Are you spoilt for choice in selecting the best altcoins to buy in 2026? We understand your concern. As an investor, you must be certain of your decisions by evaluating factors like market trends, utility, and long-term potential. Whether you’re looking for the best altcoin for utility or one with explosive growth, making the right choice can set the foundation for your financial success.

In this article, we go deeper into helping you understand the top altcoins for 2026, key factors to consider before investing, and the risks involved. From Ethereum to Solana, and even Dogecoin, we’ll explore what makes these cryptocurrencies stand out. Stay with us as we guide you through expert tips and strategies to make your altcoin investments worthwhile.

10 Best Altcoins to Buy Now for Explosive Growth

| Name | Symbol | Price (Jan 2026) | 7d % Change | Primary Use Case | Market Cap Narrative |

| Binance Coin | BNB | $910.94 | +0.57% | Utility in Binance ecosystem | $125.79B USD. Still the largest exchange coin, with strong utility in Binance’s ecosystem and growing DeFi and gaming projects on BSC |

| Ethereum | ETH | $2,520.99+ | -1.70% | Smart contracts, dApps | $384.27B. Leading blockchain for decentralized apps |

| Solana | SOL | $200-300 | +1.97% | High-speed blockchain | $78.87 B USD. Known for scalability and low fees |

| Polygon | POL | $0.16 | +2.78% | Layer 2 scaling for Ethereum | 1.62B. Focused on reducing Ethereum gas fees |

| Chainlink | LINK | $13.62 | +2.85% | Decentralized oracles | Chainlink is the leading decentralized oracle network, with a market cap of $9.4B. Its integration into DeFi, RWA, and cross‑chain protocols makes it critical infrastructure |

| Cardano | ADA | $0.41 | +2.91% | Smart contracts, dApps | Cardano’s market capitalization is $15.44B. The altcoin focuses on peer‑reviewed research, scalability, and real‑world use cases (identity, DeFi) gives it long‑term appeal, though adoption is slower than some peers |

| Arbitrum | ARB | $0.22 | +5.20% | Layer 2 scaling for Ethereum | $ 1.71B. Gaining traction for faster transactions |

| XRP | XRP | $2.10 | +3.33 % | Cross-border payments | $127.86B. Strong institutional partnerships |

| Polkadot | DOT | $2.31 | +9.74% | Blockchain interoperability | $13B. Focused on connecting multiple blockchains |

| Dogecoin | DOGE | $0.13936 | +2.43% | Meme coin, payments | $23.38B. Popular for community-driven projects |

Best Altcoins to Buy in January 2026 (High Potential Picks)

Your investment choice is subject to risk tolerance, capital size, and how early you want to enter a growing crypto project. While large cap assets offer relative stability, many investors are increasingly drawn to altcoins under $1 due to their lower entry price and higher upside potential. These tokens often sit at earlier stages of adoption, where network growth and utility expansion can translate into strong price appreciation. With that in mind, here are the best altcoins to buy in 2026.

1. BNB (BNB)

BNB, short for Binance Coin, is widely regarded as one of the best altcoins for utility due to the number of practical functions it serves within the Binance ecosystem and the broader blockchain space. Launched in 2017, BNB was initially created to help you reduce trading fees on the Binance exchange. It evolved into the native token of BNB Chain, where it powers transactions, smart contracts, and decentralized applications across DeFi, NFTs, and Web3 platforms.

From an investment perspective, BNB shows strong market fundamentals. It holds a market cap of approximately $125.79B, with a 24-hour trading volume of about $2.19B, resulting in a volume-to-market-cap ratio of 0.0173, which reflects healthy liquidity. The circulating supply stands at roughly 137.73M BNB, supported by a token burn mechanism that gradually reduces supply over time.

BNB is available on many of the top altcoin exchanges, giving you easy access whether you trade actively or hold long term. Its regular token burn mechanism reduces total supply, which many investors see as supportive of long term value. With strong adoption, clear use cases, and deep integration across trading and blockchain services, BNB remains a high-potential altcoin for 2026.

2. Ethereum (ETH)

Ethereum is used to explain altcoins, as it was the first major cryptocurrency created after Bitcoin to introduce smart contracts and programmable blockchain technology. Launched in 2015, Ethereum shifted crypto from simple peer to peer payments to a platform where you can build decentralized applications, issue tokens, and run financial protocols without intermediaries. Its blockchain supports smart contracts, NFTs, decentralized finance, and enterprise use cases, making it one of the most widely adopted networks in the industry.

