Finding the best crypto copy trading platform can change how you invest in 2025. Instead of spending years learning strategies, you can follow the actions of experienced traders and learn from their results. These platforms reduce the guesswork in trading by giving you access to real-time data, proven strategies, and risk management tools that help you grow your portfolio with confidence.

In this guide, we compare the top crypto copy trading platforms based on performance, fees, and reliability. You’ll learn how copy trading works, the different types of platforms available, and how to choose the one that fits your trading goals. Whether you’re new to crypto or looking to improve your strategy, this review will help you find the best copy trading platform that crypto investors trust in 2025.

Top Copy Trading Platforms in Crypto: Quick Comparison

| Platform | Copy Trading Fees | Commission to Lead Trader | Supported Cryptocurrencies | Minimum Copy Amount | Risk Controls Available | Notable Features |

| Binance | 10% trading fee commission. | 10% profit share. | 500+ | $10 | Stop-loss, take-profit, max position size. | Largest user base; advanced charting tools; spot and futures copy trading. |

| MEXC | 0% maker, 0.05% taker (spot); 0.02% taker (futures). | 50% discount for holding 500+ MX tokens; 20% discount for MX fee deductions. | 3000 | $5 | Stop-loss, take-profit. | Huge altcoin variety; flexible commission structures. |

| BingX | 0.1% (spot), 0.02%-0.05% (futures). | 8% profit share. | 1000+ | $2 | Take-profit, stop-loss, daily copy margin limits. | Strong social trading community; crypto and traditional market assets. |

| eToro | 1% on crypto trades. | Spread-based fees. | 100+ | $200 | Stop-loss, take-profit. | Regulated; beginner-friendly; combines social media with trading. |

| Bybit | 0.1% (spot), 0.02%-0.055% (futures). | 10% profit share. | 300+ | $50 | Stop-loss, leverage adjustments, and copy mode settings. | User-friendly interface; strong futures market; risk management per trade. |

| PrimeXBT | 0.05% trading fee. | 20% profit share. | 100+ | 0.001 BTC | Stop-loss, take-profit. | Covesting module for crypto and traditional CFD markets. |

| OKX | 0.08% maker, 0.1% taker (spot); 0.02%-0.05% (futures). | 5% profit share. | 350+ | $10 | Stop-loss, take-profit, order slicing. | High-performance engine; detailed trader analytics; social trading features. |

| Bitget | Fees range from 0-50 USDT per strategy. | 8% profit share. | 800+ | $50 | Stop-loss, take-profit, max copy amount per trader. | Pioneer in copy trading; large lead trader community; one-click copy. |

| Coinbase | N/A (No native feature). | N/A. | 250+ | N/A | N/A. | Beginner-friendly; highly regulated; excellent security features. |

| Gate.io | No specific fees. | 5% profit share. | 3400+ | $10 | Stop-loss, take-profit. | Extensive altcoin support; innovative trading tools. |

10 Best Crypto Copy Trading Platforms in 2025

When you are choosing your copy trading platform, you need to check on details that truly matter. Dig deeper into fees, supported cryptocurrencies, risk controls, and KYC requirements that can impact your performance. By comparing these factors side by side, you can find a platform that fits your trading style, goals, and risk tolerance. To help you make an informed decision, here are the top 10 best copy trading crypto platforms that are leading the way in 2025.

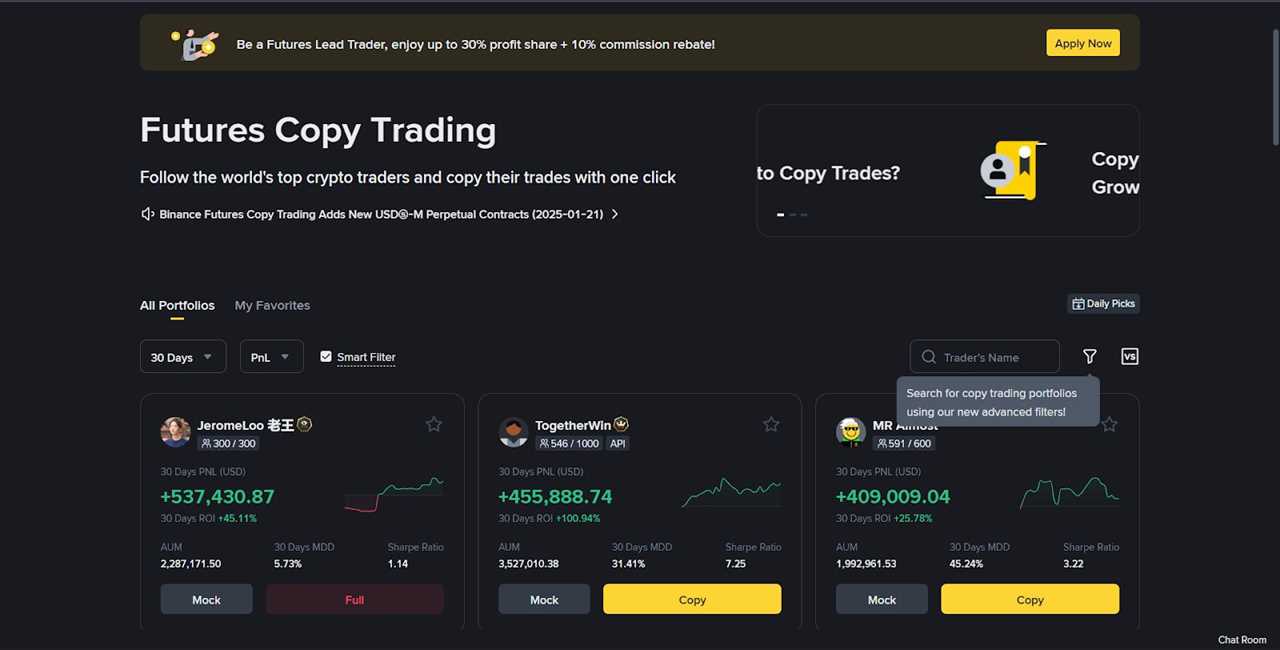

1. Binance

Since its launch in 2017, Binance has grown to become the largest exchange by trading volume, supporting over 500 cryptocurrencies and a wide variety of trading pairs. Additionally, its global presence in over 180 countries ensures accessibility and compliance with local regulations, making it a reliable choice for traders worldwide.

