About Ethena Labs, Ethena Protocol, ENA Token

Ethena Labs and Ethena Protocols

Ethena Labs has launched a sophisticated DeFi protocol on the Ethereum blockchain: Ethena Protocol. This strategic choice underpins its core tenets of decentralization and censorship resistance, crucial for operational integrity.

At Ethena’s heart are two primary digital assets: USDe, a synthetic dollar stablecoin pegged 1:1 to the US dollar, and ENA, its native governance token. These tokens form the essential framework for a stable medium of exchange and decentralized protocol evolution.

Ethena’s mission is to deliver a crypto-native, scalable, and censorship-resistant alternative to existing stablecoins and conventional banking. This aims to democratize access to stable, transparent money for DeFi and CeFi participants, resolving financial exclusion and vulnerabilities tied to centralized intermediaries.

The protocol’s concept draws significant inspiration from BitMEX founder Arthur Hayes’s “Luna Brothers, Inc.” blog post. This emerged during Terra’s UST/LUNA collapse in 2022. Hayes’s proposed decentralized stablecoin model, designed for extreme market volatility, served as Ethena’s architectural blueprint. This historical context highlights Ethena’s design philosophy, prioritizing resilience and stability.

Formally unveiled by Guy Young in July 2023, Ethena’s rapid growth since then demonstrates strong market demand for its unique offering.

For more: The Rise of Stablecoins: 2025 Market Update and Key Statistics

Understanding the ENA Token

The ENA token serves as the native governance token of the Ethena protocol, which is built on the Ethereum blockchain. Its primary function is to empower holders to participate in the decentralized governance of the protocol, allowing them to vote on critical decisions such as risk management frameworks, asset composition, and future protocol upgrades.

The total supply of ENA tokens is capped at 15 billion, with a circulating supply of approximately 6 billion ENA as of recent data. Staking ENA can also offer rewards, aligning incentives with the protocol’s success.

ENA token information. Source: Coingecko

Ethena’s Unique Value Proposition in DeFi: USDe

Ethena carves a distinct niche in DeFi with its innovative USDe stablecoin. Its core uniqueness lies in a crypto-native solution for maintaining its peg, using a sophisticated delta-neutral hedging strategy within the crypto ecosystem. This mitigates centralization risks and offers a truly independent digital dollar.

A key differentiator is USDe’s inherent yield-generating capability. sUSDe holders can earn attractive returns (e.g., around 10% APY), organically derived from ETH staking rewards and derivatives market funding rates. This makes USDe a compelling crypto-native savings account.

Ethena’s design also emphasizes capital efficiency and scalability. Its 1:1 collateral ratio for minting USDe makes it more efficient than over-collateralized stablecoins, enabling rapid scaling. Furthermore, Ethena prioritizes censorship resistance and transparency through on-chain verifiability and Proof of Reserves reports.

Finally, USDe is highly composable, ensuring seamless integration across various DeFi and CeFi platforms, expanding its utility within the broader crypto ecosystem.

For more: A Comprehensive Analysis of Yield and Payment Stablecoins

sUSDe APY

Core Mechanics of USDe: The Yield-Bearing Synthetic Dollar

Delta-Neutral Strategy for Peg Stability

Ethena’s synthetic dollar, USDe, uniquely distinguishes itself by maintaining its 1:1 peg to the US dollar through an innovative “delta-neutral” strategy, fundamentally departing from traditional fiat reserves or simple over-collateralization models. This sophisticated approach is central to USDe’s design, explicitly aiming to provide stability within the often-volatile cryptocurrency markets.

