The cryptocurrency market is constantly evolving, introducing new financial instruments like crypto derivatives, which allow traders to participate without directly owning the assets. Products such as perpetual contracts, options, and futures offer the ability to leverage positions, manage risk, and amplify profit opportunities.

As these derivatives gain popularity, they provide traders with versatile tools to enhance their strategies. This guide aims to help you understand the mechanics of crypto derivatives trading, empowering you to use these instruments effectively in your trading approach.

What Are Crypto Derivatives?

Crypto derivatives allow you to trade cryptocurrency without owning the actual assets. Unlike traditional crypto trading, where you buy and store assets in a wallet, derivatives let you bet on the future price of a cryptocurrency, such as Bitcoin or Ethereum, without holding the asset itself. These include products like futures, options, and perpetual swaps.

Derivatives derive their value from the underlying crypto asset and play a key role in the crypto market by providing liquidity, often more than spot trading. They help fill trades and influence market prices, offering an alternative to traditional crypto trading.

How Do Crypto Derivatives Work?

Types of Cryptocurrency Derivatives

1. Futures Contracts

Crypto futures refer to a derivatives contract where an investor bets on the future price of a cryptocurrency. The buyer agrees to purchase the asset from the seller on a future date at a specified price, which can be taken in a short or long position. In the case of long positions, traders get to benefit when the asset’s price rises beyond the predetermined futures contract price. On the other hand, traders who take the short position will help if the asset price drops below the futures contract’s settlement price.

The traders are free to close out their position before the expiry of a futures contract. This means that the long trader can vacate the position and sell the futures contract to someone else, while for the short trader, it means they can buy back the underlying asset. Futures are a zero-sum product, which means there’s going to be a winner and a loser. The winner or loser is determined by the difference between the contract price and the market price at the time of executing the contract and whether a profit or loss was made.