Pros & Cons of Binance

| Pros | Cons |

| Access to over 500 cryptocurrencies and a variety of trading pairs. | Advanced features can be overwhelming for beginners. |

| Supports both spot and futures copy trading. | Regulatory restrictions in some regions. |

| High liquidity ensures quick trade execution. | Customer support can be slow during peak times. |

| Low trading fees with discounts for using Binance Coin (BNB). | The interface may have a learning curve for new users. |

Key Features of Binance Copy Trading

- Diverse Trading Options: Binance supports both spot and futures copy trading platforms, giving you the flexibility to choose strategies that match your trading style.

- Detailed Trader Profiles: You can review metrics like return on investment (ROI), win rate, and asset allocation, helping you make informed decisions about who to follow.

- Risk Management Tools: Binance prioritizes your financial safety by offering tools like stop-loss orders, take-profit levels, and maximum investment limits. These features allow you to manage your risk effectively and protect your capital.

- Flexible Copy Modes: You can choose between fixed ratio and fixed amount modes, tailoring your copy trading experience to your portfolio size and risk appetite.

Copy Trading Fees on Binance

Binance’s fee structure is straightforward and competitive, solidifying its reputation as one of the best copy trading platform crypto options. There are no additional subscription fees for copy trading. Instead, users pay the standard trading fees, which are among the lowest in the industry. Lead traders earn a 10% share of the profits they generate for their followers, creating a strong incentive for them to perform well.

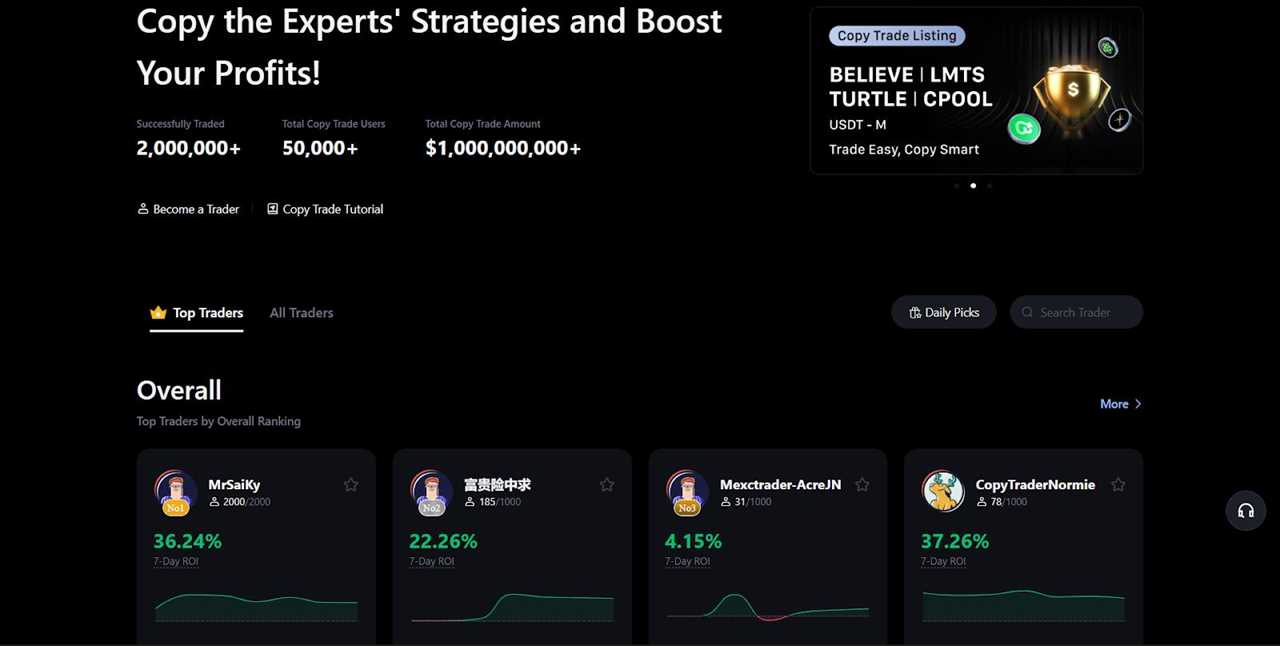

2. MEXC

MEXC is your gateway to a world of cryptocurrency opportunities. Since 2018, MEXC has been empowering over 30 million traders across 170+ countries, making it one of the most trusted and versatile exchanges in the market. With access to more than 3,000+ trading pairs, you’ll find everything you need to diversify your portfolio and seize new opportunities.

Pros & Cons of MEXC

| Pros | Cons |

| Trade over 3000+ cryptocurrencies | Limited availability in regions like the US, UK, and Canada. |

| Save with zero maker fees and low taker fees (0.05% for spot, 0.02% for futures). | No direct fiat-to-bank withdrawals in most countries. |

| Use advanced tools like demo trading and up to 500x leverage for futures. | Fewer fiat currencies supported for P2P trading. |

| Protect your assets with strong security measures, including a $100M Guardian Fund. | Pay up to 15% commission on copy trading profits. |

Key Features of MEXC Copy Trading

- Follow the Best: MEXC makes it easy to copy top-performing traders. You can review their ROI, PNL, and win rate, then let the platform replicate their trades for you.

- Save More, Trade More: Enjoy zero maker fees and low taker fees, and cut your costs even further with a 50% discount when you hold MX tokens.

- Stay in Control: Use tools like stop-loss and take-profit orders to manage your risk and protect your investments.

- Learn Without Risk: Practice your strategies in a demo trading environment before committing real funds.

Copy Trading Fees on MEXC

MEXC keeps fees simple and affordable. You’ll pay zero maker fees and low taker fees, 0.05% for spot trading and 0.02% for futures trading. If you hold MX tokens, you’ll unlock a 50% discount, saving you even more. For copy trading, you only pay up to 15% of your profits as a commission to lead traders, ensuring you only pay when you succeed.

