As the blockchain ecosystem continues to evolve, the Layer 1 race remains a fiercely contested domain. Ethereum, the original smart contract platform, still dominates in terms of TVL and developer mindshare. However, newer L1s such as Solana and Sui are pioneering innovative architectures to enhance scalability and performance. Monad has recently made bold claims to achieve Ethereum compatibility while simultaneously radically improving throughput and latency.

Understanding Monad’s Proposition

Monad positions itself as a high-performance Layer 1 blockchain that supports full EVM compatibility. Its most distinctive feature lies in parallel optimistic execution, a technique that combines parallel transaction processing with deterministic reordering and optimistic assumptions about transaction independence.

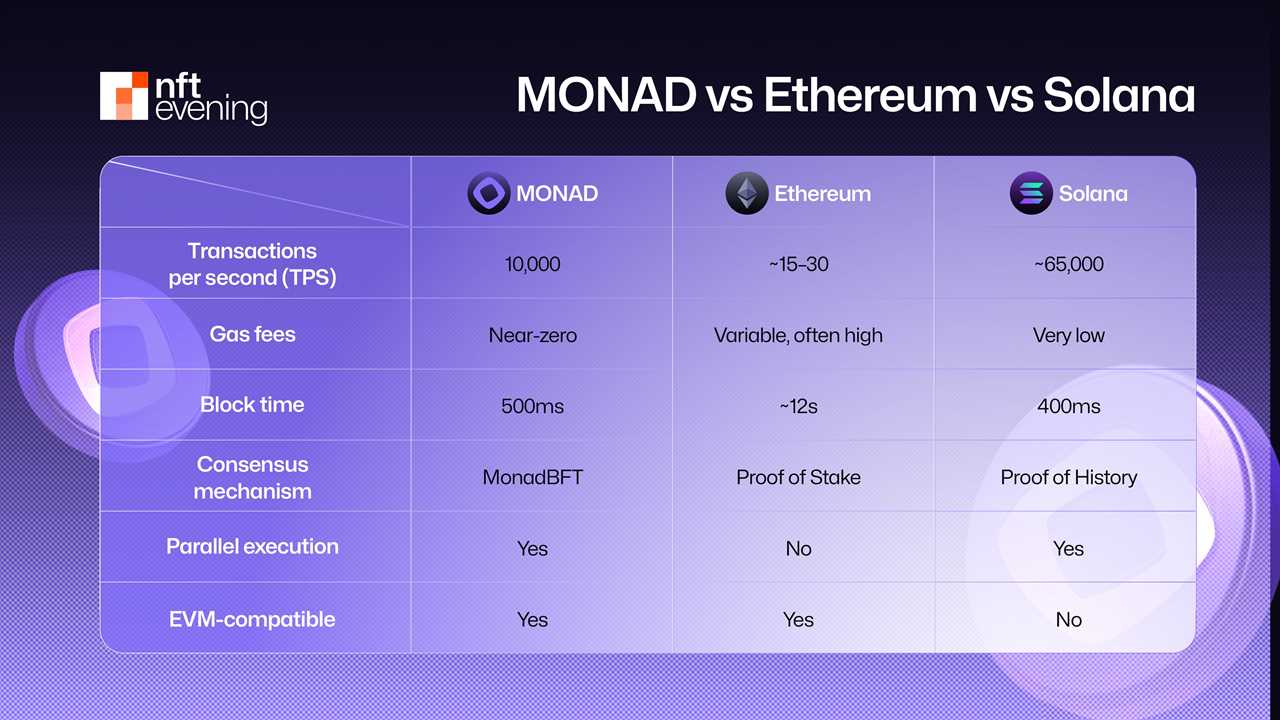

Monad claims to achieve 10,000 TPS and a one-second block time while preserving full compatibility with Ethereum bytecode. This is a notable departure from traditional EVM-based chains that process transactions serially. The protocol operates as a sovereign L1 and remains Ethereum-equivalent, unlike rollups that inherit Ethereum’s security but rely on shared data availability layers.

One of the protocol’s key innovations is its decoupling of consensus and execution, allowing for speculative execution of transactions before final ordering. This feature is achieved using a method called “speculative concurrency”, which ensures that transactions that don’t conflict can be reordered in a predictable way. As of July 2025, Monad is still in the testnet phase, with its mainnet expected later this year.

the Monad Testnet is launching on February 19th

under 48 hours pic.twitter.com/KN9vO31LY9

— Monad ⨀ (@monad) February 17, 2025

Monad vs Ethereum: Scaling the Same Stack

Monad is purpose-built for Ethereum developers, offering full Solidity and bytecode compatibility while addressing the performance limitations of Ethereum’s architecture. Unlike Ethereum, which processes transactions serially due to inherent EVM constraints—even in rollups—Monad decouples execution from consensus, enabling optimistic parallel execution to dramatically increase throughput. It leverages superscalar pipelining and advanced scheduling to achieve 1-second block times, positioning itself as a high-performance, EVM-equivalent chain without requiring a Layer-2 stack.