Advantages

- Investors can hedge against risk by locking in an asset’s future price

- Investors can profit from speculating on an asset’s future price

- Users can diversify their portfolio

Disadvantages

- It’s possible to lose more money than you invested

- Futures contracts are complex and need great understanding and experience

- Futures are subject to market volatility

Source: Cointelegraph

2. Options Contracts

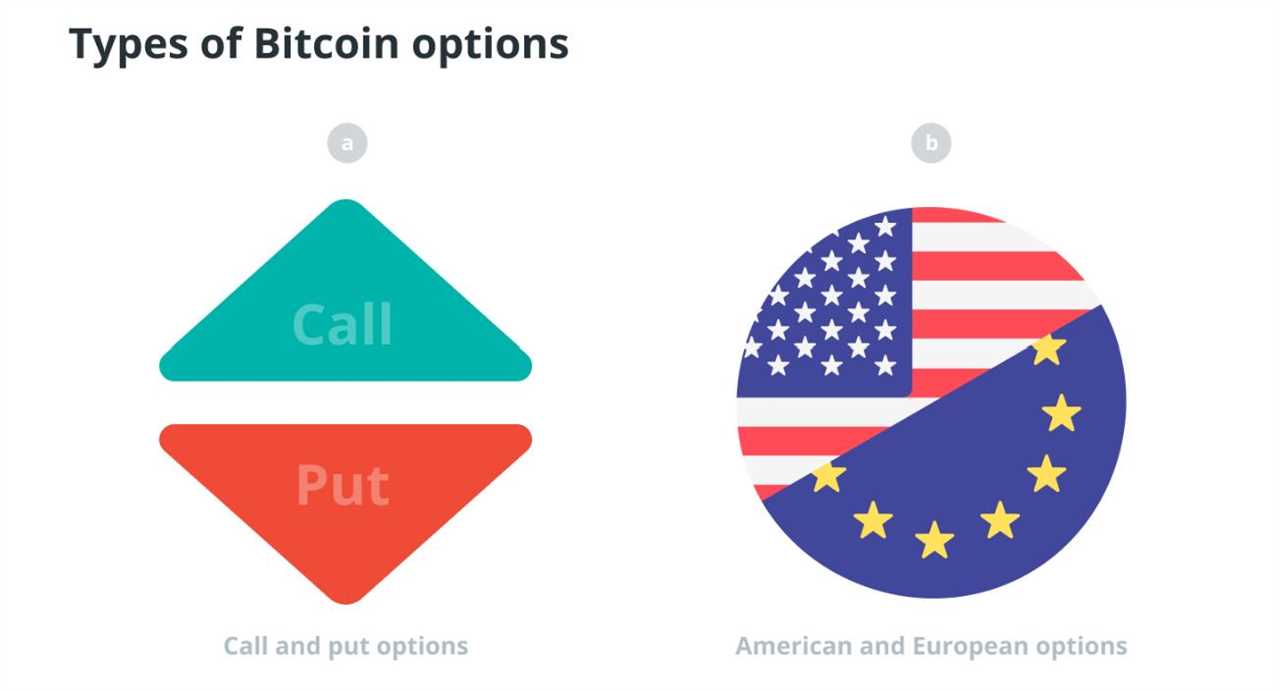

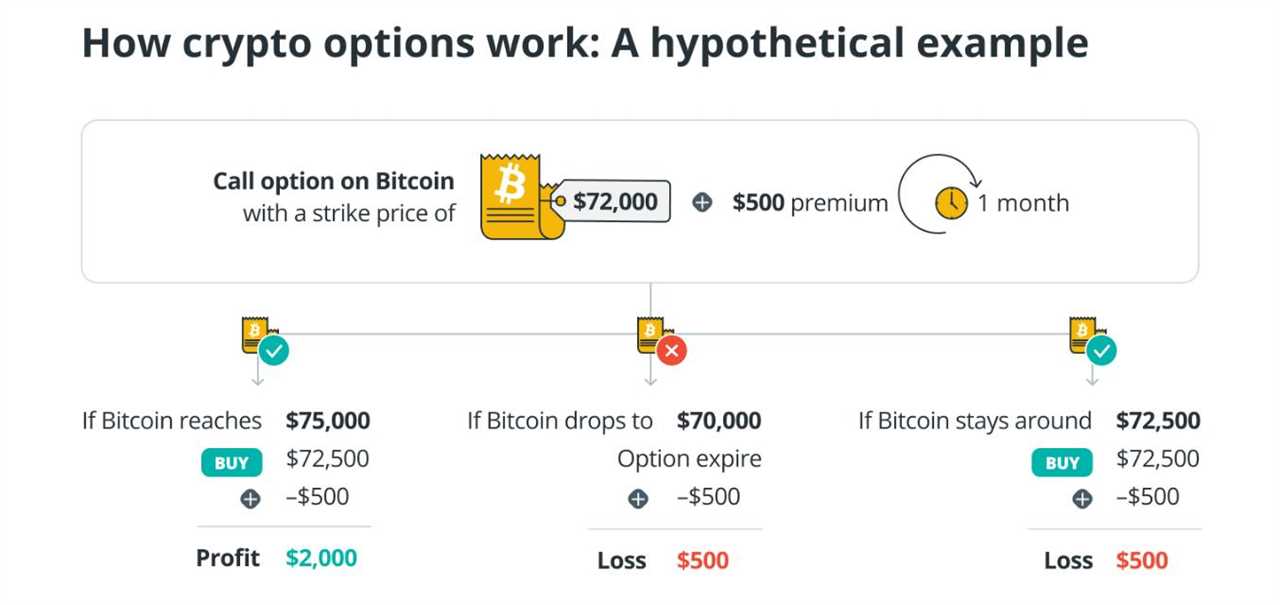

Options are a type of crypto derivatives contract that gives a buyer the right to buy or sell an asset at a particular price on a specified date, but they are not obliged to do so. Unlike futures contracts, the options contract doesn’t commit the buyer or seller to buy or sell if they think the contract will be unprofitable. The right to buy is called a call option, and the right to sell is called a put option. Buyers can execute the contract at expiration or anytime before, depending on the type of option:

- American or “anytime”: Buyers can exercise the option at any time before expiration.

