The crypto market has officially surpassed the leverage mania of the 2021 bull run. According to a November 2025 report from Galaxy Digital, total crypto-collateralized lending reached a record-breaking $73.59 billion in Q3 2025, eclipsing the previous peak of $69.4 billion set in Q4 2021.

Albeit a highly volatile market structure, today transparent on-chain protocols are shifting from “trust-based” credit to “code-based” collateralization.

Learn more: What is Euler (EUL)? Modular Engine Rebuilding DeFi Lending

DeFi Now Leads

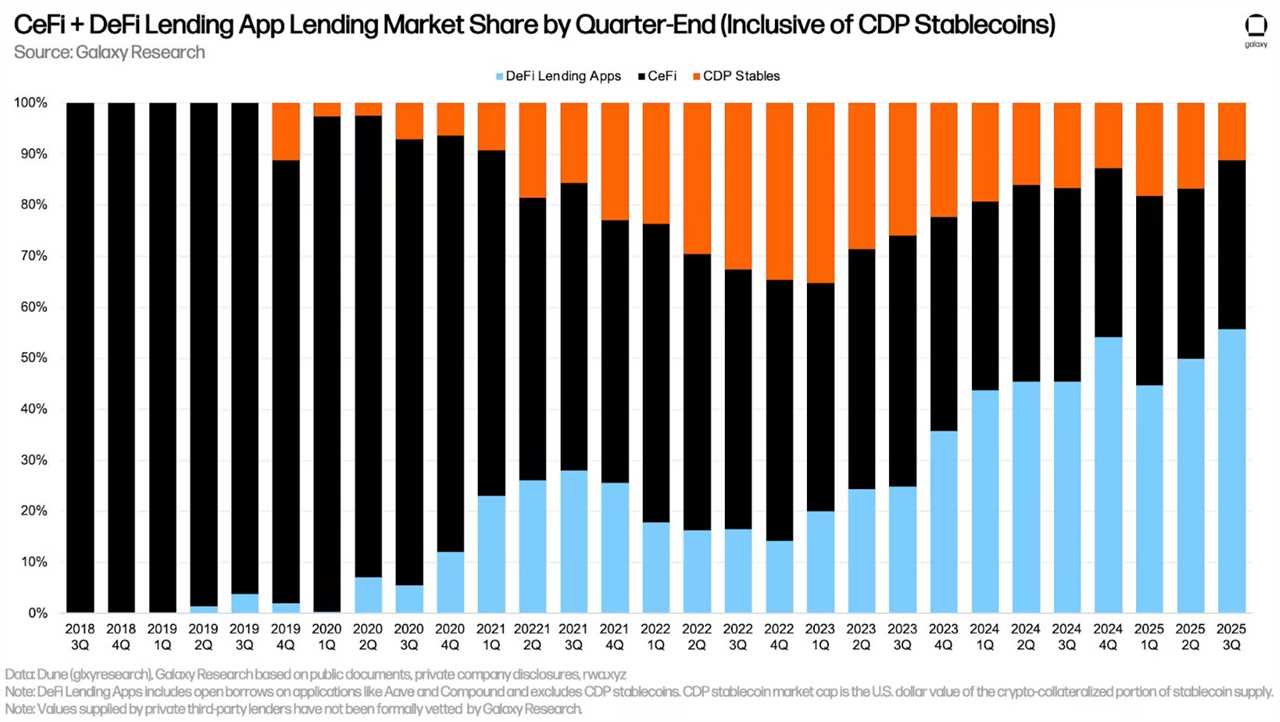

DeFi has consumed the lending market. Galaxy’s data reveals that DeFi protocols now control approximately 66.88% of all crypto lending activity, a stark contrast to the centralized dominance of the last cycle. In Q3 alone, the dollar value of outstanding loans on DeFi applications surged 55.7% to reach $41 billion.

DeFi dominance rose in Q3, while CDP Stables saw decreasing demands from users. – Source: Galaxy Research

Two specific behaviors drive this on-chain explosion. First, traders are aggressively “looping” assets, specifically borrowing Ethereum against liquid staking tokens like stETH, to amplify yield. On the other hand, “points farming” has warped borrowing incentives. Users now take out loans across new networks not just for liquidity, but to qualify for future token airdrops.

The report highlights a major pivot within DeFi itself. Users have abandoned Collateralized Debt Positions (CDPs) like MakerDAO in favor of direct lending pools. Lending applications (such as Aave and Morpho) now capture over 80% of on-chain borrowing volume.