This architectural leap means developers can deploy existing Solidity contracts on Monad with zero code changes, providing a low-friction path for multi-chain expansion. Real-time DeFi applications like Aave can benefit from faster finality, lower latency, and reduced fees, enhancing user experience significantly.

However, while Monad excels in execution-layer performance, it has not yet achieved Ethereum’s level of decentralization and security maturity. Ethereum’s validator set exceeds 1 million, supported by years of battle-tested infrastructure. In contrast, Monad’s validator network remains in its early test phases. Philosophically, Ethereum is focused on modularity, data availability through Danksharding, and maximum resilience, whereas Monad prioritizes execution speed and EVM compatibility, reflecting two divergent approaches to blockchain scalability and decentralization.

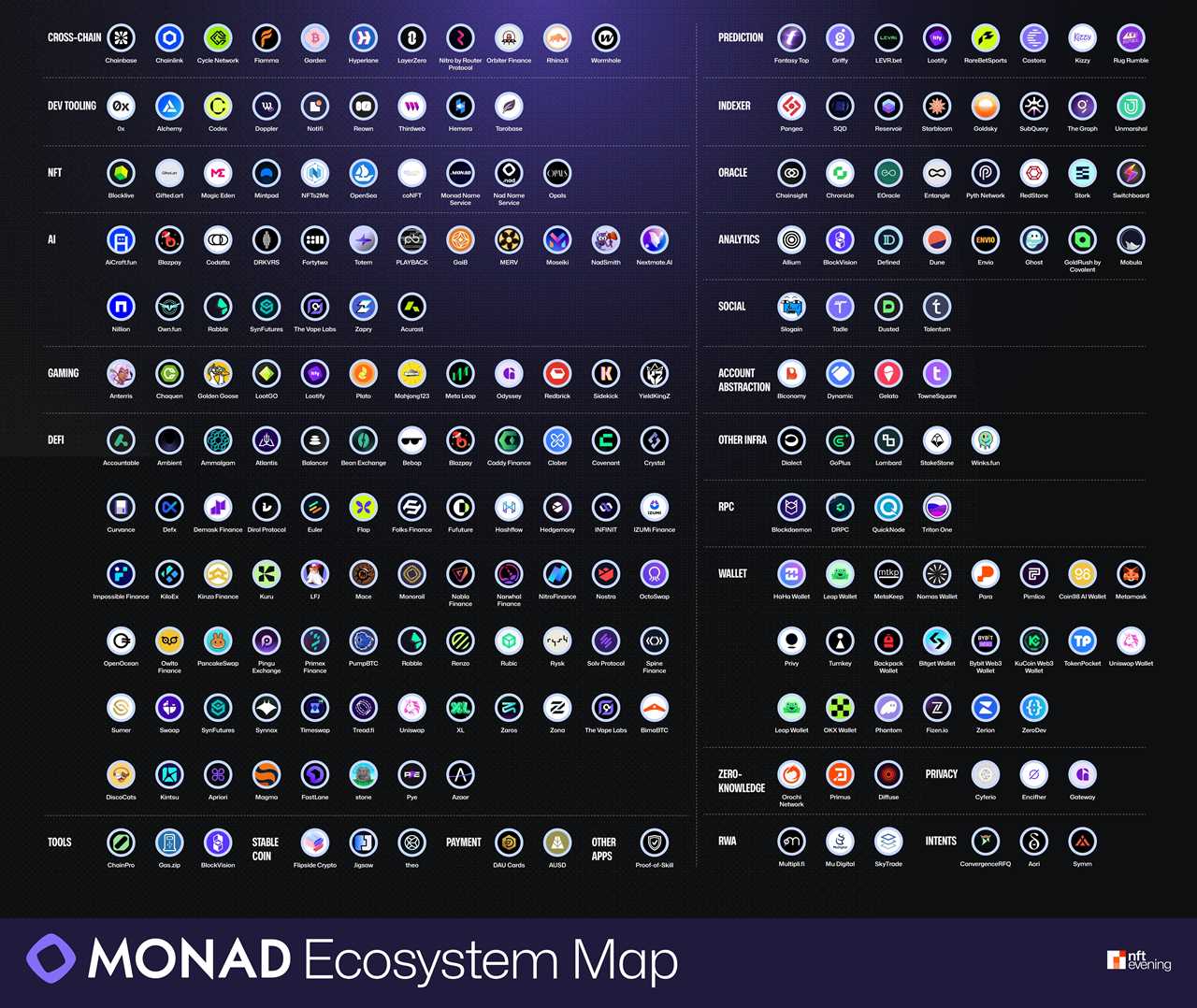

For more: Monad Ecosystem Map: Best Projects Review

Monad vs Solana: Parallelism with Familiarity

Solana and Monad both pursue high-performance blockchain infrastructure, but they take fundamentally different approaches to execution and developer experience. Solana employs a custom runtime called Sealevel, which enables massive parallel execution by analyzing read/write access patterns. This design has proven highly performant, allowing Solana to process thousands of transactions per second. However, it comes at the cost of complexity: developers must write smart contracts in Rust or C, manage explicit account handling, and adapt to a non-EVM environment. Additionally, Solana’s high throughput requires specialized validator hardware, and although its validator set exceeds 2,000 members, it remains heavily concentrated in terms of stakes, which raises concerns about decentralization.

Monad, by contrast, retains full EVM compatibility, allowing developers to use Solidity and existing Ethereum tooling with no code rewrites. It introduces deterministic optimistic parallelism, enabling high throughput similar to Solana’s without requiring developers to manually manage account conflicts. This feature offers a key advantage: Solana-level performance combined with Ethereum’s composability, developer familiarity, and tooling ecosystem.

If Monad’s early testnet metrics—10,000 TPS, 1-second finality, and low compute overhead—prove sustainable under mainnet conditions, it could emerge as a compelling alternative for developers who want performance without abandoning the EVM stack. However, Solana still benefits from a more mature ecosystem, deeper liquidity, and battle-tested infrastructure, which remain significant hurdles for any new Layer 1 attempting to gain market share.

For more: Is Monad a Good Investment in 2025?

Monad vs Sui: Different Takes on Parallel Execution