- European or “point of expiration”: The option can only be exercised at the date and time of expiration.

Source: Cointelegraph

Since the buyer is allowed to pull out of the contract if they deem it unprofitable, they will pay a fee in the form of a premium to the option seller. This serves as a form of compensation when the buyer chooses to withdraw from the options contract without fully executing it. The premium serves as a form of insurance in this type of contract, protecting the seller.

Advantages

- Investors have the option to pull out well in advance if they believe the trade will burn their fingers.

- Traders can use options to hedge against market volatility by speculating on price movements.

- Investors can leverage their capital and use a small amount of capital to leverage a prominent position.

- Options are more affordable than other forms of derivatives contracts.

Disadvantages

- Options contracts can be challenging to understand

- Options have an expiry date, meaning you must remain aware of when your options will expire.

Source: Cointelegraph

3. Perpetual Contracts

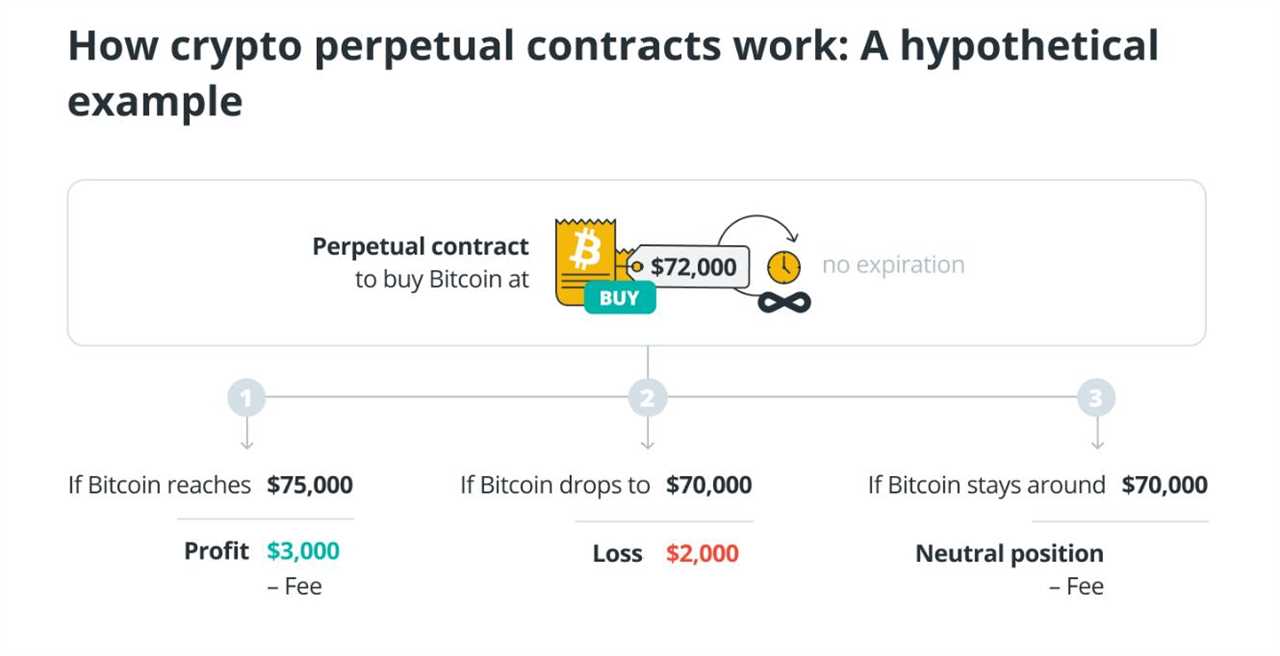

Perpetual contracts are similar to regular futures contracts by allowing investors to bet on the future price of a particular cryptocurrency. However, they differ from traditional futures contracts by not having a predetermined expiry date. This means that an investor is allowed to keep the contract open for as long as they desire.

