBs) are a standout feature, allowing a single Sui transaction to atomically call up to 1024 separate Move functions. This capability enables rich and safe code composability, dramatically improving gas efficiency and simplifying complex smart contract logic by moving composition from the contract level to the transaction level.

Programmable Transaction Blocks (PTBs)

Dynamic Fields further enhance composability and flexibility, allowing developers to add or remove object fields on the fly, link objects together, and organize data into intuitive object hierarchies. Developers actively building on Sui praise Move for enabling atomic and dynamic operations, reducing programming difficulty, and providing robust type safety, leading to faster and more secure product development.

Consensus Mechanism and Scalability Innovations

Sui operates on a permissionless Delegated Proof-of-Stake (DPoS) system. At its core, it employs Mysticeti, a novel Byzantine Fault Tolerant (BFT) consensus protocol. This protocol optimizes validator communication, allowing simple transactions to settle in milliseconds by bypassing full consensus, while complex ones use the full power of Narwhal and Bullshark for robust ordering.

This intelligent dual-path mechanism directly contributes to Sui’s exceptional high throughput and ultra-low latency, avoiding sequential processing bottlenecks. Sui achieves impressive scalability through parallel transaction execution and supports horizontal scalability by partitioning its state space into independently manageable objects, ensuring the network scales with demand by adding more validators.

Key User-Centric Features

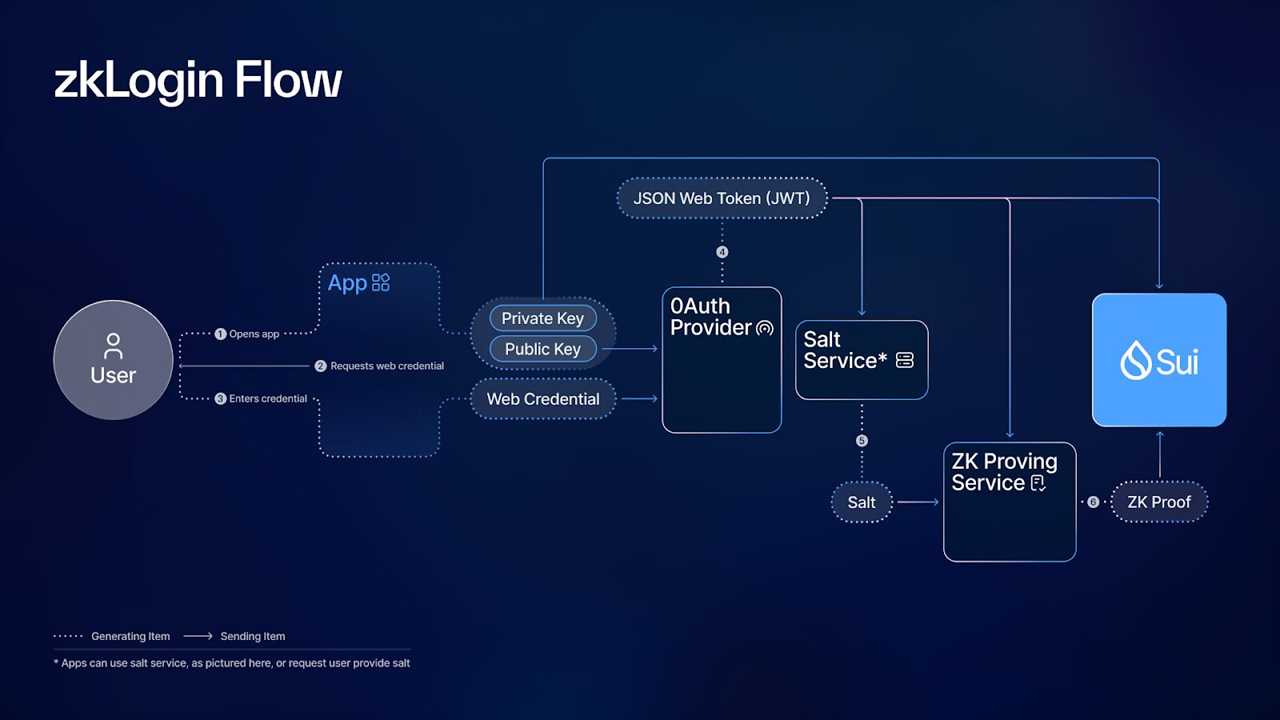

Zero-Knowledge (ZK) Login is a critical innovation that allows users to access dApps on Sui using existing Web2 credentials (e.g., Google accounts), completely bypassing traditional private keys or seed phrases. This significantly lowers the barrier to entry for mainstream users, making blockchain interactions more accessible and user-friendly and demonstrating Sui’s strong focus on user experience.

