The current Bitcoin price structure signals a critical shift into a mature speculative phase, according to on-chain analytics on CryptoQuant. Key metrics, traditionally associated with late-stage bull markets, are suggesting Bitcoin is entering its final expansion phase.

However, newer investors are currently experiencing immediate profitability hurdles. This convergence of technical indicators highlights both the strong underlying market confidence and the inherent volatility within a cycle propelled by aggressive new capital inflows.

Shifting from Optimism to Euphoria

The Net Unrealized Profit/Loss (NUPL) metric measures the aggregate profitability of the circulating Bitcoin supply. It has definitively crossed into a historically significant zone.

Meanwhile, the current NUPL reading sits at approximately +0.52, which signals a definitive shift from the “optimism” phase into the established “euphoria” territory.

NUPL sits at approximately +0.52, hinting at “euphoria” phase – Source: CryptoQuant

In preceding cycles, specifically 2017 and 2021, NUPL readings exceeding the 0.5 threshold consistently indicated that the vast majority of investors were in profit. This phenomenon fueled speculative activity and marked the run-up to the cycle’s potential blow-off top.

Currently, roughly 97% of the circulating Bitcoin supply is demonstrably in profit. While this reflects strong overall market confidence, it also structurally suggests that significant upside without a necessary consolidation period may be constrained.

Short-Term Holder Dominance and Supply Transfer

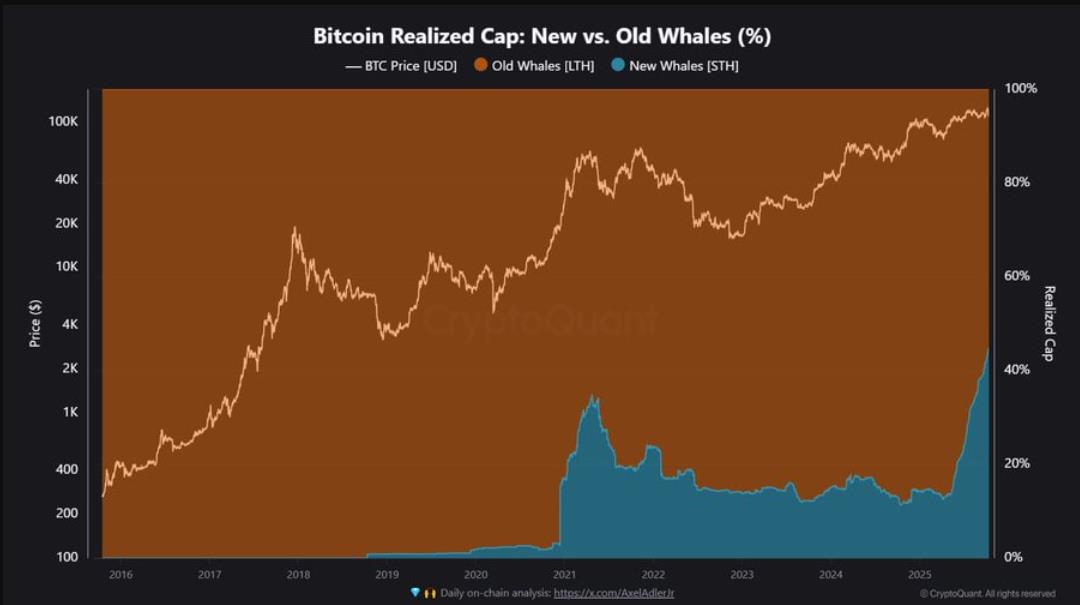

A further analytical element confirming the market’s phase is the dramatic increase in the proportion of the realized cap held by Short-Term Holders (STHs). STHs are defined as entities that have held BTC for a duration of up to 155 days.

STHs now account for a record 44% of the Bitcoin realized cap. The realized cap represents the summation of all supply at the price point it last moved.

STHs account for 44% of the Bitcoin realized cap. Source: CryptoQuant

This elevated STH dominance is the direct product of supply being systematically transferred from Long-Term Holders (LTHs) and large entities (whales) who are realizing profit from their older, lower cost bases.

Historically, this distinct transfer of realized cap control from LTHs to STHs has consistently coincided with the final expansion phase of a bull market, immediately preceding peak valuation.

The Critical $112,500 Cost Basis Squeeze

Despite the overall market euphoria, new investors are currently facing immediate capital inefficiency and heightened volatility around a key realized price level.

CryptoQuant identifies the aggregate cost basis, or realized price, for the Short-Term Holder cohort at approximately $112,500.

This critical price point functions as a highly crucial pivot. It also historically serves as strong support during bull-market drawdowns but, if lost, can swiftly convert into a major overhead resistance trendline.

The Critical $112,500 Cost Basis Squeeze – Source: CryptoQuant

Consequently, the current range-bound performance of the BTC price, oscillating both above and below the STH cost basis, effectively “squeezes” the profit margin of these newer investors. Consistent movement and establishment above this $112,500 barrier is a crucial prerequisite for maintaining aggregate STH profitability and momentum.

Learn more: $19 Billion Liquidated After Trump’s Tariff Bomb

Institutions Shaping A More Stable Euphoria

It is imperative to note that the structure of the current cycle stands in deliberate contrast to past instances. The expected impact of the rapid realized cap shift may be substantially mitigated by powerful institutional involvement.

Specifically, factors such as large-scale ETF inflows and expanding stablecoin liquidity are actively absorbing the systematic sell pressure generated by profit-taking LTHs and whales.

This fundamental institutional participation is therefore creating a unique, more stable type of euphoria that is potentially preventing the immediate and sharp price collapse that might otherwise accompany such a rapid transfer of supply to short-term speculators.

The key signal for the definitive conclusion of this expansion phase will be a sustained decline in the STH realized cap share. This indicates that long-term accumulation, and thus a renewed groundwork for a subsequent growth cycle, has effectively commenced.

The post Bitcoin Enters Speculative Phase, Onchain Signals Market Top Risk appeared first on NFT Plazas.

Read MoreBy: NFTPlazas

Title: Bitcoin Enters Speculative Phase, Onchain Signals Market Top Risk

Sourced From: nftplazas.com/bitcoin-enters-speculative-phase-onchain-signals-market-top-risk/

Published Date: Fri, 17 Oct 2025 10:28:23 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/check-your-monad-airdrop-a-new-era-for-high-performance-layer-1-begins

.png)