Sui and Aptos are emerging “parallel” Move-language L1s with aggressive claims (~100,000+ TPS, ~100 ms finality). These chains achieve concurrency by design (transactions tied to independent objects). However, neither uses EVM: developers must rewrite in Move. In contrast, Monad brings comparable parallelism to the Ethereum world. For example, Aptos Labs touts consistent sub-second end-to-end latency for transactions, and both Sui and Aptos use BFT variants to finalize in ~1 s. Monad achieves similar finality but with Ethereum tooling.

Monad and Sui both prioritize parallel execution to scale blockchain performance, but their architectural philosophies and developer experiences diverge sharply. Sui introduces a novel object-based execution model powered by the Move programming language, which allows transactions to be processed in parallel based on ownership rules and object references. This model excels in scenarios like gaming or micro-asset transfers, where transaction patterns are straightforward and high-frequency. However, Sui’s system demands that developers adopt entirely new paradigms, including strict composability rules and full rewrites in Move, limiting its compatibility with existing Ethereum applications.

For more: Monad Deep Dive: Into the Fully Compatible EVM Blockchain

MONAD VS APTOS VS SUI

#Monad – The future ninja of EVM

Fully EVM-compatible (EZ for Solidity devs)

Parallel execution magic

Finality: ~1s

Just raised $225M (a16z + Paradigm

)

Note: Not mainnet yet, but hype is real#Aptos – The Meta-born sorcerer

160K TPS in… pic.twitter.com/WJSBJvpLTe— Monad Insiders (@monad_insiders) July 14, 2025

Monad, on the other hand, retains full EVM compatibility while achieving parallelism through speculative scheduling and deterministic reordering. Developers can continue using Solidity and standard Ethereum tooling without modifying their code, benefiting from performance gains—such as up to 10,000 TPS and 1-second finality—without the learning curve or architectural changes required by Sui. This makes Monad more accessible for Ethereum-native teams looking to scale complex DeFi protocols, such as AMMs, lending markets, and arbitrage platforms, where cross-contract composability and shared state are essential.

In essence, while Sui offers cutting-edge performance, particularly for simple, high-throughput use cases, Monad provides a smoother transition path for EVM developers and better supports DeFi’s complex, composable logic. Long-term adoption will hinge on tooling, ecosystem maturity, and real-world stress testing in their respective domains.

Other high-speed L1s (NEAR, Avalanche, etc.) also trade EVM compatibility for throughput. NEAR and Avalanche can do hundreds of TPS at <1s finality, but none reach 10k TPS on Ethereum bytecode. Arbitrum and Optimism (L2s) are EVM-native but rely on Ethereum L1 finality and achieve only 50–100 TPS on-chain.

In summary, Monad occupies a unique niche: it seeks Solana-class scaling within the Ethereum ecosystem. It offers multi-thousand TPS and ~0.5–1 s confirmation like Solana/Sui/Aptos, but without forking off to a new VM. This combination may provide it an edge in attracting Ethereum dApps that hit performance limits on L1.