Beyond ZK Login, Programmable Transaction Blocks (PTBs), as mentioned earlier, are central to complex dApp creation, offering gas efficiency and secure atomic operations. Sui also ensures digital assets are stored directly on-chain for integrity and true ownership, and its modular architecture allows for seamless future upgrades.

zkLogin Flow

Sui Performance Metrics

The following table provides a quantifiable overview of Sui’s technical capabilities and the tangible growth of its ecosystem, offering critical data for assessing its performance and competitive standing.

| Metric | Value |

| Theoretical Transactions Per Second (TPS) | 297,000+ |

| Current Transactions Per Second (TPS) | ~1,800 |

| Time to Finality (Simple Transactions) | Milliseconds |

| Time to Finality (Mysticeti) | ~39ms (at 100k TPS) |

| Average Time to Finality | ~400ms |

| Total Value Locked (TVL) (as of June 2025) | $1.8 Billion |

| Stablecoin Market Capitalization | >$860 Million |

| Monthly Stablecoin Transfer Volume | >$70 Billion |

| Total DEX Volume | >$110 Billion (cumulative) / $398 Million (24-hour) |

| Activated Wallets | >8 Million |

| Total Transactions Processed | >2.64 Billion |

SUI Tokenomics and Utility

Sui Token

SUI is the native token of the Sui network, serving as the fundamental asset that powers every action and transaction on the platform.

SUI utility:

- Gas Fees: SUI is used to pay the computational costs for executing transactions and storing data on the network. A key design objective ensures these gas fees remain low and stable, largely unaffected by network congestion, distinguishing Sui from many other blockchains.

- Staking and Network Security: SUI holders can actively participate in the network’s security and operation through staking. By delegating their SUI tokens to validators within the Delegated Proof-of-Stake (DPoS) system, they contribute to network security and earn rewards. Validators, who collateralize SUI, receive gas fee rewards and share them proportionally with their delegators.

- Governance: SUI token holders possess governance rights, enabling direct participation in on-chain voting. This includes critical decisions regarding protocol upgrades, network parameters, and the overall strategic direction of the Sui ecosystem.

- Versatile Utility and Ecosystem Asset: SUI is designed as a versatile and liquid asset for diverse applications across the ecosystem. It functions as a unit of account, medium of exchange, and store of value, facilitating complex functionalities through smart contracts, interoperability, and composability. Within the Sui ecosystem, SUI tokens are actively utilized for trading on Decentralized Finance (DeFi) platforms, for creating and managing Non-Fungible Tokens (NFTs) in games and collectibles, and as the primary currency for interactions within DeFi and gaming dApps.