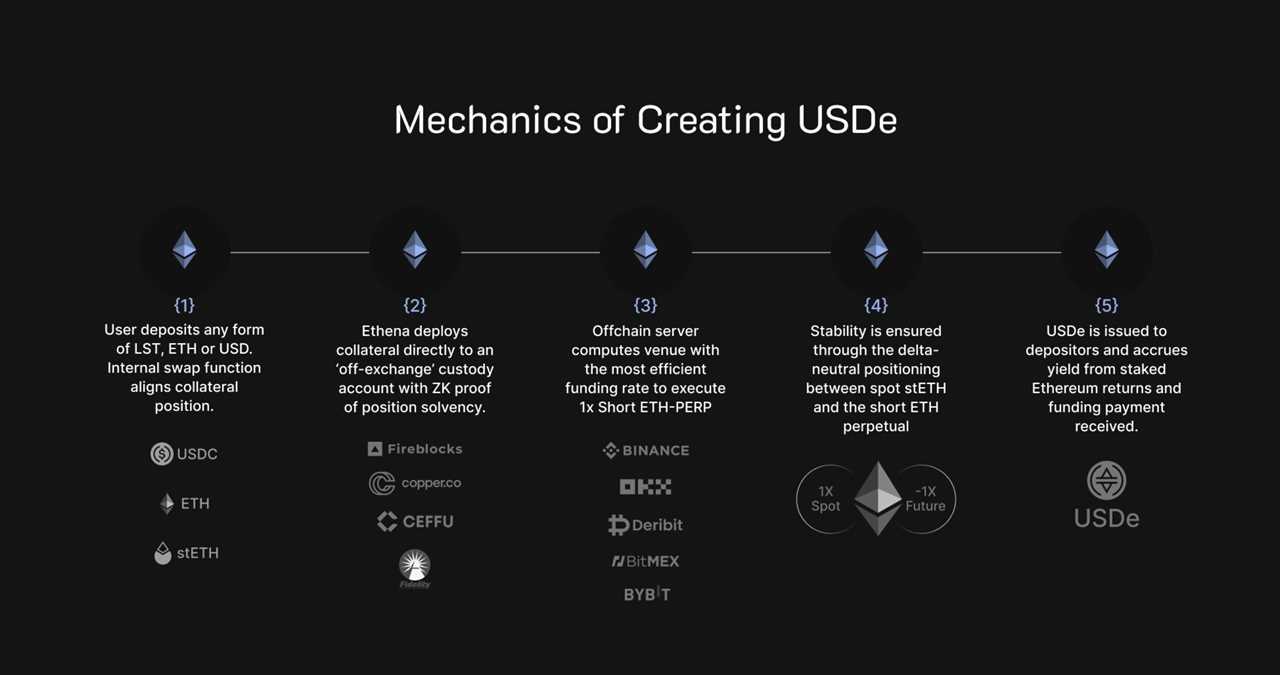

The core of this strategy involves two primary, interconnected components: collateralization and equivalent short positions.

When users choose to mint USDe, they deposit accepted crypto assets, primarily Ethereum (ETH), staked ETH (stETH), or other liquid staking tokens (LSTs) as collateral.

Simultaneously, the Ethena protocol opens corresponding short positions in derivatives markets, specifically perpetual and deliverable futures contracts, equivalent to the value of the deposited collateral.

This pairing of a long spot position (the collateral) with a short derivatives position creates a delta-neutral hedge. The intent is that if the price of the underlying collateral asset (e.g., ETH) drops, the gains from the short position will offset the loss in the collateral’s value, thereby maintaining the stability of USDe’s peg.

Conversely, if the collateral’s price increases, the loss on the short position is balanced by the increased value of the collateral. This mechanism ensures the net value of the backing assets remains stable relative to the US dollar, irrespective of market fluctuations in the underlying crypto assets.

