Since the launch of the Ordinals protocol by software engineer Casey Rodarmar on January 21, 2023, almost 2,000,000 “digital artifacts” have been created — ranging from memes to massive NFT projects like Taproot Wizards. But despite the explosive rise and frenzied media coverage of these seemingly new “Bitcoin NFTs,” developers have been focused on improving the protocol’s functionality since at least as early as 2012.

In short, there have always been ways to mint and launch assets on Bitcoin’s underlying blockchain. These tools began with things like Bitcoin Colored Coins and, later, platforms like Counterparty in 2014, which helped lay the foundation for tokenized assets like Spells of Genesis and Rare Pepes to emerge in 2016.

In this respect, Ordinals represent merely the most recent advancement within the ever-evolving Bitcoin ecosystem. To recognize the efforts of developers who have been diligently working on the chain, let’s explore the numerous tools and features that truly constitute the ecosystem.

Counterparty

Counterparty was founded in 2014 by Robert Dermody, Adam Krellenstein, and Evan Wagner. The protocol, including an inbuilt decentralized exchange, was created to extend Bitcoin’s functionality by figuratively “writing in the margins” of regular transactions.

In essence, as a Layer-2 solution — a platform that works “on top of the foundational Bitcoin mainnet (something that inherits the security of the original blockchain, but provides additional functionality) — Counterparty provides the infrastructure for innovation and advanced features. For example, minting new Bitcoin-based assets isn’t possible with ordinary Bitcoin software.

While surpassed by Ethereum and other popular NFT chains in recent years, Counterparty still has an active community of supporters with close to 30,000 Twitter followers and over 100,000 assets —some of which are bridged to Ethereum through the Emblem Vault.

More importantly, Counterparty is best known as the original home for what eventually came to be known as the “CryptoArt movement” — a genre of organic, decentralized, and verifiably rare artwork and memes on Bitcoin largely catalyzed through assets like Rare Pepes — tokenized variations of the Pepe the Frog meme by Matt Furie, which still command significant sums on secondary markets.

How does it work?

Similar to how Ethereum token standards define how certain assets work on its protocol, Counterparty provides the infrastructure that outlines how people can create unique tokens on the Bitcoin blockchain. These assets aren’t limited to digital collectibles or tokens but anything with a proven rarity — even physical items.

Counterparty is Bitcoin-native and can embed and use data from the Bitcoin protocol when executing contracts, so transacting on the platform looks just as it would when using BTC. Counterparty nodes simply interpret the data in these transactions based on specific rules. From there, the protocol creates its native ledger of related transactions that it has seen on the underlying Bitcoin network.

Another way to think about how transactions on Counterparty work is via the concept of Russian nesting dolls, whereby the Bitcoin transaction would contain a smaller Counterparty transaction inside of it. Added complexities aside, the transactions on Counterparty are the same as Bitcoin and, therefore, just as secure.

That said, a notable difference between Bitcoin and Counterparty is the relationship between nodes. Unlike Bitcoin nodes, Counterparty nodes don’t communicate with each other and don’t offer a “peer-to-peer network.” While they all share the same code and receive the same transaction data, the primary role of Counterparty nodes is to connect to the Bitcoin software.

Once connected, the nodes download and decode data from each transaction while benefiting from Bitcoin’s security and computing power. In addition, as with gas on Ethereum, users still need to pay mining fees when transacting on Counterparty.

How do dispensers work?

Buying and selling assets on Counterparty is often done via automatic dispensers, which work like digital vending machines. Anyone can create a dispenser and decide how much of a token or asset to sell, along with the price in BTC.

Buying assets from these dispensers is akin to transferring tokens between digital wallets. Buyers just need to scan the dispenser’s QR code or enter its wallet address and then send the minimum required amount of BTC for the items they want to buy. The dispenser will then send the asset to the buyer’s wallet.