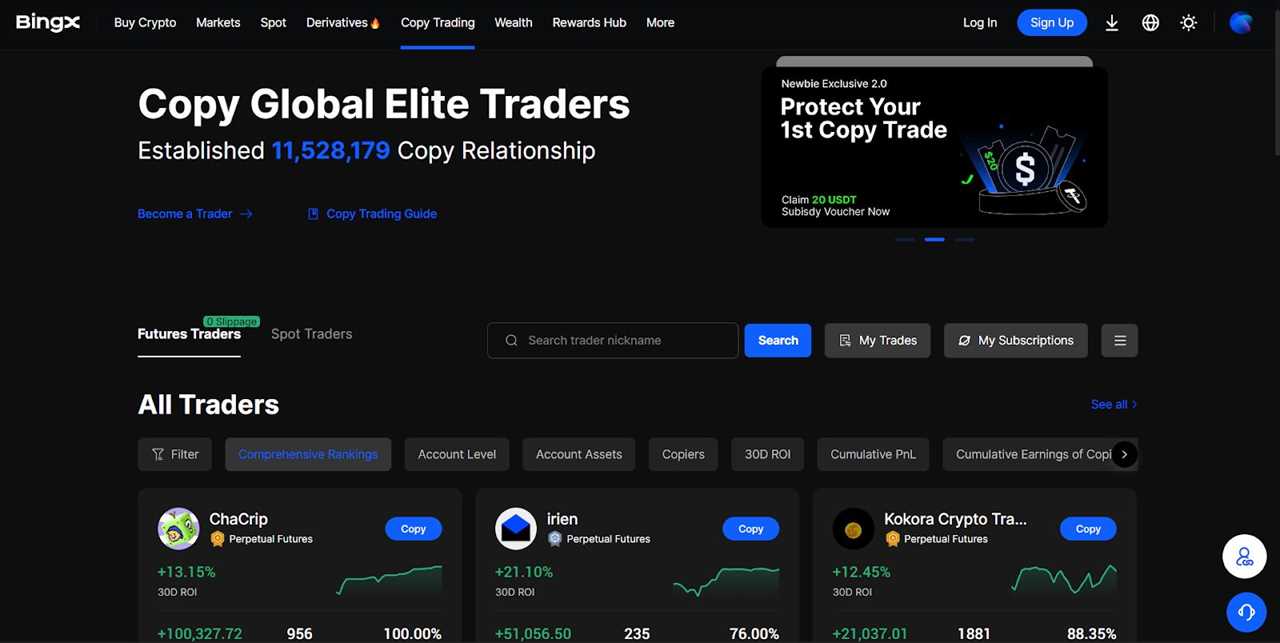

3. BingX

BingX has carved out a niche for itself as a leading social trading network, designed to connect novice traders with seasoned experts. Launched in 2018, the platform has grown rapidly, focusing on making cryptocurrency trading accessible and user-friendly. If you’re looking to step into the world of copy trading, BingX provides an environment that is both intuitive and powerful, allowing you to learn from and replicate the strategies of successful traders.

Pros & Cons of BingX

| Pros | Cons |

| Supports both spot and futures copy trading. | Not available to users in the United States and Canada. |

| No Know Your Customer (KYC) requirement for basic use. | Withdrawal limits are lower for non-verified accounts. |

| Access to a large pool of over 17,000 elite traders to copy. | The platform can be overwhelming for absolute beginners. |

| User-friendly interface with detailed trader analytics. | Limited fiat currency deposit options. |

Key Features of BingX Copy Trading

- Vast Trader Selection: You can choose from a massive community of over 40,000 professional traders. The platform provides in-depth statistics, including return on investment (ROI), risk level, and past performance, so you can find a trader who fits your style.

- Spot and Futures Options: BingX offers the flexibility to copy trades in both the spot and futures markets. This allows you to diversify your strategies, from lower-risk spot trading to higher-leverage futures contracts.

- Risk Management Tools: You have control over your investments with customizable settings. You can set a maximum amount per order, a daily copy trading limit, and a stop-loss ratio to protect your capital.

- Voucher-Based Trading: For futures copy trading, BingX uses a unique voucher system. This means you can try out futures trading with platform-provided vouchers, minimizing your personal risk while you learn.

Copy Trading Fees on BingX

BingX maintains a competitive and clear fee structure for its copy trading services. For spot trading, both maker and taker fees are set at 0.1%. In the futures market, the maker fee is 0.02% and the taker fee is 0.05%.

When you copy another trader, you’ll also share a portion of your profits with them. Lead traders on BingX can earn an 8% to 10% commission on the net profits generated by their followers. This performance-based fee ensures that lead traders are motivated to execute successful strategies, creating a win-win situation for both parties.

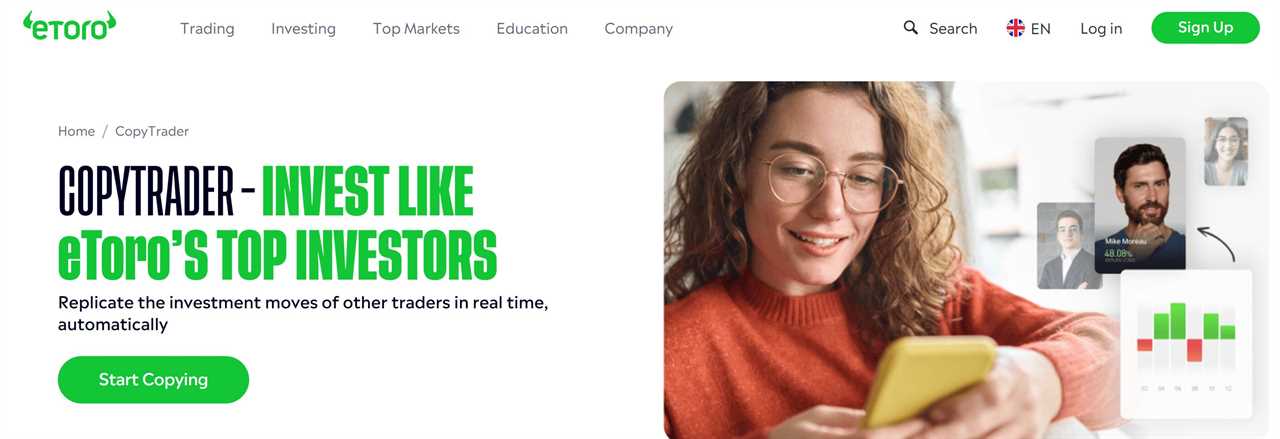

4. eToro

eToro was launched in 2007 and has made copy trading simple for everyone. You can follow top investors in crypto, stocks, and other assets without a complicated setup. Every investor profile displays clear stats, like trading history and risk level, so you know exactly what you’re getting into. You stay in control with options to change, pause, or stop copying anytime.