Source: Ethena Labs

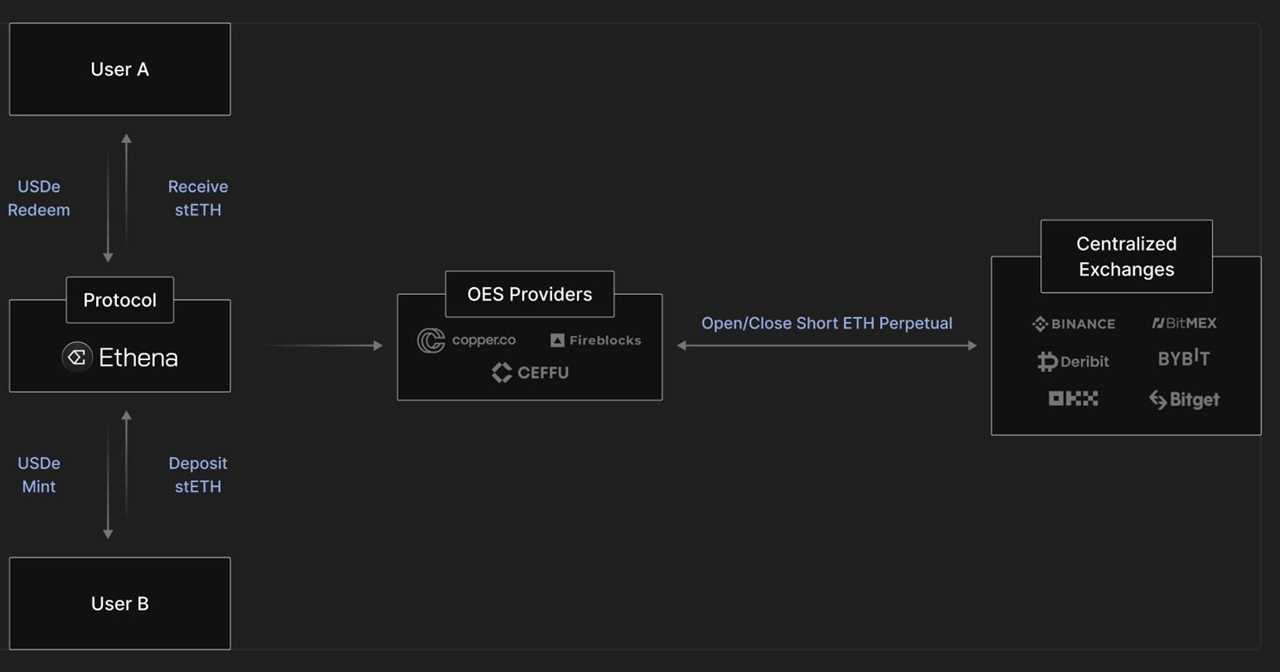

A critical element in the operationalization of this strategy is the vital role of Off-Exchange Settlement (OES) providers and custodians. These entities are responsible for holding the deposited assets in custody, while centralized exchanges (CEXs) manage the derivative positions.

This crucial separation of custody from trading ensures that Ethena retains full control and ownership of the collateral assets, even if an exchange experiences an idiosyncratic event.

For instance, Ethena partners with major custodial platforms like Copper, CEFFU, and Cobo, which frequently employ legal structures, such as bankruptcy-remote trusts, to legally protect user funds in the event of the custodian’s failure.

Furthermore, Ethena implements frequent profit and loss (PnL) settlements, occurring in cycles between 8 to 24 hours depending on the custodian, to minimize counterparty risk exposure to CEXs.

The protocol also enables users to verify the existence of both protocol collateral and Ethena’s derivatives positions through direct read access to custodial wallet APIs and exchange sub-account APIs, along with third-party attestations of collateral on a monthly basis, actively promoting transparency.

Ethena Delta Neutral model. Source: Ethena

USDe Yield Generation Mechanisms

Ethena’s USDe is designed as a yield-generating asset, significantly enhancing its appeal as a crypto-native savings instrument. Its attractive yields, sometimes exceeding 30% APY, stem from two primary sources.

The first source is staking rewards from ETH. A portion of USDe’s collateral consists of staked Ethereum (stETH) or other liquid staking tokens. These assets generate a foundational yield, typically around 3-4% annually, from participating in Ethereum’s Proof-of-Stake consensus.