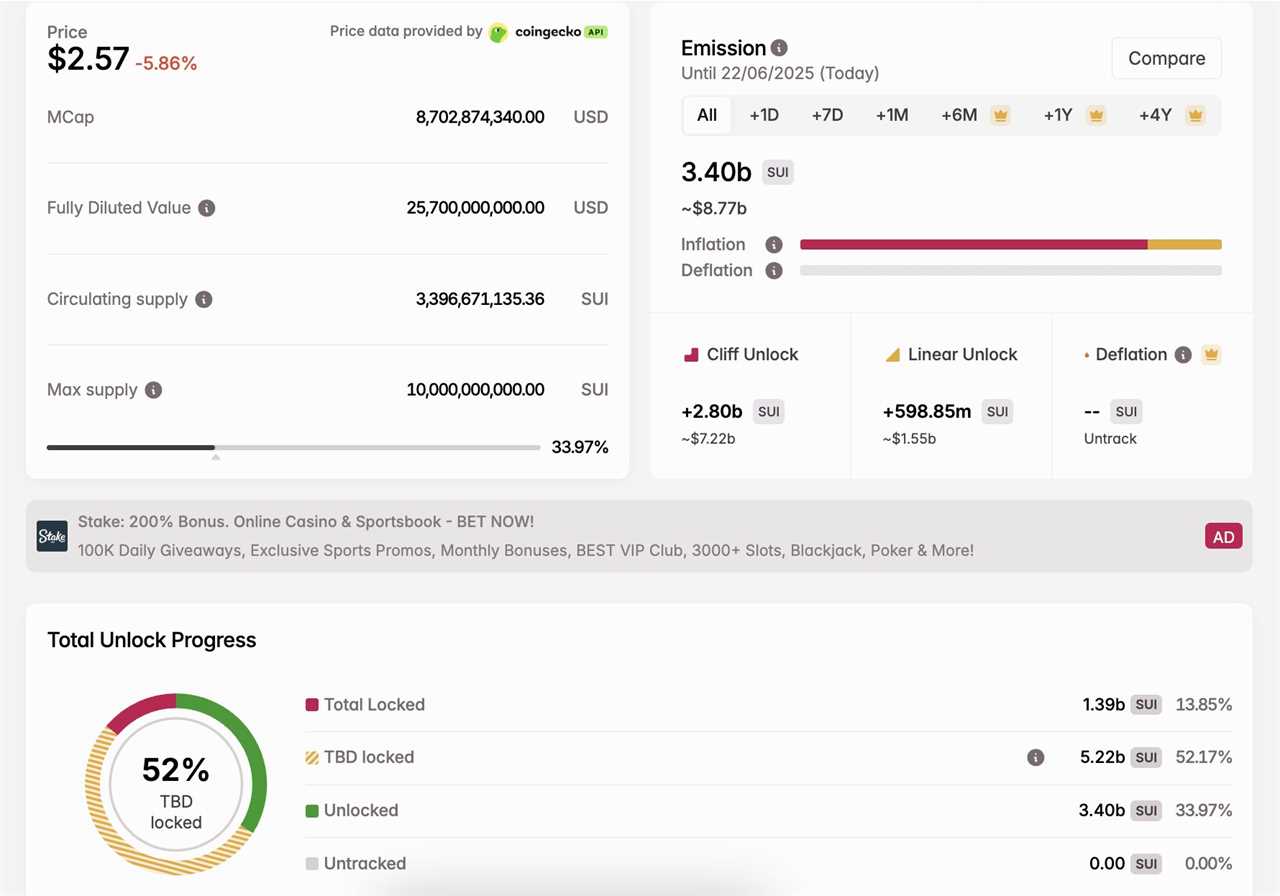

Token Distribution and Vesting Schedule

The total supply of SUI tokens is capped at 10 billion. The distribution of this supply is structured across several key categories:

| Category | Allocated Amount (SUI) | Share (%) | Vesting Schedule/Details |

| Total Supply | 10,000,000,000 | 100% | Capped Supply |

| Early Contributors | 2,000,000,000 | 20% | 12-month cliff, non-linear vesting over subsequent year |

| Investors (Series A & B) | 1,400,000,000 | 14% | 12-month cliff, linear vesting |

| Mysten Labs Treasury | 1,000,000,000 | 10% | |

| Community Access Program (Public Sale) | 600,000,000 | 6% | 1/13 unlocked at TGE, 1/13 monthly for 12 months |

| Community Reserve | 5,000,000,000 | 50% | ~29.55% unlocked at launch, remainder vests gradually over several years; includes Stake Subsidies (9.49%) unlocking linearly over 7 years |

It is important to note that token unlock events are a common phenomenon in the crypto industry and can significantly impact market dynamics due to the sudden increase in circulating supply.

For example, a scheduled unlock in February 2025 released over 64 million SUI tokens. This represented about 1.2% of the total supply, valued then at around $51 million.

This process presents an inherent tension. While token unlocks certainly introduce short-term market risk, due to potential selling pressure, they are also vital. Importantly, they progressively decentralize token ownership. Furthermore, these unlocks reward key stakeholders, including early contributors and investors, who helped develop the network. Ultimately, they foster broader community participation.

Sui token emission and Unlock progress

The “paradox of capital inflows,” where high inflow volume might not signify stable, long-term support , makes these unlock events even more sensitive.