Pros & Cons of eToro

| Pros | Cons |

| Easy, beginner-friendly copy trading setup | 1% crypto trading fee is higher than some rivals |

| Copy investors across crypto, stocks, & more | $200 minimum to copy a trader |

| Regulated, secure, and trusted globally | Fees for withdrawals and currency conversion |

| Tons of useful performance and risk data | Not all coins can be transferred to a wallet |

Key Features of eToro Copy Trading

- Start copying top traders in crypto, stocks, ETFs, and more-all from one account.

- Check in-depth performance stats, past results, and risk ratings before you start.

- Set a stop loss to manage your risk across your whole copied investment.

- Simple pricing: pay a 1% fee when you buy or sell crypto, with no hidden charges.

- Be part of a big, active community where you can follow, copy, and learn every day.

Copy Trading Fees on eToro

You’ll pay a 1% fee when you buy or sell crypto. There are no management or copy fees for using the copy trading service. Be aware that eToro also charges for withdrawals and currency conversions.

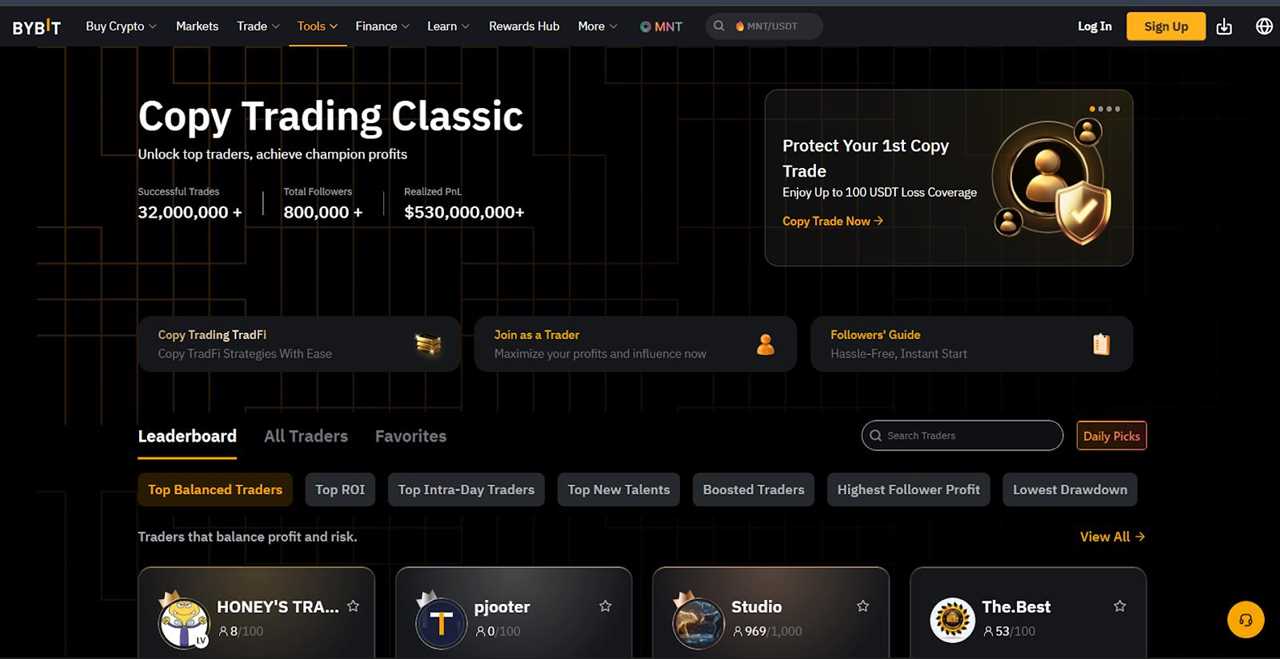

5. ByBit

ByBit has made a name for itself as a powerhouse in the crypto derivatives space since its launch in 2018. The platform has expanded its services to include a robust copy trading system, letting you tap into the strategies of professional traders on a platform built for performance.

Pros & Cons of ByBit

| Pros | Cons |

| Advanced trading engine with high liquidity. | Platform may be complex for complete beginners. |

| Supports both spot and futures copy trading. | Unavailable to users in the United States and the UK. |

| Low trading fees and competitive profit sharing. | A large number of features can feel overwhelming. |

| Strong risk management tools for followers. | Focuses more on derivatives, which carry higher risk. |

Key Features of ByBit Copy Trading

- Diverse Trading Options: You can copy trades across both spot and futures markets. This flexibility allows you to choose strategies that match your risk appetite.

- Bybit Trading Bots: You can copy not just individual traders but also their automated trading bots. This gives you access to strategies that run 24/7, like the Futures Grid Bot or DCA Bot, without needing to configure them yourself.

- Detailed Trader Analytics: Before you commit, you can dig into the performance of each Master Trader. ByBit shows you key stats like their return on investment (ROI), win rate, maximum drawdown, and preferred assets, so you can make a smart choice.

- Follower Protection: The platform includes a feature called CopyGuard. This tool helps you automatically adjust your trades if there’s significant slippage, protecting you from entering a position at a much worse price than the Master Trader.

Copy Trading Fees on ByBit

The standard trading fees apply to all copied trades. For spot trading, both the maker and taker fees are 0.1%. For futures trading, the maker fee is 0.02%, and the taker fee is 0.055% When it comes to profit sharing, you’ll give a portion of your net earnings to the Master Trader you follow.