Dispensers are basic smart contracts with set rules that handle and distribute assets independently. To help mitigate scams, a warning sign will show next to an empty dispenser, informing prospective buyers not to send any BTC because the dispenser is closed.

What is XCP?

Buying assets on Counterparty can also be done using the platform’s native XCP token. Unlike more conventional methods for launching tokens like crowd sales or initial coin offerings (ICOs), Counterparty used the proof-of-burn (PoB) consensus protocol to issue XCP in January 2014.

To better secure the network, miners burn some of their coins to acquire a virtual mining rig, granting them the ability and authority to mine blocks on the Counterparty network. The more coins a miner burns, the larger their virtual mining “platform” becomes.

The Counterparty team said it settled on PoB to keep the distribution of tokens as fair and decentralized as possible while avoiding potential legal issues. To generate XCP in the network, around 2,140 BTC—valued at over $2 million back then—were destroyed or “burned” by sending them to a provably unspendable Bitcoin address with no known private key, making them permanently lost. The XCP token is also used in various ways in the Counterparty protocol, like helping users create new assets, trade, and make bets. XCP trades on exchanges like Dex-Trade and Zaif, paired with either BTC or the Japanese yen.

What are some disadvantages?

Compared to more mainstream marketplaces like OpenSea, where one simply has to connect their MetaMask or Ethereum wallet, the user interface on Counterparty is not as streamlined and requires a few more steps to mint assets. Also, as with gas wars on Ethereum, dispensers can be front-run, with transactions being prioritized over others if people pay higher fees to miners.

Ordinals

Extending on the concept that originated in 2012 is Ordinals. This platform allows people to inscribe messages or images onto the smallest divisible units of Bitcoin, known as Satoshis (named after the pseudonymous creator, Satoshi Nakamoto). These unique inscriptions can be shared, traded, and preserved directly on the Bitcoin blockchain. As of April 2023, over 1,900,000 Ordinals have been created.