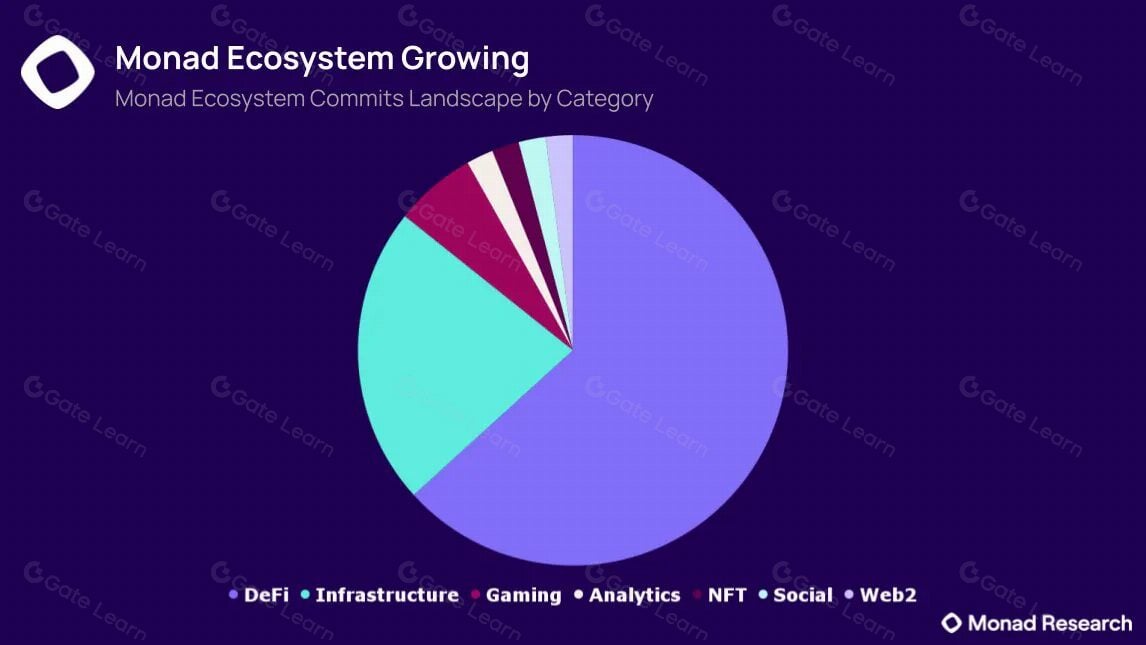

The Ecosystem Factor: Bootstrapping Liquidity and Community

Monad is still in early stages, with its testnet attracting performance benchmarking interest but limited organic developer activity. Its ability to compete will hinge on ecosystem bootstrapping—attracting DeFi protocols, stablecoins, oracles, and wallets. Solana and Sui They benefit from years of business development efforts, foundation grants, and venture capital backing to seed projects and bootstrap liquidity.

Source: Monad Research

Moreover, Monad must prove its security assumptions under real-world attack surfaces. Parallel optimistic execution introduces complexity in transaction ordering and state synchronization, which could lead to edge-case bugs or exploit vectors. Formal verification, audits, and adversarial testing will be critical before DeFi projects deploy serious capital.

If Monad can cultivate a performant yet secure developer experience, it may become the preferred L1 for latency-sensitive applications like perpetuals, HFT bots, or flashloan-enabled protocols. Its challenge is to avoid the fate of past “fast L1s” that scaled performance but failed to build sustainable ecosystems.

For more: Top 10 Monad Projects to Try for Airdrops

A Promising Contender with Work Ahead

Monad enters the Layer 1 arena with a bold premise—matching Ethereum’s contract logic while dramatically improving performance. Its approach of speculative parallel execution and EVM equivalence provides a compelling middle ground between Ethereum’s modularism and Solana’s monolithic performance. Against Ethereum, it offers speed. Against Solana, it offers compatibility. Meanwhile against Sui, it offers familiarity.

However, execution will be key. If Monad can validate its testnet claims under real usage, build trust with developers, and launch a robust mainnet with sufficient decentralization, it could carve out a unique position in the L1 landscape. For now, it remains one of the most closely watched new chains, with the potential to bridge two worlds: the power of parallelism and the ubiquity of the EVM.

The post Comparison of Monad vs Other L1s: Sui, Solana, Ethereum appeared first on NFT Evening.

Read MoreBy: Liam Miller

Title: Comparison of Monad vs Other L1s: Sui, Solana, Ethereum

Sourced From: nftevening.com/monad-sui-solana-ethereum-comparision/?utm_source=rss&utm_medium=rss&utm_campaign=monad-sui-solana-ethereum-comparision

Published Date: Tue, 22 Jul 2025 02:25:21 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/earn-6321-with-dogecoin-leading-dogecoin-cloud-mining-platforms-in-2025

.png)