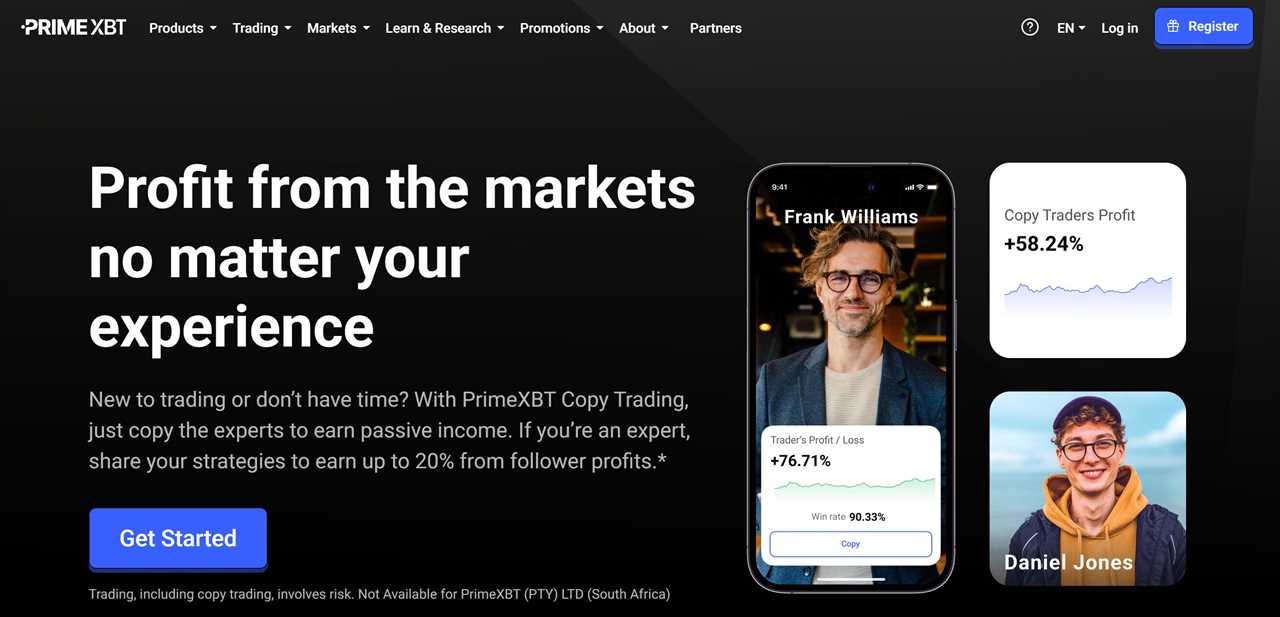

6. PrimeXBT

Launched in 2018, PrimeXBT integrates these diverse assets into its copy trading module, allowing you to follow traders who specialize in a wide range of financial instruments. What this means for you is the ability to build a more resilient portfolio by mirroring experts from different markets.

Pros & Cons of PrimeXBT

| Pros | Cons |

| Access to a wide range of markets, including crypto and Forex. | Higher minimum follower deposit compared to other platforms. |

| Transparent performance metrics and public leaderboards. | Limited number of cryptocurrencies available. |

| Strong security features, including cold storage for assets. | UI can be complex for those new to trading. |

| No KYC requirements for crypto deposits and withdrawals. | Primarily focused on CFD trading, which can be high-risk. |

Key Features of PrimeXBT Copy Trading

- Multi-Asset Strategies: You can copy traders who are active in various markets, not just crypto. This includes Forex, stock indices like the S&P 500, and commodities like gold and oil, all from a single account.

- Transparent Leaderboards: The platform features a public leaderboard that ranks strategy managers based on their total profits. You can see their detailed performance history, which helps you choose a manager who aligns with your goals.

- Advanced Risk Management: When following a strategy, you can set your own stop-loss and take-profit levels. This gives you greater control over your investment and helps you manage your risk exposure effectively.

- Peer-to-Peer Functionality: It creates a peer-to-peer environment where traders can monetize their trading skills. As a follower, you get to leverage their expertise, while successful traders are rewarded for their performance, creating a motivated community.

Copy Trading Fees on PrimeXBT

PrimeXBT’s fee structure for copy trading is based on a profit-sharing model. There is a platform entry fee of 1% that followers pay to start copying a strategy. Beyond that, the primary cost is the performance fee paid to the strategy manager.

You’ll pay a 20% commission on the profits you make from copying a successful strategy. This fee is only charged on profitable trades, so you’re only sharing your success. The standard trading fees of the platform also apply to all copied trades, which are 0.01% for crypto assets and 0.05% for indices and commodities.

7. OKX

If you’re a trader looking innovative platform, OKX offers a comprehensive copy trading system that lets you mirror the trades of experienced professionals. OKX has established itself as a top-tier crypto exchange since its launch in 2017, known for its extensive features and highly secure trading environment. This is an ideal solution if you want to get into trading but don’t have the time or expertise to analyze the markets yourself.

Pros & Cons of OKX

| Pros | Cons |

| Access to over 500 trading pairs for copy trading. | Not available to users in the United States. |

| Low trading fees and competitive profit-sharing model. | The vast number of features can be overwhelming for new users. |

| Strong security with a large proof-of-reserves fund. | Requires KYC verification to access all features. |

| User-friendly interface with detailed trader analytics. | The platform’s primary focus is on more experienced traders. |

Key Features of OKX Copy Trading

- Extensive Market Access: You can copy successful traders’ trades across more than 500 trading pairs. This massive selection allows you to follow traders with diverse strategies and gain exposure to a wide range of market opportunities.

- Detailed Performance Metrics: OKX provides a transparent look into each lead trader’s performance. You can review key data such as their profit and loss (PnL), win rate, risk score, and asset preferences. This helps you make an informed decision and find a trader who matches your investment style.

- Flexible Investment Modes: You have the choice between two investment modes: a fixed amount or a percentage of your portfolio. This flexibility lets you control exactly how much capital you want to allocate to each trade, helping you manage your risk more effectively.

- Practice with a Demo Account: If you’re new to copy trading, you can use a demo account to get comfortable with the platform. This lets you practice following traders and testing strategies with virtual funds.

Copy Trading Fees on OKX

The standard trading fees for the platform apply to all copied trades. For futures trading, the maker fee is 0.02% and the taker fee is 0.05%. These low fees help you keep more of your returns. In addition, the profit-sharing rate is typically between 8% to 13%. This commission is only paid on profitable trades, which means the lead trader’s success is directly tied to yours.