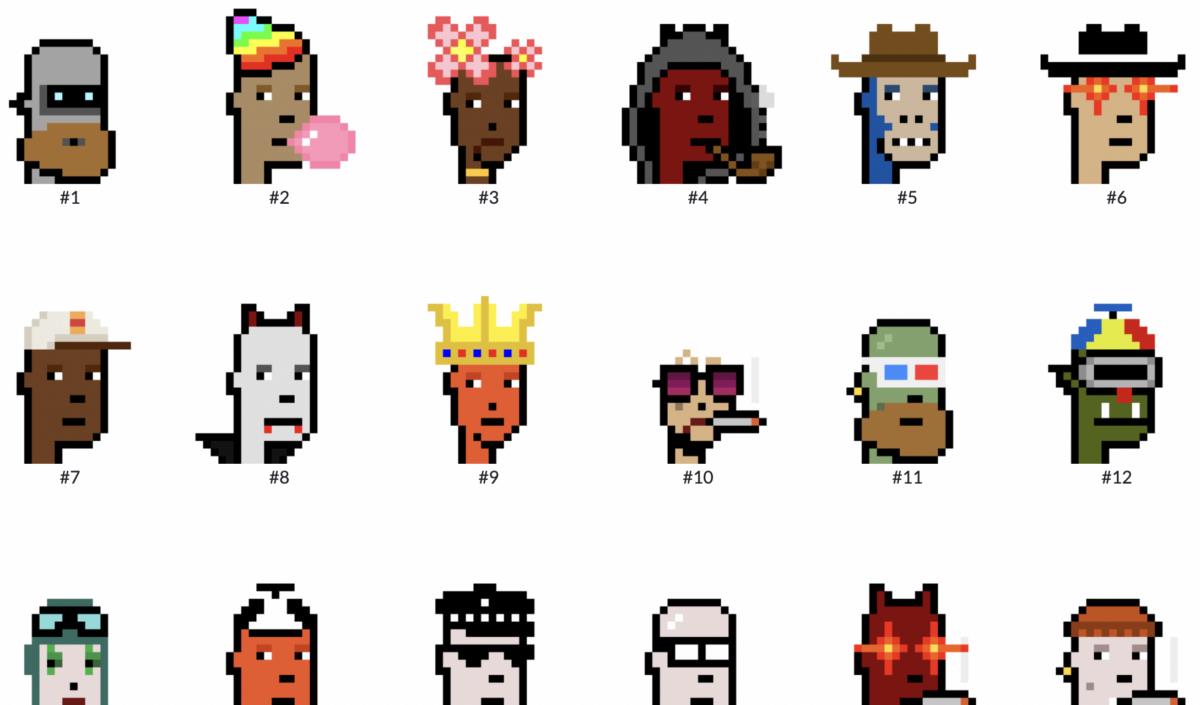

Credit: Ordinal Punks

For those unfamiliar with the mechanics, each Bitcoin is broken into 100,000,000 units called satoshis (or sats) or 1/100,000,000 of a BTC. Launched on the Bitcoin mainnet, the Ordinals protocol allows people who operate Bitcoin nodes to inscribe each satoshi with data (stored in a Bitcoin transaction’s signature), thus creating what’s known as an Ordinal.

That data inscribed on Bitcoin can include smart contracts, which, in turn, enables NFTs. In other words, Ordinals are NFTs or digital artifacts like images, text, programs, and video games you can mint or inscribe directly onto the Bitcoin blockchain, unlike Counterparty, which functions more like a Layer-2 solution (not directly on the mainnet). Although the idea of inscriptions on Bitcoin isn’t anything new, it is largely possible thanks to the Taproot upgrade introduced on the Bitcoin network on November 14, 2021.

How are Ordinals different from other NFTs?

Drawing parallels between Ordinals and NFTs can help demystify an inherently complex system, but it’s essential to recognize the subtle distinctions between them. NFTs on blockchains like Ethereum or Solana typically point to off-chain data on the Interplanetary File System (IPFS) — a decentralized storage solution akin to an external hard drive. This approach allows for dynamic metadata updates, making it suitable for projects that need to enhance image quality or alter the appearance of their NFTs over time.

However, this ability to change NFT metadata is the setback that Ordinals Rodarmor was trying to improve with the new protocol. According to Rodarmor, NFTs are “incomplete” as they compromise integrity or security with off-chain or external data.

In comparison, Ordinals are “complete” as all the data is inscribed or stored directly on the Bitcoin blockchain. Hence the reason behind naming them “digital artifacts” rather than Bitcoin NFTs. Another difference is that while most NFTs have creator royalties imbued in the contract or attached to the asset, Ordinals do not. As stated by Rodarmor, an Ordinal “is intended to reflect what NFTs should be, sometimes are, and what inscriptions always are, by their very nature.”

How to create and trade Ordinals

While still burdened by a slight technical barrier, inscribing on Bitcoin is becoming easier. After setting up a wallet, some key methods include:

- Run a Bitcoin node and inscribe an Ordinal yourself.

- Use a service like Gamma to inscribe an Ordinal without running your node.

- The Satoshibles NFT collection team has created Ordinals Bot, which will inscribe an Ordinal on your behalf.

Typically, these services require users to supply a BTC address to receive the Ordinal, often using an Ordinal-compatible wallet like Sparrow. Users are then informed of the number of satoshis (smaller units of Bitcoin) needed to cover transaction and data fees, as well as a service fee. Payment can be made in BTC, and an address for payment will be provided. The cost of inscribing an Ordinal can vary from under $50 in BTC to several hundred dollars, depending on the file size.

What are some disadvantages?

Users should be mindful that, unlike regular BTC transactions, which usually complete within minutes, the potentially risk-laden process of sending BTC for an Ordinal might take hours or even days to finalize.

However, the idea of filling Bitcoin blocks with JPEGs and videos — or even video games — isn’t sitting well with some in the Bitcoin community who have voiced concerns that putting NFTs directly on the Bitcoin network will drive up transaction costs.

