Crypto trading attracts millions each year with the promise of fast profits and financial freedom. But here’s the hard truth: most beginners lose money and fail. It makes you wonder: Why do so many fail in their first year, and how can you avoid the same mistakes?

Our new survey set out to uncover the real reasons behind first-year trading failures, highlighting the most common mistakes, risky moves, and poor habits that cause beginners to lose their money. These findings reveal practical insights you can use to spot these mistakes before they happen, make smarter trading decisions, and improve your chances of long-term success in the crypto market.

Methodology

We surveyed 1,005 retail crypto traders using a widely used online research platform. Participants were eligible only if they had traded cryptocurrency in their first year. To maintain data quality, the survey included attention-check questions, and any invalid responses were excluded from the final analysis.

Since the findings rely on self-reported data, there is a possibility of biases such as recall errors or exaggeration. The results presented here reflect participant responses, not our own views, and should not be interpreted as financial or investment advice.

The survey was conducted on August 8, 2025.

The Harsh Truth: 84% Traders Lose Money in Their First Year

Most new crypto traders enter the market full of hope, but the reality is not easy. Our survey shows that 84% of traders lose money and fail within their first year and the struggle is so great that 1 in 3 traders quit within the first six months.

Worse still, 58% of new traders lose almost all of their money in that first year. For some, it’s one big losing trade, while for others, it’s a series of smaller losses that slowly add up. Whatever the reason, the outcome is the same: a costly lesson in just how unforgiving the crypto market can be.

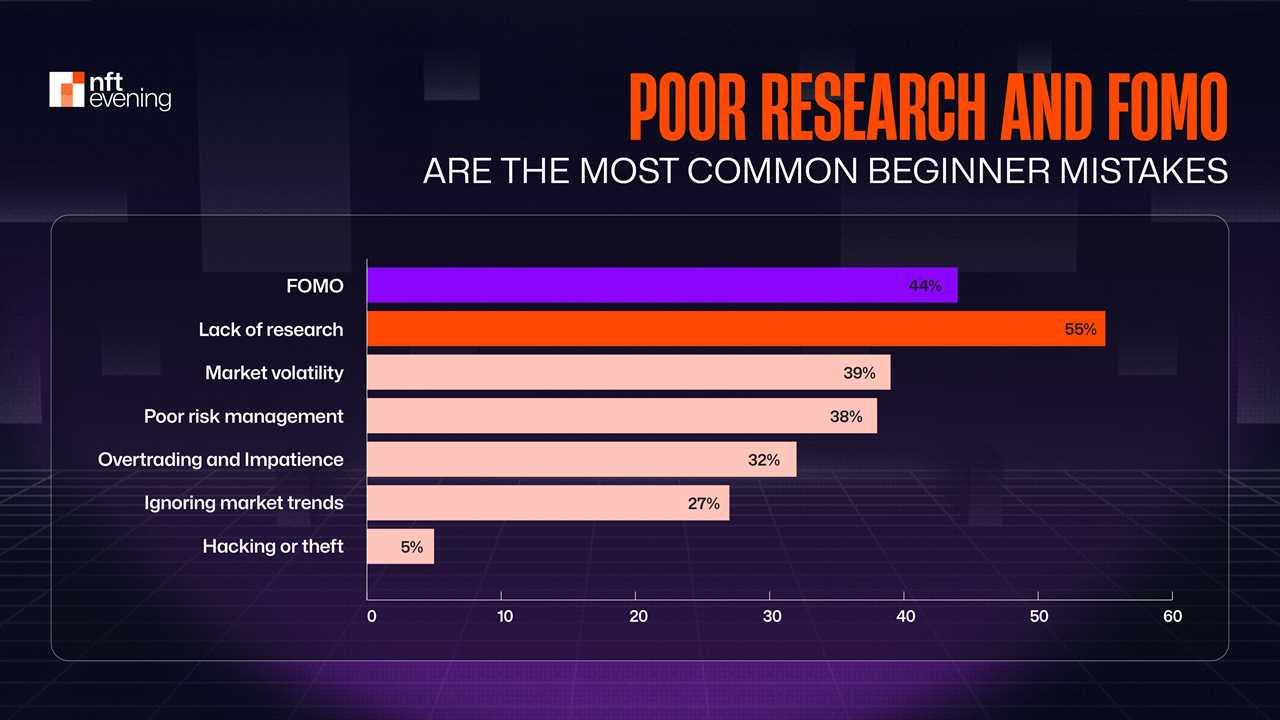

What Causes New Traders to Lose Money?

Our survey shows that the two most common mistakes beginners make are poor research (55%) and FOMO (44%). More than half of new traders admit they enter trades without fully understanding the market or the asset, making decisions based on excitement and rumors instead of solid, well-checked information. Almost as many jump into trades when prices are at their peak because they are afraid of missing an opportunity, only to face losses soon after.

How Do Your Trading Habits Affect Your Results?

The survey shows that 54% of new traders choose day trading, making it the most popular but also the most dangerous approach for beginners. The fast pace of day trading requires experience, discipline, and quick decision-making, qualities most beginners haven’t yet developed.

The risk increases even more with frequent trading. Our survey found that 66% of traders who trade often end up with bigger losses, especially when they don’t use proper risk management. In fact, over 85% of new traders fail to consistently use tools like stop-loss or take-profit orders, leaving their capital exposed to sudden market swings.

Why Traders Keep Going Despite Losses

Despite heavy losses, most traders don’t walk away from the market. Our survey found 86% keep trading despite losses. Nearly half become more cautious in their approach. Even more striking, 58% of new traders don’t seek professional advice when they’re losing, relying instead on friends, social media.

This determination to keep going isn’t without reason. The main motivation for pushing forward varies, but a common theme stands out: many believe in the long-term future of crypto and see it as a way to earn extra income outside their main job.

Conclusion

Most new traders lose money not because the market is impossible to beat. They start unprepared and fall into common traps like lack of research, FOMO-driven trades, risky habits, and weak risk management. These mistakes can be avoided if you treat trading as a skill that takes time, patience, and discipline to master.

Your first year should be seen as a learning period, not a race to get rich. Focus on building strong habits and managing risk. Learn from every trade, whether it ends in a win or a loss. With the right mindset, early setbacks can become valuable lessons. They lay the foundation for long-term success in the crypto market.

The post Study: 84% of Retail Crypto Traders Lose Money in Their First Year appeared first on NFT Evening.

Read MoreBy: Liam Miller

Title: Study: 84% of Retail Crypto Traders Lose Money in Their First Year

Sourced From: nftevening.com/84-percent-of-retail-crypto-traders-lose-money-in-their-first-year/?utm_source=rss&utm_medium=rss&utm_campaign=84-percent-of-retail-crypto-traders-lose-money-in-their-first-year

Published Date: Mon, 18 Aug 2025 15:31:04 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/sol-mining-launches-xrp-contracts-to-help-xrp-holders-increase-ripple-assets

.png)