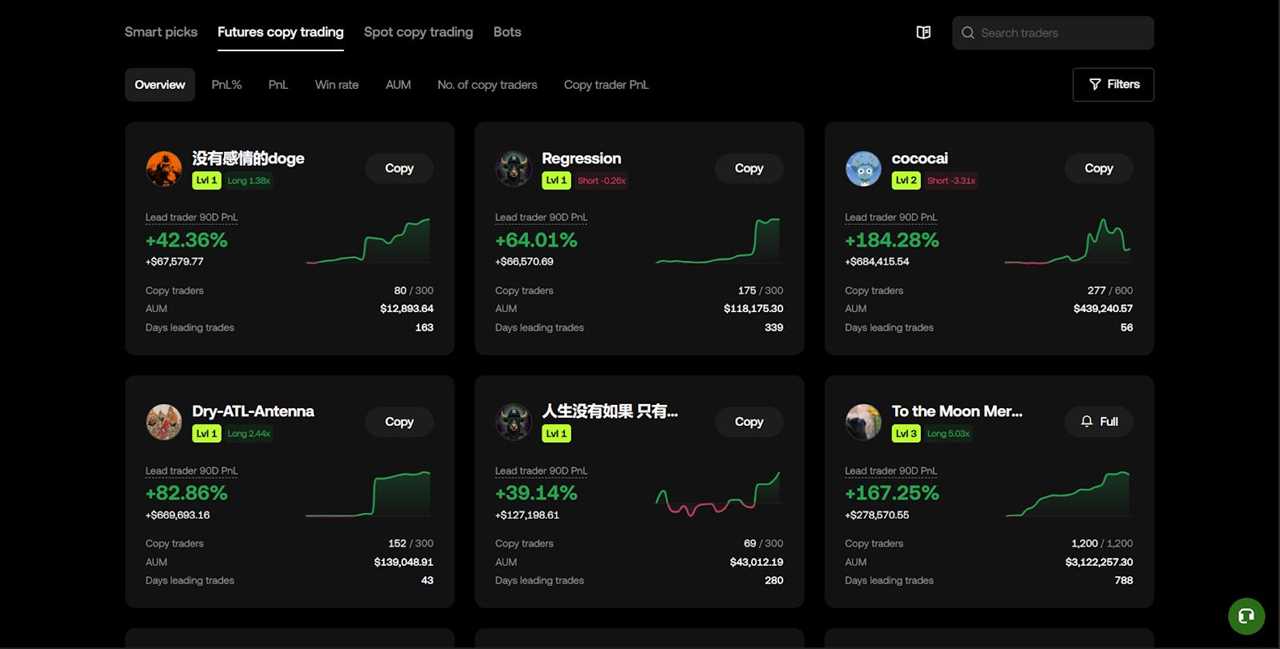

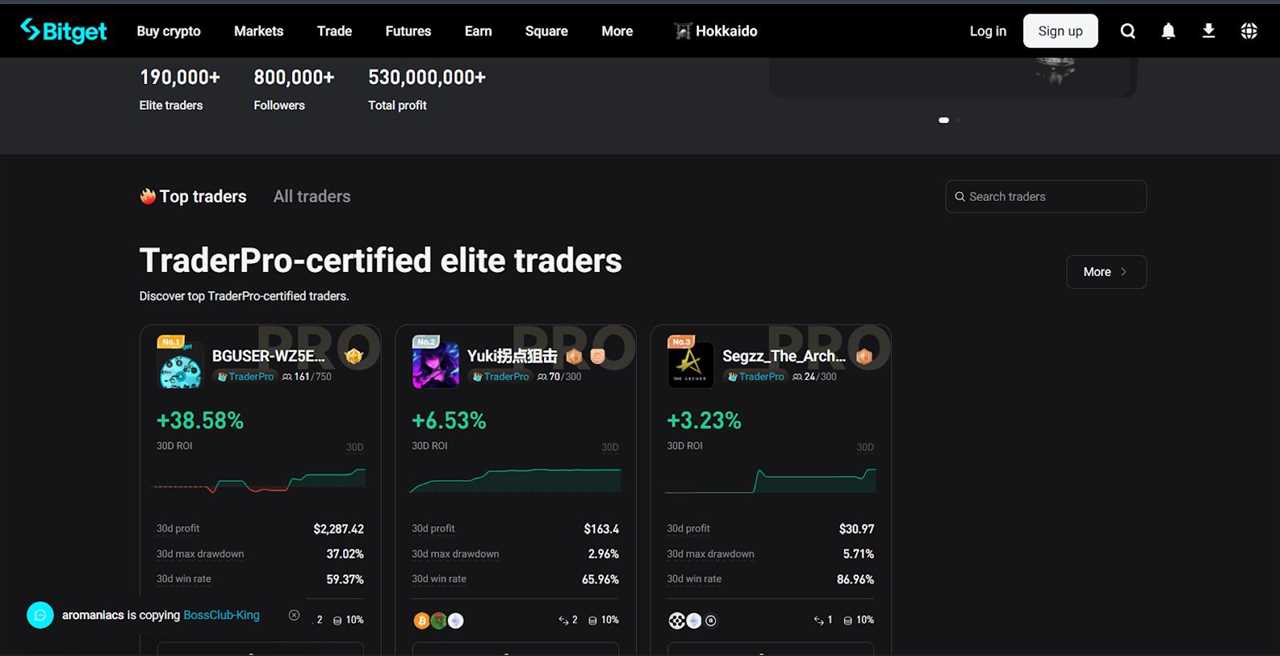

8. Bitget

Bitget has become a major player in the crypto space since its launch in 2018, especially for its pioneering work in copy trading. The platform was one of the first to introduce one-click copy trading, which has made it a favorite for traders who want to automate their strategies by following seasoned professionals.

Pros & Cons of Bitget

| Pros | Cons |

| One of the largest copy trading platforms with a huge user base. | Not available to users in the United States and Canada. |

| Low trading fees and a straightforward profit-sharing model. | The platform can feel crowded with so many traders to choose from. |

| Supports both spot and futures copy trading. | Requires Know Your Customer (KYC) verification for full access. |

| Strong risk management features for followers. | The mobile app can be less intuitive than the desktop version. |

Key Features of Bitget Copy Trading

- Vast Pool of Elite Traders: You get access to one of the largest networks of professional traders. The platform hosts over 130,000 elite traders, giving you an enormous range of strategies and styles to choose from and follow.

- Comprehensive Performance Data: Bitget gives you all the information you need to make a smart decision. You can check a trader’s total profit and loss (PnL), ROI, win rate, and AUM (Assets Under Management) to find someone who fits your risk tolerance.

- Spot and Futures Copy Trading: The platform supports copy trading in both the spot and futures markets. This allows you to diversify your approach, whether you prefer the lower-risk nature of spot trading or the high-leverage potential of futures.

- Personalized Risk Controls: You stay in control of your money. Bitget allows you to set specific parameters for your copied trades, including the amount per trade, stop-loss levels, and take-profit targets.

Copy Trading Fees on Bitget

All copied trades are subject to the platform’s standard trading fees. For spot trading, maker and taker fees are 0.1%. If you use Bitget’s native token (BGB) to pay for fees, you get a 20% discount. For futures trading, the maker fee is 0.02% and the taker fee is 0.06%.

The profit-sharing model is simple. When you follow an elite trader, you agree to share a portion of your net profits with them. This commission ranges from 4% to 10%, which the elite trader sets. You only pay this fee on trades that make money, ensuring that the trader you’re copying is motivated to perform well.