Also known as perpetual contracts, these differ in the way they track the price of the underlying cryptocurrency. Perpetual derivatives employ a funding rate model to ensure the contract’s value is aligned with the value of the underlying crypto asset. The model ensures that long position holders pay a fee to short position holders and vice versa.

The long position holder will pay the shirt position if the contract price ends up higher than the value of the underlying cryptocurrency. On the other hand, the short position will have to pay if the contract price becomes lower than the value of the underlying cryptocurrency. This model aims to create a balance between long and short traders so that when too many traders take long positions, the system will incentivize other traders to take short positions and earn the funding rate fees.

Advantages

- Some crypto-derivate exchanges give high leverage ratios

- It offers a lower entry barrier than the traditional futures derivative

- Low-risk profit opportunity through indirect exposure to the crypto market

Disadvantages

- High liquidation risk if you use a large amount of leverage

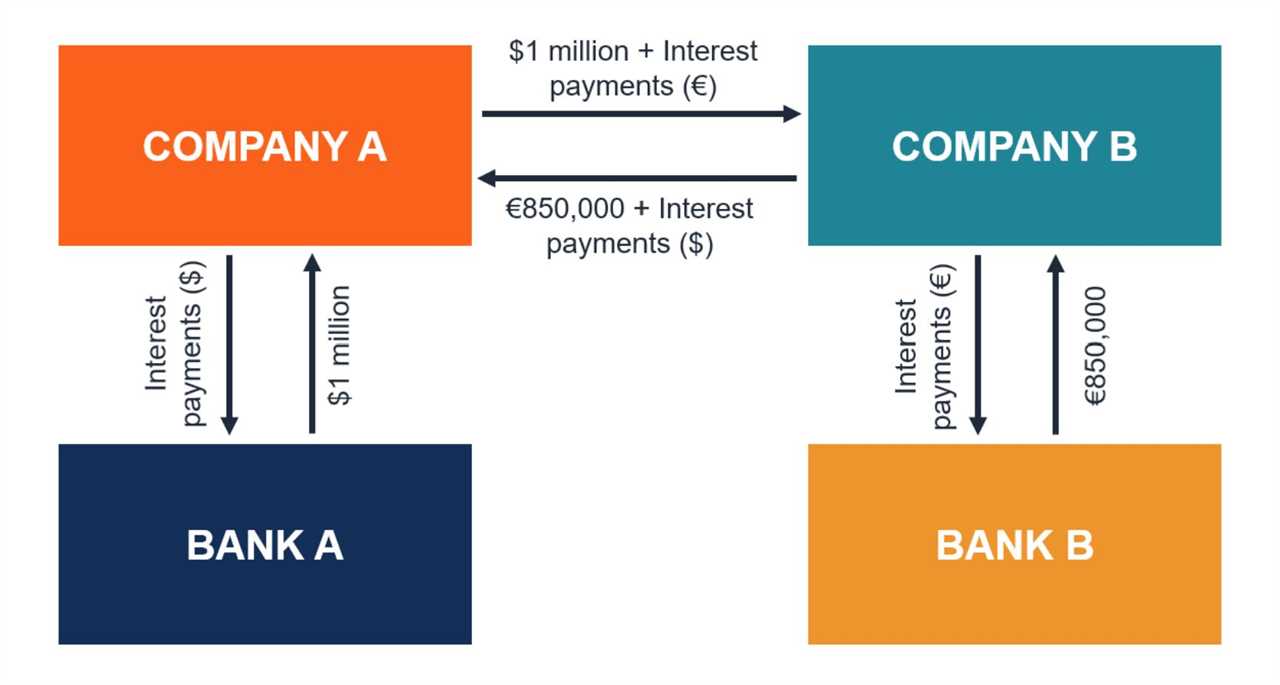

4. Derivative Swaps

Derivative swaps are similar to futures contracts but without an expiry date. As a result, a trader can maintain a position for as long as they want, which allows them greater leverage than the traditional futures contract. Derivative swaps involve parties agreeing to exchange one cryptocurrency for another on a predetermined date and at a pre-agreed rate. The investor can use the cryptocurrency for any purpose, including arbitrage, speculation, or hedging against inflation.