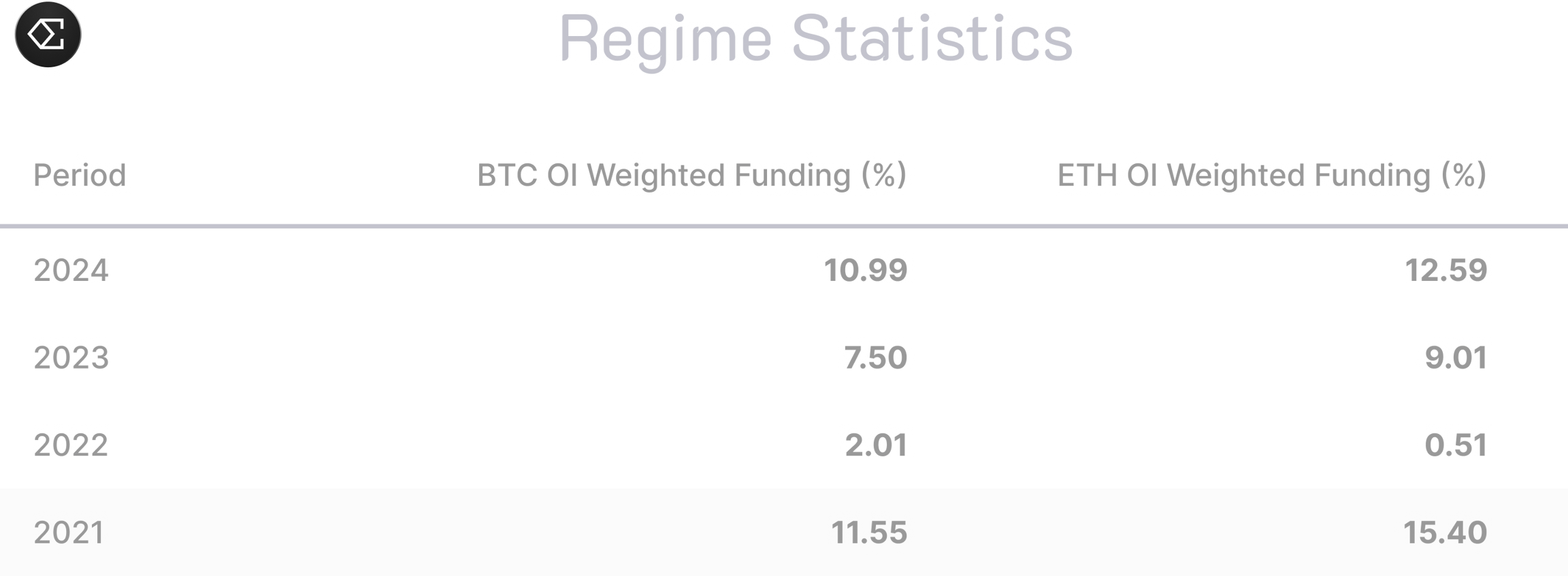

The second, and often more substantial, source is funding rates from derivatives markets. Ethena maintains short positions in perpetual futures contracts (e.g., ETH, BTC) as part of its delta-neutral strategy.

Source: Ethena Labs

Historically, perpetual futures funding rates are “long-biased,” meaning Ethena, as a short position holder, receives payments. This phenomenon has historically provided an average yield of approximately 6-7% over the last three years for the short side. Ethena captures these funding fees, creating a sustainable, non-inflationary yield tied to real market forces.

The combination of these staking rewards and derivatives funding rates allows Ethena to offer an “excess return” to its users. This aggregated yield is passed on to holders of sUSDe, known as the “Internet Bond.”

sUSDe is a reward-bearing token that accrues value from Ethena’s underlying delta-neutral position, aiming to be a globally accessible, dollar-denominated savings vehicle for Web3 investors. Users can stake USDe for sUSDe, participating in revenue distribution, with a 7-day unstaking period.