9. Coinbase

Founded in 2012, Coinbase has earned a solid reputation for safety, ease of use, and regulatory compliance. While trading crypto is straightforward on Coinbase, its take on copy trading stands out. The exchange doesn’t offer a built-in copy trading feature; instead, it lets you link your Coinbase account to trusted third-party platforms for automated, social trading.

Pros & Cons of Coinbase

| Pros | Cons |

| Highly secure and regulated platform. | No native, in-house copy trading feature. |

| Easy for beginners to navigate. | Trading fees can be higher than other large exchanges. |

| Available to users in the United States and many other regions. | Relies on external partners for copy trading functionality. |

| Well-known brand with deep liquidity. | Access depends on features offered by partner platform. |

Key Features of Coinbase Copy Trading

- Fund Security: Your crypto stays in your Coinbase account, protected by the exchange’s security.

- Regulated Integrations: You can only connect to social trading partners that meet high standards for safety and compliance.

- Quick Setup: You link your Coinbase account, pick a trader to follow, and set your investment amount.

- High Liquidity for Trades: Trades are executed on Coinbase, so you benefit from quick order fills and minimal price slippage.

Copy Trading Fees on Coinbase

The fees for copy trading with Coinbase come from two places. You pay Coinbase’s competitive trading fees, which are typically 0.05%–0.60% for maker orders and 0.10%–0.80% for taker orders, based on your monthly trading volume. The partner platform may add a profit-sharing commission, usually about 10% of any net profits earned from copied trades.

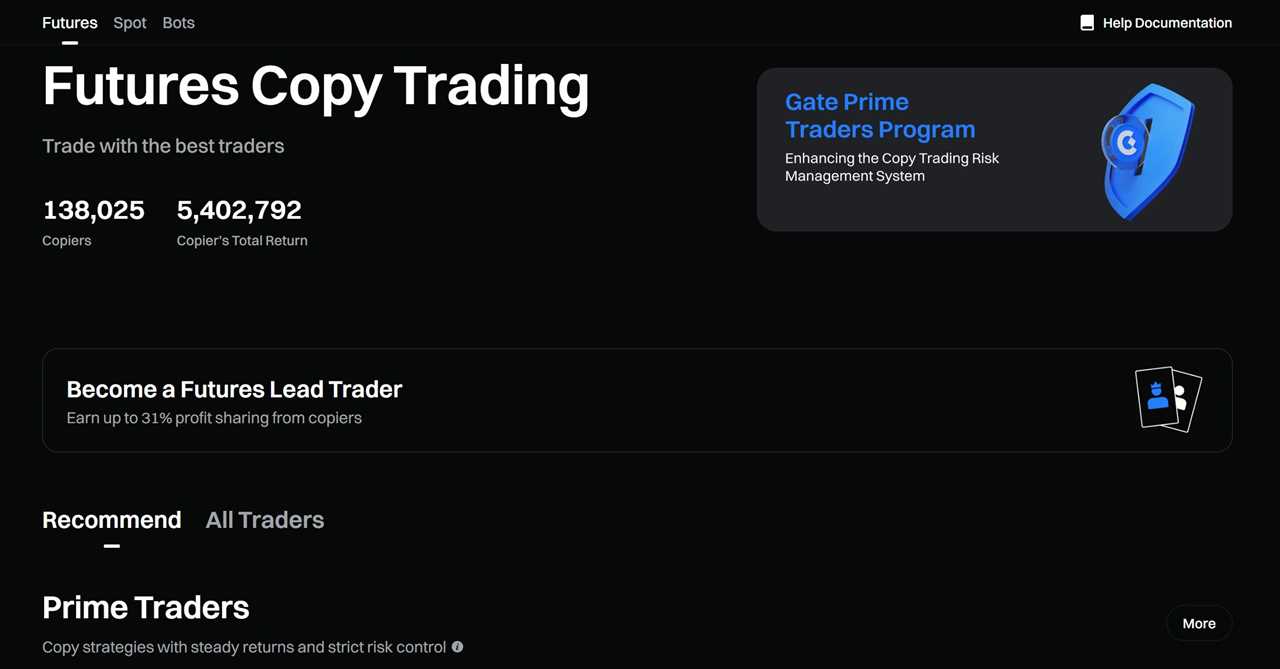

10. Gate.io

Established in 2013, Gate.io is one of the oldest and most comprehensive cryptocurrency exchanges in the market. Its platform is known for offering an enormous selection of digital assets, making it a destination for traders looking for access to new and emerging coins. Gate.io has integrated a powerful copy trading system that lets you tap into this vast marketplace by following the strategies of expert traders.

Pros & Cons of Gate.io

| Pros | Cons |

| Huge selection of over 3,400 cryptocurrencies. | Not available to users in the United States and Canada. |

| Advanced filtering options to find top traders. | The sheer number of options can be overwhelming for beginners. |

| Strong security with 100% proof-of-reserves. | User interface is more suited for experienced traders. |

| Competitive fee structure and profit-sharing model. | Requires KYC verification for full platform access. |

Key Features of Gate.io Copy Trading

- Unmatched Asset Selection: You get access to one of the largest selections of cryptocurrencies available for copy trading. With over 3,400 coins, you can follow traders who specialize in everything from major players like Bitcoin to obscure, high-potential altcoins.

- Advanced Trader Analytics: Gate.io provides an in-depth look at each lead trader’s performance. You can review their total investment, ROI, win rate, and past trades.

- Customizable Copying Parameters: The platform allows you to set a fixed amount or a multiplier for your copied trades. You can also implement a stop-loss ratio to automatically exit positions and protect your capital.

- Leaderboard and Filtering: The platform’s leaderboard helps you quickly identify top-performing traders. You can filter them by various metrics, including ROI, total profit, and the number of followers, making it easier to find an investment strategy that aligns with your financial goals.

Copy Trading Fees on Gate.io

All copied trades are subject to the platform’s standard spot trading fees, which are 0.2% for both makers and takers. If you hold the platform’s native GateToken (GT), you can receive discounts on these fees. When you copy a lead trader, you agree to give them a 5% commission on your net profits. This fee is only charged when a trade is profitable.

What is Copy Trading in Crypto?

Copy trading in crypto is a method where you replicate the trading actions of experienced traders. This can be done manually by observing their trades or automatically through platforms that sync your trading account with theirs. It’s particularly popular among beginners as it allows them to learn trading strategies while potentially earning profits.