Investors engage in this form of blockchain derivative trading directly on the participating blockchain network, utilizing smart contracts that automate the process to ensure a secure and transparent transaction. In most cases, the trading venue is a decentralized exchange or other platforms such as decentralized finance (DeFi) protocols.

Advantages

- Derivative swaps don’t have an expiry date, meaning investors can hold them indefinitely without worrying about managing expirations or rolling over contracts.

- Investors can trade continuously, entering and exiting positions at will without restrictions.

- Derivative swaps offer high-leverage trades, allowing investors to use a small capital outlay to control a prominent position.

- Traders can use the spot price of the underlying asset to track the derivative swap, thereby minimizing tracking errors.

Disadvantages

- The funding rate mechanism used to maintain price alignment between long and short positions comes with costs that can erode profits.

- High leverage increases the risk of liquidation when the market moves unfavorably.

- Sudden price fluctuations affecting different crypto assets can lead to potential liquidation and slippage.

Source: Corporate Finance Institute

Benefits of Trading Crypto Derivatives

Numerous benefits are associated with cryptocurrency derivatives that make them appealing to investors, including:

Leverage Opportunities

Leverage enables investors to use a smaller amount of capital to control larger trading positions. For reference, if you have $1,000 to invest, you can be able to trade up to $10,000 worth of contracts using a leverage of 10x. However, note that while leverage offers high-income potential, it also enhances the risk of potential loss. This means that if the market moves against your leveraged position, you’re likely to take in losses that will exceed your initial investment.

Hedging Against Market Volatility

The cryptocurrency market is known to be notoriously volatile, where prices can fluctuate without notice. Crypto derivatives trading serves as an effective tool for traders seeking to create a hedge against such price swings. For example, investing in Bitcoin derivatives as a hedge when you’re holding a sizeable position can enable you to offset potential losses since you’ll have the right to sell BTC at a predetermined price, thereby guaranteeing your safety in the event of a negative price movement.

Speculation on Price Movements without Ownership

Another benefit of engaging in the crypto derivatives market is that traders can speculate on the price movement of different cryptocurrencies without necessarily buying the cryptocurrency assets themselves. This type of flexibility is important for cryptocurrency investors who want to speculate on the rise or fall of crypto prices and take short positions that enable them to earn profits before the prices fall. Moreover, since crypto derivatives trading doesn’t involve owning the actual crypto assets, investors don’t have to worry about their security, storage, and transfers.

Risks Involved in Crypto Derivatives Trading

There’s no doubt that cryptocurrency derivatives offer great opportunities for investors to make profits; they also come with several risks that could easily lead to financial losses. If you plan to dip your toes into this kind of investment, you need to be aware of the following potential risks so you can make an informed decision on their effective management.

When it comes to the potential for making losses, crypto derivative trading exposes traders to at least two primary risks, namely:

Leverage Risks

Leverage enables traders with a small amount of capital to control a significant investment. However, this is a double-edged sword that can lead to losses exceeding a trader’s initial investment when the market moves against their position. The trader would need to liquidate their position or inject more capital to remain afloat. The same leverage that enables a trader to make large profits using a small amount of capital can lead to huge losses or liquidation if the market moves in the opposite direction.

Market Volatility

The cryptocurrency market is highly volatile, and the regular price swings can become highly magnified when trading derivatives. When you combine fast price swings with leveraged positions, you could easily incur substantial financial losses. The rapid price movements in the cryptocurrency market can easily trigger a margin call that calls for more capital to maintain one’s position. The trader’s position becomes immediately liquidated if they fail to raise the required capital. Such risks are especially magnified in the cryptocurrency market, where the likelihood of a sudden price movement remains high 24/7.

Counterparty and Operational Risks

Investors may also encounter exchange risks. This involves a crypto derivatives exchange operating without proper licensing, something that could expose investors to counterparty risks. In such a situation, or if the platform becomes involved in fraudulent activity, traders will find themselves incurring huge losses with no recourse. Moreover, investors may encounter scams when dealing with exchanges that are not regulated or lack a reputable reputation.