Despite this divisiveness, Ordinals are another method for anyone to preserve their messages for posterity. Some technologists and developers have even started to find and inscribe satoshis with a specific historical date and inscribe unique messages on them with important historical data or facts that would be subverted through conventional mainstream media.

Bitcoin Stamps

Next up is Bitcoin Stamps. One disadvantage and misnomer in the broader NFT world (including Ordinals) is that storing “art on the Blockchain” is enough to achieve permanence. The reality is that most NFTs are merely image pointers to centralized hosting or stored on-chain in prunable witness data.

Bitcoin Stamps proposes a method of embedding base64-formatted image data using transaction outputs in a novel fashion. To put it more simply, Bitcoin Stamps are digital collectibles similar to ERC-1155 semi-fungible tokens stored on Bitcoin’s unspent transaction outputs (UTXOs) instead of witness data like Ordinals.

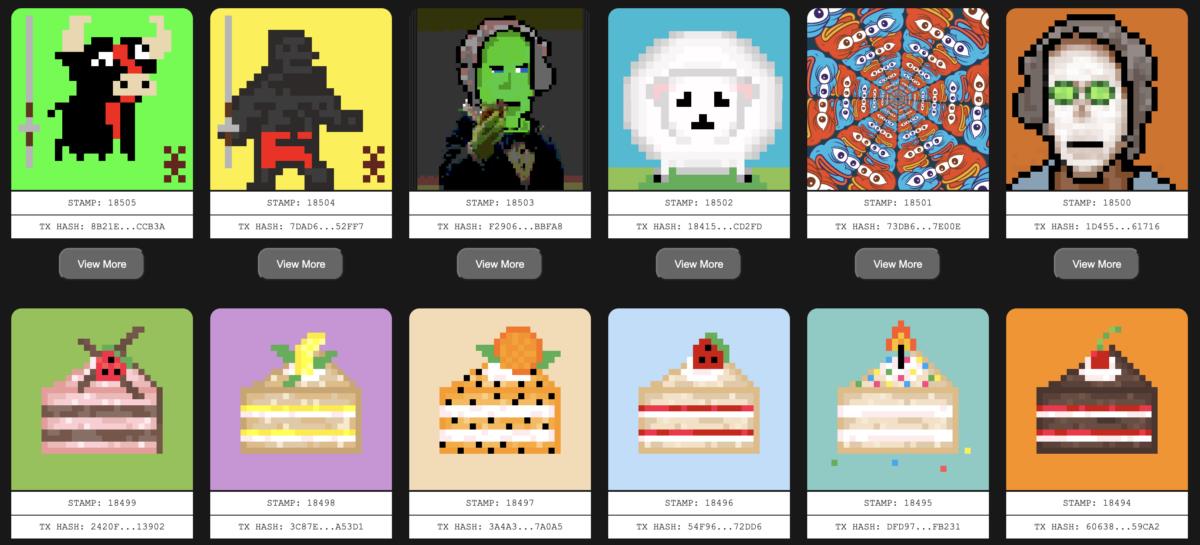

Credit: Bitcoin Stamps

Bitcoin Stamps abide by the following rules:

- A Bitcoin Stamp has to be a numeric asset, like this: [A1997663462583877600].

- You can create a Bitcoin Stamp from an existing numeric asset that wasn’t a stamp before. To do this, update the asset to include the stamp:base64 string in a new transaction.

- You can’t duplicate Bitcoin Stamps on the same asset. If an asset is already a stamp, changing the description field to a new base64 string won’t make it a new stamp. A new STAMP transaction will still be created on the blockchain, but the official STAMPS project won’t index it. This is to maintain a one-to-one relationship with the first created stamp.

- The image data should be in jpg, png, gif, or webP format and encoded in base64.

How do Stamps differ from Ordinals?