Centralized Lenders Have Changed

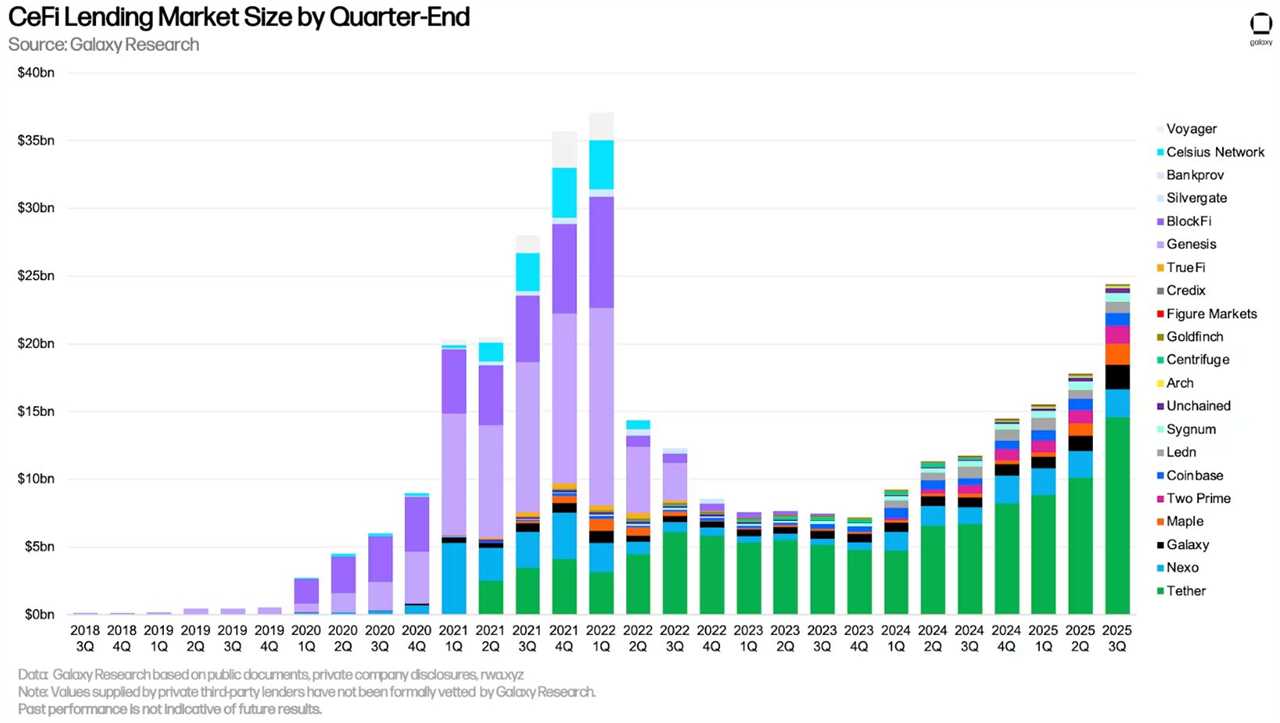

While DeFi soars, Centralized Finance (CeFi) has staged a disciplined recovery. CeFi loan books grew 37% in Q3 to $24.4 billion. However, the centralized sector remains roughly 34% below its 2022 peak, reflecting a cautious institutional approach.

The CeFi landscape has consolidated heavily. Three giants, Tether, Nexo, and Galaxy Digital, now control 75% of the centralized market. Tether alone accounts for nearly 60% of this activity.

CeFi lending market size has seen a significant growth in Q3 2025. – Source: Galaxy Research

In other words, the nature of these loans has changed. The industry has eradicated the uncollateralized, “handshake” lending practices that doomed firms like BlockFi and Genesis. Today’s centralized lenders demand strict over-collateralization, primarily accepting Bitcoin and stablecoins. The new standard eliminates the “hidden insolvency” risk that triggered the contagion events of 2022. If a borrower fails today, the lender holds the assets to cover the loss immediately.

Why Volatility Remains King

A safer credit structure does not equal a stable price environment. The Galaxy report details how automated leverage creates violent, mechanical price corrections.