Ethena Stableoin in Comparison with Other Stablecoin Models

Ethena’s USDe significantly evolves stablecoin design, diverging from traditional fiat-backed, crypto-backed, and algorithmic models. Fiat-backed stablecoins like USDT and USDC are most common, maintaining a 1:1 peg with fiat reserves in centralized banks. They offer stability but carry centralization risks and depend on traditional infrastructure.

Crypto-backed stablecoins, such as DAI, use over-collateralized crypto assets locked in smart contracts, removing central bank reliance but introducing liquidation risks due to asset volatility.

In contrast, algorithmic stablecoins, infamously exemplified by TerraUSD (UST), attempted peg maintenance via token supply adjustments with no real backing. UST’s collapse demonstrated the extreme fragility of unbacked, subsidized yield models, leading to catastrophic depegging and billions in losses.

Ethena’s USDe offers a distinct synthetic dollar model. It is fully backed by crypto assets (ETH, stETH, BTC, liquid stables) and corresponding short futures positions. This delta-neutral hedging mechanism fundamentally departs from predecessors, aiming for stability without over-collateralization or reliance on traditional banking systems.

Stablecoin Pegging History. Source: ruishang

This unique design offers several advantages: capital efficiency through 1:1 collateralization, superior to DAI’s over-collateralization, allowing greater scalability. Its crypto-native nature also provides enhanced transparency and censorship resistance, addressing centralization risks inherent in fiat-backed stablecoins. Crucially, Ethena learned from Terra/UST’s downfall.

Unlike UST’s unsustainable, subsidized yields, USDe’s yield is organically generated from verifiable sources: ETH staking rewards and positive funding rates from derivatives markets. This robust, market-driven yield generation and fully backed, delta-hedged position aims to prevent a similar “death spiral” scenario, positioning Ethena as a more resilient attempt at a decentralized, yield-bearing stablecoin, despite its own complexities.

The Rise of Ethena: Historical Growth and Adoption

Ethena’s trajectory since its formal introduction in July 2023 has been characterized by an extraordinary surge in growth and adoption, quickly establishing it as a significant force in the DeFi ecosystem.

Ethena Key Growth Milestones and Adoption Drivers

Ethena has rapidly ascended, achieving several notable milestones since its July 2023 launch. USDe experienced explosive market capitalization growth, briefly surpassing DAI between December 2024 and March 2025.

As of early June 2025, USDe’s market cap stands between approximately $5.46 billion and $5.88 billion, solidifying its position as the third-largest stablecoin globally, behind USDT and USDC. This rapid expansion underscores strong investor appetite in the yield-bearing stablecoin sector, which itself soared to over $11 billion by May 2025, from $1.5 billion in early 2024.