The process is social in nature, often involving leaderboards or profiles where you can analyze a trader’s performance, risk levels, and strategies before deciding to follow them. Many crypto exchange platforms, like eToro and PrimeXBT, offer built-in tools for copy trading, while others allow integration with third-party services.

Is Crypto Copy Trading Profitable in 2025?

Copy trading can be profitable in 2025, but its success largely depends on several factors, including the trader you choose to follow, your risk management strategies, market conditions, and the underlying reasons for engaging in crypto trading. Here’s what you need to consider:

- Choosing the Right Trader: Profitability hinges on selecting a skilled and consistent trader. Look for traders with a proven track record, high win rates, and low drawdowns.

- Market Volatility: Crypto markets are inherently volatile, which can amplify both gains and losses. While experienced traders may navigate this volatility effectively, it’s crucial to understand that no strategy is foolproof.

- Risk Management: Even with copy trading, you remain in control of your investments. Setting stop-loss limits, diversifying your portfolio, and not over-allocating funds to a single trader can help to mitigate risks.

- Profit-Sharing Fees: Most copy trading crypto platforms charge a percentage of your profits as a commission to the trader you follow. While this aligns their interests with yours, it’s important to factor these fees into your overall profitability.

Types of Crypto Copy Trading Platforms

Crypto copy trading platforms come in various forms, each catering to different traders and investors. Here are the main categories.

1. Broker-Integrated Copy Platforms

These platforms are built directly into cryptocurrency exchanges or brokers, such as eToro or PrimeXBT. They allow users to copy expert trades seamlessly without needing external tools. The advantage is convenience and security, as your funds remain within the broker’s ecosystem.

2. Third-Party Platforms and Aggregators

Third-party platforms like ZuluTrade or Covesting connect to multiple exchanges via APIs. They aggregate traders from various platforms, giving you a broader selection of strategies to copy. While they offer flexibility, you’ll need to ensure the security of API connections and be mindful of additional fees these services may charge.

3. Social Trading Platforms

Social trading platforms, such as those offered by Binance or KuCoin, combine copy trading with community interaction. They allow users to follow, discuss, and learn from experienced traders in a social environment. These platforms are ideal for those who value collaboration and want to engage with a community while trading.

How to Choose the Right Crypto Copy Trading Platform?

Selecting the best copy trading platform crypto requires careful consideration of several key factors. Here’s what to evaluate:

- Platform Reputation and Trustworthiness. Research the platform’s history, user reviews, and security track record. Established platforms have a proven reputation for reliability and transparency.

- Trader Performance Metrics. Look for platforms that provide detailed analytics on lead traders, such as ROI, win rate, drawdowns, and trading history.

- Supported Cryptocurrencies. Ensure the platform supports the assets you want to trade. Some platforms focus on major cryptocurrencies like Bitcoin and Ethereum, while others offer a broader range, including altcoins.

- Community and Support. Platforms with active communities and responsive customer support can enhance your experience.

- Regulatory Compliance. Check if the platform complies with local regulations and offers services in your region.

How to Start & Succeed with Crypto Copy Trading

Starting with crypto copy trading involves choosing a trustworthy platform and setting clear goals. First, link your account to verified traders whose performance is open and easy to evaluate. Decide how much money to invest, use built-in tools like stop-loss and take-profit limits, and regularly check your results. Avoid copying too many traders at once; focus on understanding how each strategy performs in different market situations. Consistency, discipline, and good risk management are essential for long-term success.

How to Choose the Best Crypto Traders to Copy

Look for traders with a solid history of making money, low drawdowns, and strategies that fit your risk level. Examine metrics like crypto ROI, win rate, and average trade duration to evaluate performance. Stay away from traders who take big risks or have inconsistent results. The best copy trading crypto strategies come from traders who focus on steady growth, clear communication, and effective risk control.

Proven Copy Trading Strategies That Work in 2025

- Diversify Your Portfolio: Follow multiple traders with different strategies to reduce risk. A balanced mix of short-term, long-term, and sector-focused traders can help stabilize returns when the market fluctuates.

- Set Stop-Loss Limits: Protect your investments by limiting potential losses. Automated stop-loss settings keep you in control, even when the market changes unexpectedly.

- Monitor Performance Regularly: Continuously assess the traders you follow and make changes when necessary. Monitor their success rates, risk scores, and trading frequency to stay in line with your profit goals.

- Start Small: Start with a small investment to get a feel for the platform before increasing your stake. This method helps you understand how the platform operates and improve your strategy without risking too much of your capital.

Final Verdict: Which Platform Should You Choose?

The best copy trading crypto platform depends on your trading style. eToro is a great option for beginners because of its regulated environment and active trader community. Bitget and Binance are better for users who need advanced tools, high liquidity, and the chance to copy futures traders.

If low fees and a variety of strategies are your top priorities, MEXC and Gate.io provide excellent flexibility. Bybit and OKX are perfect for traders seeking access to analytics, leverage, and customizable copy trading options.

Regardless of the platform you select, make sure to review each trader’s history, set clear risk limits, and start with small amounts. Copy trading can be an effective way to learn and earn when paired with consistent risk management and the right platform for your objectives.

FAQs

What is the most successful copy trading platform?

The most successful copy trading platform delivers consistent results, supports a large network of traders, and offers features that match your trading goals.

What is the most reliable copy trader?

A reliable copy trader shows steady profits, maintains low drawdowns, and follows a strategy that matches your risk tolerance.

Do you need KYC for copy trading?

Yes, KYC is generally required for copy trading. This process ensures compliance with regulations and enhances the security of your trading activities.

Is copy trading a good option for beginners?

Yes, copy trading is a good choice for beginners. It allows them to learn from experienced traders while getting real market experience. Starting small and diversifying helps lower risk and build confidence.

Can you lose money while copy trading?

Yes, losing money is possible in copy trading because it involves market risks. Even the best traders can experience losses, so it’s important to monitor your investments and set stop-loss limits.

The post Best Crypto Copy Trading Platform: A Complete 2025 Guide appeared first on NFT Plazas.

Read MoreBy: Michael Sacchitello

Title: Best Crypto Copy Trading Platform: A Complete 2025 Guide

Sourced From: nftplazas.com/exchange/best-crypto-copy-trading-platform/

Published Date: Thu, 30 Oct 2025 09:30:53 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/10-hottest-swiss-cloud-mining-services-in-2025-definitive-list-and-insights

.png)