Sui’s challenge is to manage these periodic supply increases without undermining market confidence, ideally by ensuring that demand from new use cases and sustained ecosystem growth can absorb the increased supply. This highlights the ongoing need for robust ecosystem development to counteract potential sell-side pressure.

Economic Model and Incentives

Sui’s economic model meticulously aligns incentives for users, SUI token holders, and validators, fostering long-term viability and decentralization. Vesting schedules mitigate sell-offs, ensuring a community invested in sustained success.

A crucial “storage fund,” fueled by transaction fees, subsidizes future validator rewards for data storage. This forward-thinking mechanism ensures sustainable data persistence, attracting institutional adoption seeking predictable development.

The Delegated Proof-of-Stake (DPoS) model incentivizes validators for high performance, as their rewards tie directly to delegated SUI. Users, as delegators, choose validators based on performance and commission rates, fostering competition and overall network health.

Challenges and Limitations

Security Risks

Security risks are inherent in any new platform, especially those using a novel language like Move. While Move and Sui’s object-based data model offer strong safety guarantees (e.g., preventing double-spend), audits remain crucial for identifying logical flaws and validating custom business logic.

UPDATE: We have not received any communication from the hacker. We encourage the hacker to sincerely consider our offer terms.Simultaneously, with the support of Inca Digital and financial support from Sui Foundation, we are announcing a bounty of $5M for relevant information…

— Cetus

(@CetusProtocol) May 23, 2025

A notable incident was the Cetus Protocol breach in May 2025, where an estimated $260 million was at risk due to a flaw in the protocol’s mathematical functions, not Sui’s core infrastructure or Move language.

In response, Sui committed $10 million to enhance security, focusing on advanced analytical tools, increased monitoring of high-risk components, and technical audits. This incident highlights that despite inherent language safety, complexity in a rapidly expanding ecosystem can introduce new application-layer vulnerabilities.

We’re kicking this off by committing to spend an additional $10M on security initiatives. These funds will be spent on audits, bug bounty programs, formal verification, and other ways to harden Sui — we’ll figure out the details in collaboration with our developer community.

— Sui (@SuiNetwork) May 26, 2025

The network’s response demonstrates a commitment to resilience, but the inherent trade-offs between speed, decentralization, and security will remain a critical focus for Sui’s long-term viability. Additionally, the degree of validator centralization in DPoS, while enabling high performance, necessitates strong governance and community oversight to prevent potential abuses or systemic risks.

Adoption Hurdles

Sui faces tough adoption challenges. Specifically, it must compete fiercely with established blockchains like Ethereum and Solana for developers and projects. Consequently, its “build it and they will come” strategy hinges on overcoming strong network effects. Indeed, despite Sui’s technical advantages—speed, scalability, and low fees—older platforms possess large, loyal communities and robust ecosystems.

Therefore, Sui’s challenge involves fostering long-term, utility-driven engagement. This means moving beyond attracting short-term speculative capital. Instead, it requires not only strong technology but also sustained effort in community building. Furthermore, demonstrating consistent real-world value encourages deep integration and loyalty. Thus, offering developer grants, hackathons, and and comprehensive tooling is crucial to lowering entry barriers for new projects.

Ecosystem Growth and Regulatory Uncertainty

Ecosystem growth is essential for Sui’s success, necessitating a diverse range of payment solutions, DeFi applications, gaming platforms, and robust partnerships with enterprises and infrastructure providers. A thriving and diverse ecosystem is critical for sustaining user and developer interest.