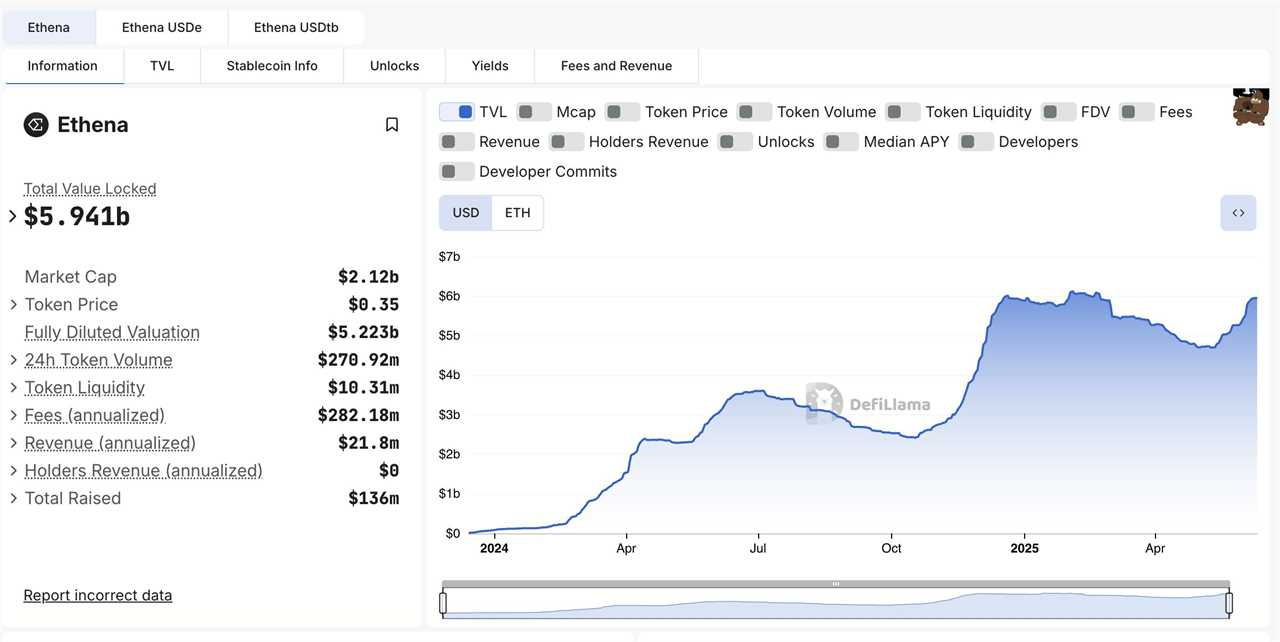

Source: DefiLlama

Accompanying this, Ethena’s Total Value Locked (TVL) increased substantially, exceeding $6.3 billion before settling at $5.935 billion in early June 2025, ranking it among top DeFi protocols and indicating robust user confidence.

Ethena also quickly surpassed the $100 million revenue mark in just 251 days, showcasing its efficient yield generation from staking rewards and futures spreads, with annualized fees reported at $282.12 million. The protocol’s ecosystem boasts over 682,000 users across 24 chains, highlighting widespread accessibility and growing adoption.

Factors Contributing to Rapid Adoption

Ethena’s rapid adoption is driven by several key factors.

- Firstly, its attractive yields are a major draw, with sUSDe offering competitive annual returns that can sometimes exceed 30% APY, often settling around 7%-10% APY.

- Secondly, its crypto-native design and censorship resistance align strongly with DeFi principles, providing transparency and independence from traditional banking.

- Thirdly, strategic partnerships, notably with Telegram (tsUSDe) offering up to 10% yield, significantly expand its user base and mainstream reach.

- Finally, Ethena’s capital efficiency, allowing 1:1 collateralization for USDe minting, enables effective scaling and attracts substantial liquidity, solidifying its market fit.

Risks and Challenges to Ethena’s Stability and Sustainability

Ethena’s innovative design faces inherent risks. Its delta-neutral strategy is vulnerable to market volatility. Negative funding rates can deplete its reserve fund. S&P Global rated USDe’s peg stability as “weak.”

Operationally, Ethena relies on CEXs, posing counterparty risk. Custodial risks exist with OES providers. Smart contract vulnerabilities are also possible despite audits.

Regulatory challenges are significant. Germany’s BaFin ordered Ethena’s German entity to cease operations under MiCAR. This forced a move to the British Virgin Islands. Regulatory pressure on synthetic stablecoins is increasing globally.

To succeed, Ethena must enhance risk management. It needs to diversify yield sources. Strengthening its reserve fund is crucial. Navigating these complexities and demonstrating stability will define its future in DeFi.

The post Ethena Deep Dive: Understand USDe and ENA token appeared first on NFT Evening.

Read MoreBy: Liam Miller

Title: Ethena Deep Dive: Understand USDe and ENA token

Sourced From: nftevening.com/ethena-deep-dive-understand-usde-and-ena-token/?utm_source=rss&utm_medium=rss&utm_campaign=ethena-deep-dive-understand-usde-and-ena-token

Published Date: Wed, 11 Jun 2025 07:00:15 +0000

----------------------------

.png)