Cryptocurrency derivatives are a relatively new but complex and still evolving product in the market. The crypto regulatory framework is still under development in many jurisdictions, resulting in a lack of clear guidelines to govern its use. This leads to several grey areas, which could make compliance a nightmare for users and crypto derivative exchanges.

Many traders are unaware of the legal requirements regarding Bitcoin derivatives in their countries. They may be unaware of the legal implications of non-compliance, which could lead to frozen accounts, penalties, and other forms of legal action.

How to Start Trading on Crypto Derivatives: Step-by-Step

Starting with crypto derivatives trading may not be rocket science, but it can be compared to entering a financial battlefield. You need to have a plan and strategy and then execute them by following this step-by-step procedure:

- Step 1: Find an Exchange – Try and locate an exchange that offers cryptocurrency derivatives. Begin by searching for a crypto derivatives exchange from crypto price aggregators like CoinGecko or CoinMarketCap. Once you log in to them, click the “Exchange” tab, and you will have a filter that will lead you to a list of platforms that offer derivatives ranked according to safety profiles, trade volumes, and products offered.

- Step 2: Create an Account – On a centralized exchange (CEX), register with your personal details (name, email, phone), and submit identity verification (KYC) documents. However, if you choose a decentralized exchange (DEX), you’ll need to link a compatible custodial digital wallet to facilitate peer-to-peer (P2P) derivative swaps.

- Step 3: Deposit Funds – Once your account is verified, deposit some funds into your account. Many cryptocurrency derivative exchange platforms accept fiat currency deposits, such as EUR or USD, as well as cryptocurrency deposits.

- Step 4: Choose a Crypto Derivative – The next logical step will now be to select the crypto derivatives product you’re going to buy. Different exchanges have varying derivatives, and, as such, you need to choose one that aligns with your trading needs and risk appetite.

- Step 5: Set Your Leverage – Depending on the crypto derivative product you select, you may be required to create a position using some amount of investment. It’s advisable to begin small if you’re starting.

- Step 6: Monitor the Market Price – Finally, keep a close eye on market movements so you can make any necessary adjustments as needed.

Key Factors to Consider When Investing in Crypto Derivatives

1. Choosing the Crypto Derivatives Exchange

Your success in crypto derivatives largely depends on the exchange you choose. Here are the key factors to consider when selecting a platform:

-

Strong Security Infrastructure: Prioritize exchanges that offer two-factor authentication, encryption protocols, cold wallet storage, and withdrawal whitelisting. Ensure the platform has a proven track record in preventing hacks and responding to threats.

-

High Liquidity and Volume: High liquidity is crucial for seamless transactions, especially during price volatility. Opt for exchanges with tight spreads, better market depth, and low slippage, particularly if you’re using leverage or managing larger positions.

- Range of Derivatives Products: Choose an exchange that offers a variety of crypto derivatives, such as futures, options, perpetual swaps, and tokenized margin pairs. A wide range provides flexibility to customize your strategy based on risk and market conditions.

- Competitive Fees and Funding Rates: Pay attention to transaction fees, especially if you’re a frequent trader. Compare maker and taker fees, as well as withdrawal fees. Look for exchanges that offer volume-based discounts to lower costs.

- Trading Tools and Interface: Ensure the exchange has an intuitive interface and advanced tools for managing positions. Real-time data, mobile and desktop integration, charting tools, and API support can significantly enhance your trading experience.

2. Understanding Market Indicators

Crypto derivatives market indicators play a crucial role in helping traders analyze and interpret price movements, enabling them to make informed decisions. As a result, you need to educate yourself to be able to understand the following:

- Trend indicators: These include trend lines and moving averages that indicate whether the market is trending upwards, downwards, or sideways.

- Momentum indicators refer to RSI and MACD metrics, which measure trend strength and price movement speed.

- Volatility indicators include ATR and Bollinger bands, designed to measure the rate of volatility and price fluctuation levels.