There are several ways in which Stamps differ from Ordinals:

- Storage: Bitcoin Stamps are stored on Bitcoin’s unspent transaction outputs (UTXOs), while Ordinals are stored in the witness data.

- Protocol: Bitcoin Stamps use the Counterparty protocol, an open-source messaging protocol built on the Bitcoin blockchain, whereas Ordinals are not mentioned to use this protocol. Furthermore, Stamps is using Counterparty bare multi-sig transactions for minting Bitcoin Stamps, allowing users to securely send BTC to a script-linked address.

- Minting cost: The cost of minting Bitcoin Stamps is approximately four times higher than inscribing Ordinals. However, Counterparty allows for more flexibility in minting larger quantities, which can lead to economies of scale.

- Immutability: The encoded image data for Bitcoin Stamps live in the transaction outputs on the Bitcoin blockchain, requiring Bitcoin nodes to download all the data to maintain the blockchain. In contrast, Ordinals’ image data lives in witness data, creating an environment where the image data can be pruned.

- Flexibility: Counterparty provides less user friction in minting a 1:1 or 1:100 at any given time, giving it more feature-rich capabilities for on-chain Bitcoin protocols than Ordinals.

- Growth rate: Bitcoin Stamps have been growing faster than Ordinals, likely due to the flexibility of minting larger quantities.

To mint Bitcoin Stamps, an image is converted to text, encoded as a Base64 file, and broadcasted to the Bitcoin network using the Counterparty protocol. The data is then recompiled to recreate the original image.

What are some disadvantages?

Some controversy around Bitcoin Stamps revolves around data permanence, UTXO set bloating, and disagreement about using block space for digital artwork. But, as with Ordinals, despite these debates, the emergence of Bitcoin Stamps once again highlights the capabilities of the Bitcoin blockchain as builders continue to develop new applications and improve user experience.

Nostr

Another platform that leverages the functionality of Ordinals is Nostr, a decentralized social network launched in 2021 by Bitcoin developer Joost Jager. Nostr enables users to post messages and content directly on the blockchain (using the Ordinals system) in a censorship-resistant manner, free from the constraints of any central authority or algorithmic censorship otherwise rampant on platforms like Twitter and Meta.

While still growing in adoption, the importance of Nostr invariably lies in its ability to foster an environment where free speech and expression can thrive unimpeded by the whims of centralized powers. In a world where information is increasingly controlled and manipulated, Nostr offers a platform that upholds democracy, transparency, and autonomy, allowing users to engage in open discourse, share ideas, and collaborate without fear of censorship.

In other words, this decentralized approach — tapping into the censorship-resistant nature of the Bitcoin blockchain — can reshape the way we interact online, giving voice to the voiceless and paving the way for a more equitable digital landscape.

A promising future

While lacking in comparative volume when compared with Ethereum, the steady rise of creativity and versatility on the Bitcoin blockchain means that developers and creators are offered a wider array of choices for free expression online. Moreover, being classified as a commodity by the U.S. Commodity Futures Trading Commission in September 2015 further bolsters Bitcoin’s role in championing freedom. This classification affords it greater autonomy and less stringent regulations than other cryptocurrencies deemed securities, enabling users to express themselves more openly through the network.

As the network expands with new nodes and as more users join to explore and engage with various concepts across all layers, the ecosystem becomes increasingly secure and decentralized. And it is through such innovative tools that we inch closer to a balanced and equitable digital landscape where every user has the opportunity to thrive and thus foster an environment where more individuals can advance the cause of liberty in the digital age.

The post Beyond Ordinals: Discover the Rich Tapestry of the Bitcoin Ecosystem appeared first on nft now.

Read MoreBy: Nft now Staff

Title: Beyond Ordinals: Discover the Rich Tapestry of the Bitcoin Ecosystem

Sourced From: nftnow.com/features/beyond-ordinals-discover-the-rich-tapestry-of-the-bitcoin-ecosystem/

Published Date: Thu, 27 Apr 2023 19:51:31 +0000

----------------------------

.png)