The crypto market dramatically saw newly launched Solana ETFs defy a market rout, recording significant inflows as major funds tracking Bitcoin and Ethereum bled capital.

For the first time, a non-major cryptocurrency ETF surpassed its Bitcoin and Ethereum counterparts in single-day net inflows, marking a powerful new phase in institutional crypto adoption.

On November 4, 2025, the ETF landscape showed institutional appetite shifting away from the established giants. Data revealed massive outflows for the largest digital assets: Bitcoin ETFs lost a staggering $566.4 million, and Ethereum ETFs saw $108.3 million exit. Completely counteracting this trend, Solana ETFs, which launched just over a week earlier, pulled in $14.9 million in net inflows.

Solana ETFs still maintained a positive net inflows.

Is Solana an Institutional Favorite?

This flow data signals more than just a momentary blip; instead, it represents a significant capital rotation. While the broader crypto market experienced a sharp correction, with prices of major coins falling, big institutions demonstrably maintained their enthusiasm for the new Solana ETF products. Since their debut in late October, these funds recorded six consecutive days of net purchases, thereby amassing a total inflow value of $284 million.

Bloomberg Senior ETF Analyst Eric Balchunas described the debut of the Bitwise Solana Staking ETF (BSOL) as a “big time debut,” further noting it outpaced all other crypto ETPs in weekly flows, even ranking in the top 20 of all ETFs overall for that period. This performance strongly suggests that institutional investors view Solana as a compelling diversification play, moving beyond the foundational pair of Bitcoin and Ethereum.

What a week for $BSOL, besides the big volume, it led all crypto ETPs by a country mile in weekly flows with +$417m ($IBIT had a rare off week, it’ll be back). It also ranked it 16th in overall flows for the week. Big time debut. pic.twitter.com/HpKUTdq1J5

— Eric Balchunas (@EricBalchunas) November 1, 2025

Drivers of Institutional Demand

Numerous factors fuel this aggressive institutional embrace of Solana. Most importantly, major Solana ETFs, like those from Bitwise and Grayscale, offer staking yields to investors. Solana’s estimated staking yield, sitting at a competitive rate (around 7% at the time of the ETF launch), provides traditional finance investors with a regulated product that delivers passive, compoundable rewards.

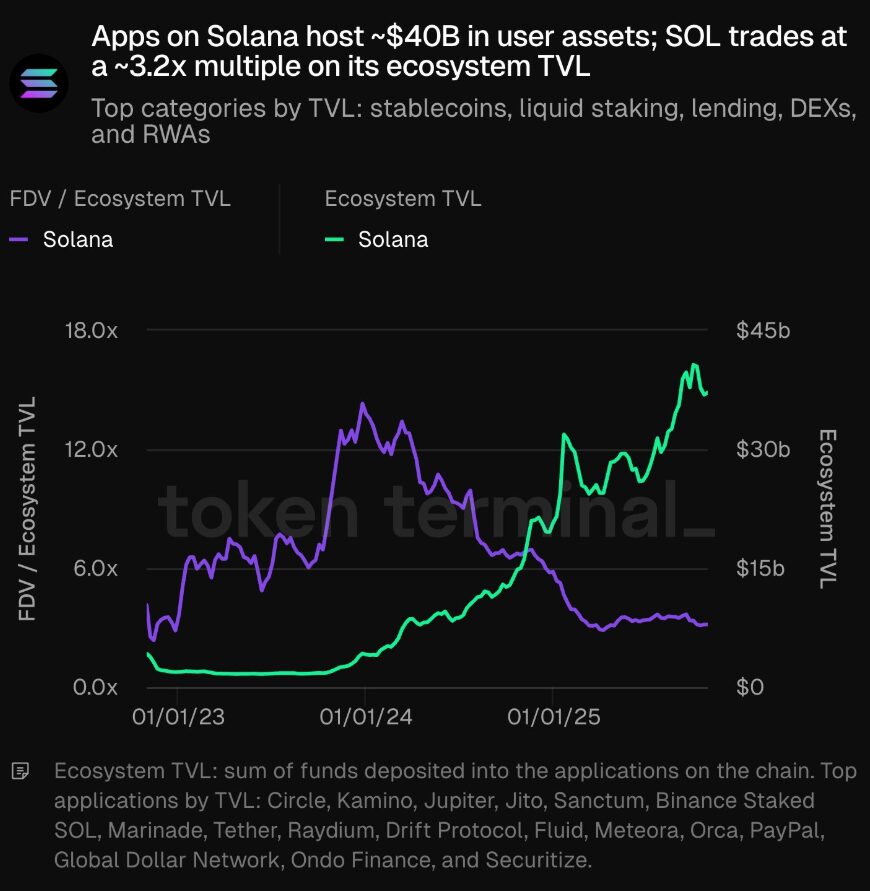

Moreover, investors recognize Solana’s unique value proposition. Its high transaction throughput, low fees, and robust developer activity in areas like DeFi and real-world assets position it as a true competitor to Ethereum. Thus, funds seek exposure to the next generation of scalable blockchain infrastructure, and Solana directly addresses this need.

Learn more: Solana Price Prediction in 2025, 2026 – 2030 and Beyond

Total Value of Assets on Solana Blockchain – Source: Token Terminal

SOL Leads Altcoin ETF Wave

Simultaneously with the debut of the Bitwise Solana Staking ETF (BSOL) and the conversion of the Grayscale Solana Trust (GSOL), several other notable altcoin ETFs began trading in the U.S. market. These included products tracking assets like Litecoin (LTC) and Hedera Hashgraph (HBAR).

Learn more: SOL, LTC, HBAR ETFs Emerge, Redefining Altcoin Investment

While the simultaneous listing of LTC and HBAR ETFs signifies a broader institutional appetite for “altcoins,” they are unlikely to serve as a direct substitution for Solana.

| Feature | Solana (SOL) ETFs (e.g., BSOL) | Litecoin (LTC) & Hedera (HBAR) ETFs | Market Role & Proposition |

| Staking Yield | Offers staking yield (~7% target APY). | Typically non-yielding (LTC is proof-of-work). | Yield-Generating Growth: Attracts capital seeking high-growth exposure plus passive income. |

| Network Category | High-performance Layer 1 (Smart Contracts, DeFi, RWA). | LTC: Transaction/Digital Silver; HBAR: Enterprise-grade Hashgraph. | Scalability & Utility: Targets investors seeking exposure to next-gen, scalable infrastructure. |

| Institutional Inflows | Record-breaking in the altcoin category (BSOL dominated opening week flows). | Flows are significantly smaller (e.g., HBAR and LTC ETFs had low single-digit millions in daily volume). | Proven Demand: Solana has demonstrated immediate, large-scale institutional demand. |

The success of the Solana ETFs stems directly from their unique ability to offer staking yield within a regulated ETF wrapper. By contrast, Litecoin is a PoW coin and does not offer staking rewards, thus removing the passive income appeal for traditional finance investors. Hedera, while different, also operates in a distinct enterprise-focused niche.

The post Solana ETFs Net Inflows Surpassed Bitcoin and Ethereum appeared first on NFT Plazas.

Read MoreBy: NFTPlazas

Title: Solana ETFs Net Inflows Surpassed Bitcoin and Ethereum

Sourced From: nftplazas.com/solana-etfs-net-inflows-surpassed-bitcoin-and-ethereum/

Published Date: Wed, 05 Nov 2025 11:13:35 +0000

----------------------------

.png)