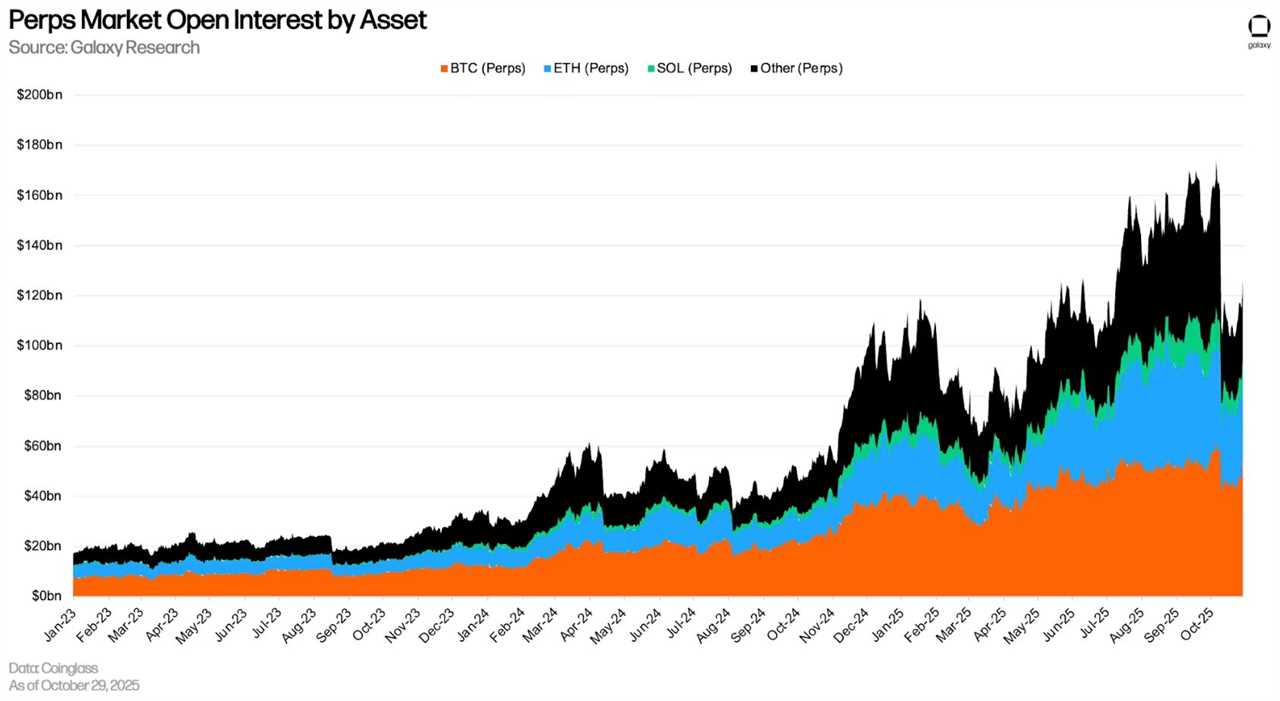

In early October 2025, crypto futures Open Interest (OI) swelled to an all-time high of $220 billion. The market corrected swiftly on October 10, triggering the largest daily futures liquidation event in history, liquidating over $19 billion in positions within 24 hours.

Perps OI peaked in early October but swiftly fell after the historic event. – Source: CoinGlass

Learn more: Best NFT Marketplaces of 2025: Top Platforms Reviewed

The historic liquidation event serves as a perfect case study for the 2025 market structure. Unlike 2022, no lenders went bankrupt, requiring no bailouts. The system worked exactly as designed: code executed liquidations instantly to protect protocol solvency. While the current market structure prevents systemic credit contagion, it guarantees that price crashes will be sharp, fast, and merciless.

To conclude, the crypto lending landscape, now built on a firmer base than it was in 2021, has traded counterparty risk for volatility risk. Investors no longer need to worry if a lending desk is secretly insolvent when on-chain data proves the collateral exists. Market volatility, at the same time, is prone to violent, short-term price shocks, but the structure holds.

The post Leverage Hits Record in Q3 2025, Still ‘Healthier’ Than 2021 – 2022 appeared first on NFT Plazas.

Read MoreBy: NFTPlazas

Title: Leverage Hits Record in Q3 2025, Still ‘Healthier’ Than 2021 – 2022

Sourced From: nftplazas.com/leverage-hits-record-in-q3-2025/

Published Date: Sun, 23 Nov 2025 14:54:41 +0000

----------------------------

.png)