- Volume indicators, such as OBV and VWAP, enable you to see the relationship between price and volume, allowing you to confirm trends or detect reversals.

3. Using the Right Trading Strategy

- Understand Crypto Derivatives: Before diving into the market, familiarize yourself with various crypto derivatives products and their pros and cons. This knowledge will help you make informed decisions.

- Conduct Market Analysis: Use both technical and fundamental analysis. Technical analysis involves charts and patterns to predict market trends, while fundamental analysis focuses on news, events, and regulatory changes that impact the market.

- Implement Risk Management: Use strategies like position sizing, stop-loss orders, and portfolio diversification to manage risks effectively in crypto derivatives trading.

- Use Leverage Carefully: Leverage allows for greater profit potential but also increases risk. Ensure you understand the margin requirements and consider professional advice on selecting the right leverage ratio for your situation.

- Create a Business Plan: Set clear profit and loss targets, define your entry and exit strategies, and remain flexible to adjust based on changing market conditions.

- Stay Updated and Adapt: The crypto market evolves rapidly, so keep up with technological advancements and industry news to adapt your strategies accordingly.

- Consider Automated Trading: Explore using trading bots or algorithms based on predefined criteria. Test strategies with historical data, then monitor their performance for adjustments.

Comparing Crypto Derivatives vs. Traditional Financial

1. Risk and Volatility

-

Crypto Derivatives: These markets are known for being highly volatile, offering both significant opportunities for profit and higher risks. The volatility increases the potential for substantial profits in a short time, but it also raises the likelihood of losses if not properly managed. Traders in the crypto derivatives space must use effective risk management strategies to navigate this unpredictability.

-

Traditional Derivatives: While traditional derivatives also experience volatility, it is generally less extreme compared to crypto markets. This means that while there are still opportunities for profit, the risks are lower. Traditional markets have a more stable environment, reducing the chances of sharp price swings.

2. Market Maturity and Liquidity

-

Crypto Derivatives: The crypto derivatives market is still in its formative stage. Despite some significant developments, it has not yet reached the maturity or liquidity levels of traditional markets. The crypto market experiences higher volatility partly due to its developmental nature. It will take more time to achieve the depth and stability found in traditional markets.

-

Traditional Derivatives: Traditional markets have been in operation for a long time and benefit from years of development. This has led to a well-established regulatory framework, sufficient liquidity, and a stable pricing mechanism. As a result, traditional derivatives tend to have tighter bid-ask spreads and less slippage, ensuring greater market efficiency.

3. Regulatory Landscape

-

Crypto Derivatives: The regulatory environment for crypto derivatives is still evolving and varies significantly across different regions. Some countries have embraced cryptocurrencies and implemented regulations, while others are more cautious or restrictive. This lack of consistent regulation creates uncertainty and risks regarding compliance and market integrity.

-

Traditional Derivatives: Traditional derivatives markets are subject to well-established regulatory frameworks that ensure investor protection, market integrity, and fair trading. In the US, agencies like the Commodity Futures Trading Commission (CFTC) oversee these markets, while in the UK, the Financial Conduct Authority (FCA) performs a similar role. These regulations provide a safety net for market participants and help maintain stability.

Crypto Derivatives Regulations

The regulatory environment for crypto derivatives is rapidly evolving as governments aim to keep up with the growing cryptocurrency market. Global regulators are focusing on consumer protection as the popularity of crypto derivatives increases.

In the US, the Commodity Futures Trading Commission (CFTC) oversees the crypto derivatives market, treating them as commodities. The CFTC enforces strict compliance, requiring exchanges to register and adhere to regulations. There is speculation that the CFTC may soon clarify its stance on DeFi platforms and their derivatives.

In Europe, Markets in Crypto-Assets (MiCA) regulations aim to establish clear rules for crypto service providers and ensure investor protection. The European Securities and Markets Authority (ESMA) is working to integrate crypto derivatives within broader financial regulations.