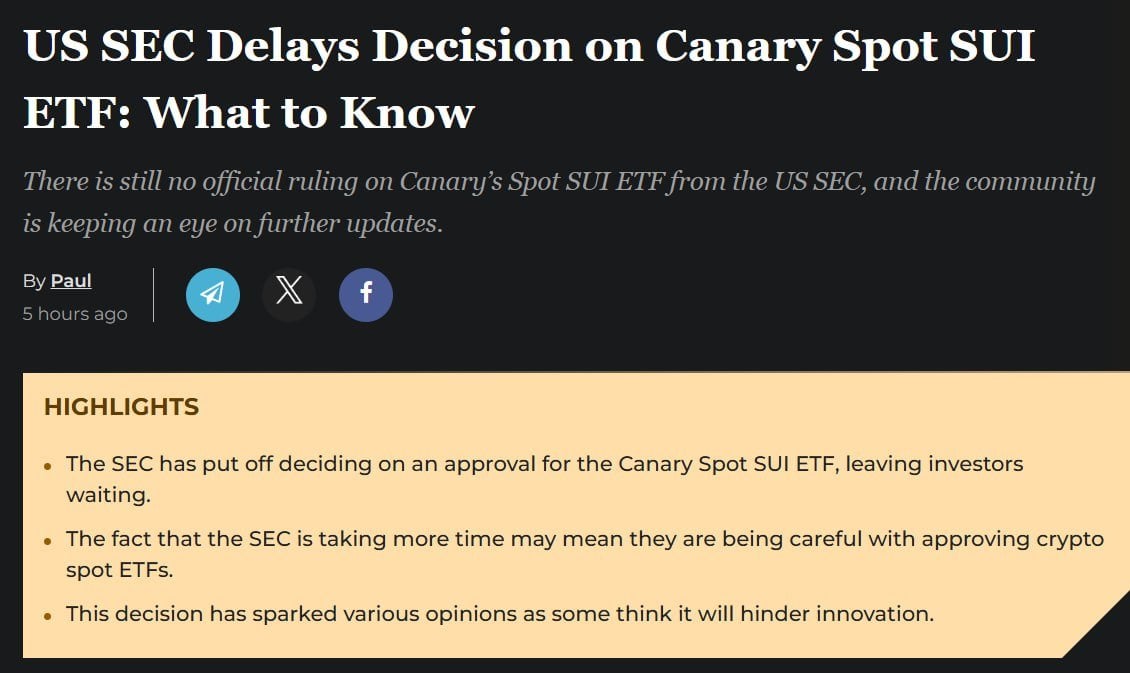

Furthermore, regulatory uncertainty poses another significant challenge. The global blockchain landscape is subject to ever-changing laws and policies, as seen with SEC delays on SUI ETF decisions (e.g., July 2025).

Sui’s ability to adapt to these regulations while maintaining its core functionality will be crucial for building trust among institutions, developers, and users. Proactive engagement with regulators and adherence to compliance requirements can mitigate these risks and help position Sui as a trustworthy, compliant platform in an evolving legal environment.

For more: The Growth Potential of Sui?

Sui Competitors

Blockchain Layer-1 space is highly competitive, with Sui vying against major players like Ethereum, Solana, and Aptos. Each network offers distinct advantages.

Sui vs. Ethereum: Sui offers superior scalability, lower fees, and faster transaction finality compared to Ethereum. However, Ethereum benefits from an established community and extensive network effects, despite its lower transaction speed and higher fees.

Sui vs. Solana: Both are high-performance Layer-1s. Solana utilizes a Proof of History (PoH) and Proof of Stake (PoS) hybrid consensus, achieving approximately 2.5 seconds finality and around 2,500 current Transactions Per Second (TPS). Sui, with its object-centric Move language, offers immediate finality for simple transactions and around 1,800 current TPS. Solana currently boasts a larger developer community (over 30,000) compared to Sui (over 15,000).

Sui vs. Aptos: Both blockchains originated from Meta’s Diem project and utilize the Move programming language. Sui employs an object-centric parallel execution model, focusing on specialized use cases like gaming and social dApps, optimized for real-time applications. Aptos, on the other hand, aims to be a general-purpose blockchain, using Block-STM for parallel execution and a Byzantine Fault Tolerance (BFT) consensus model, with claims of being a more secure, faster, and long-term solution for developers.

The post Sui Deep Dive: A Comprehensive Analysis appeared first on NFT Evening.

Read MoreBy: Liam Miller

Title: Sui Deep Dive: A Comprehensive Analysis

Sourced From: nftevening.com/sui-deep-dive-2/?utm_source=rss&utm_medium=rss&utm_campaign=sui-deep-dive-2

Published Date: Mon, 23 Jun 2025 07:41:33 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/no-hardware-no-risk-just-sign-up-and-get-500-in-free-mining-power

.png)