Asia is leading in regulation, with Singapore and Japan ahead of others. The Monetary Authority of Singapore (MAS) enforces a licensing regime for crypto service providers, focusing on anti-money laundering (AML) and counter-terrorism financing (CTF). Meanwhile, Japan’s Financial Services Agency (FSA) has an established framework overseeing cryptocurrency exchanges, including provisions for crypto derivatives trading.

The regulatory landscape for crypto derivatives is still developing. Market participants must stay informed to avoid legal risks and ensure compliance with evolving regulations, which are crucial for safe market navigation.

The Development of Crypto Derivatives Market

The crypto derivatives market has grown rapidly alongside the broader cryptocurrency ecosystem. Early innovators like OKEx and BitMEX, which introduced perpetual futures, laid the foundation for today’s dynamic market. According to market statistics, derivative trading accounted for up to 74.8% of the total cryptocurrency market, which reached an impressive $2.95 billion, as reported by CoinGecko. By 2024, derivative trading accounted for a substantial share of the crypto market, reaching $3.5 trillion, a 21% increase in just a few months, highlighting rapid expansion and growing investor interest.

Exchanges are driving this growth by offering innovative investment tools and advanced trading technology. Notably, Coinbase launched its derivatives program in late 2024, providing perpetual futures to both retail and institutional investors, positioning itself alongside Binance and Deribit.

Institutional adoption is accelerating. Surveys indicate that 69% of institutional players plan to increase their crypto exposure, with derivatives as a primary focus. This trend boosts liquidity, enhances market depth, and drives further growth. Additionally, the rise of Bitcoin and Ethereum ETFs has opened new channels for institutional engagement.

Regulatory clarity is evolving. In the US, agencies like the CFTC and SEC focus on protecting investors, while Europe’s MiCA framework harmonizes rules for crypto trading and service providers across member states. This emerging regulatory environment provides confidence for both retail and institutional participants.

With new products, increasing institutional involvement, and improving regulatory frameworks, the crypto derivatives market is poised for unprecedented growth. Advancements in technology, governance, and innovative financial instruments are reshaping trading dynamics, creating more opportunities, and moving the market toward greater maturity.

FAQs

What are the top 5 derivatives?

The top five most common derivatives include futures, options, perpetual swaps, derivative swaps, and default swaps. Every one of these derivatives has its advantages and disadvantages.

Does Coinbase do derivatives?

Yes, Coinbase launched a crypto derivatives exchange in 2024, trading under the name Coinbase Derivatives. The program offers Bitcoin derivatives and Ether futures on a platform that is available 24/7.

How do crypto derivatives provide leverage?

Crypto derivatives provide leverage to traders who want to use a small amount of capital to control a larger position. In essence, users borrow funds to enhance their potential profit or loss margin. Traders achieve this through margin trading by depositing a fraction of the contract value as collateral, and the rest of the funds are borrowed from the exchange.

How can I choose the right crypto exchange?

If you’re a beginner, ensure the cryptocurrency exchange is ideal for you by examining its interface, which should be easy to use. Other factors to consider when choosing an exchange include security, the number of supported cryptocurrencies, and whether they have responsive customer support.

What are some effective risk management strategies for crypto derivatives trading?

While crypto derivative trading carries a level of risk, you can easily shield your portfolio from being liquidated by playing smart. Some of the fundamental techniques you can employ include:

- Set up take-profit and stop-loss orders

- Avoid over-trading

- Evaluate your risk-reward ratio

- Be prudent in capital management

- Avoid emotional trading

- Be disciplined

- Diversify your crypto assets

- Set your leverage to 1x

- Trade with confidence

The post Crypto Derivatives Explained: Types, Benefits, and Risks appeared first on NFT Evening.

Read MoreBy: Amit Chahar

Title: Crypto Derivatives Explained: Types, Benefits, and Risks

Sourced From: nftevening.com/crypto-derivatives/?utm_source=rss&utm_medium=rss&utm_campaign=crypto-derivatives

Published Date: Sat, 23 Aug 2025 11:43:41 +0000

----------------------------

.png)