In terms of market position, Ethereum continues to dominate the smart contract space. As of January 2026, ETH trades around $2520.99 with an estimated market cap near $384.27 billion, making it the second largest cryptocurrency after Bitcoin. The network secures hundreds of billions in on-chain value and supports thousands of active applications, while Ethereum Layer 2 solutions handle a growing share of transaction volume. These factors keep Ethereum firmly positioned among the best altcoins to invest in for both retail and institutional participants.

Looking ahead, Ethereum’s future potential is closely tied to ongoing network upgrades and its expanding role in global finance. Improvements in scalability, reduced transaction costs through Layer 2 adoption, and growing use cases like tokenized assets and on-chain identity strengthen its long term outlook.

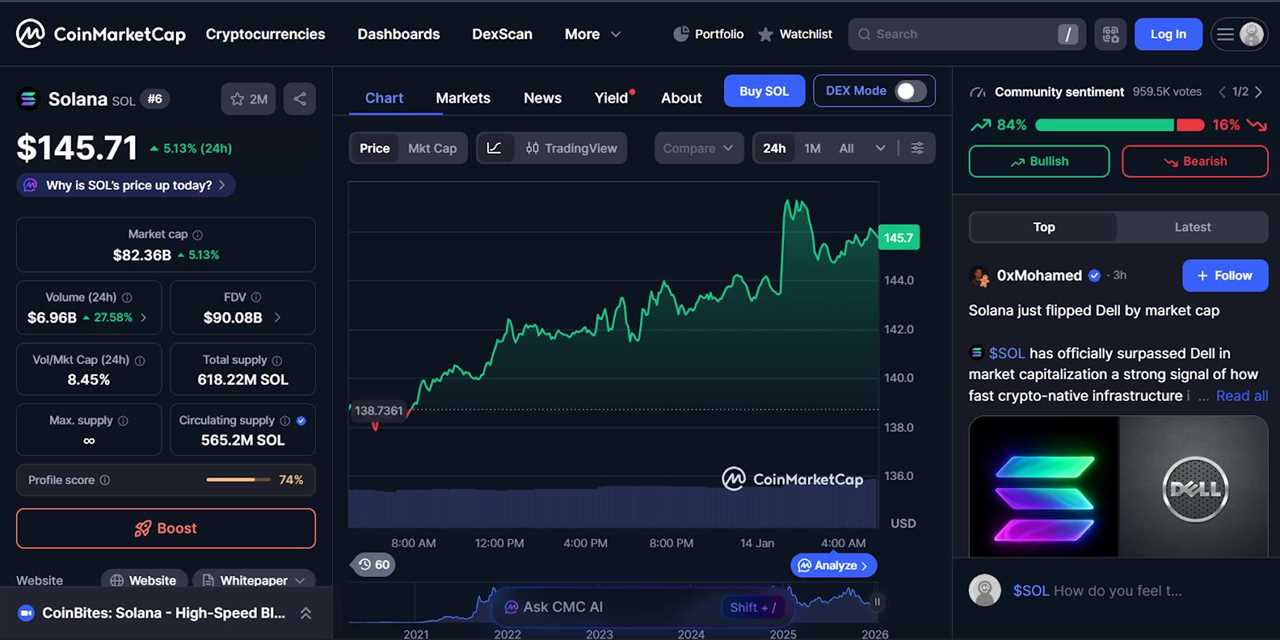

3. Solana (SOL)

Solana is a high-performance blockchain launched in 2020 with a clear focus on speed, scalability, and low transaction costs. It was designed to handle thousands of transactions per second without relying on Layer 2 solutions, making it attractive if you value efficiency and seamless user experience. Solana supports smart contracts, decentralized applications, NFTs, and gaming platforms, all powered by its unique proof-of-history and proof-of-stake hybrid model. These features allow developers to build complex applications while keeping fees low for everyday users.

Solana stands among the top altcoins for long term growth due to its strong adoption and expanding ecosystem. It holds a market cap of approximately $ 78.87 billion, with a circulating supply of about 564.58 million SOL tokens. Its global presence is clear through widespread use by developers and institutions across North America, Europe, and Asia. The Solana ecosystem now supports over 5,000 decentralized applications, including decentralized exchanges, NFT marketplaces, payment tools, and emerging AI-driven platforms, reinforcing its role as a major innovation hub.

Solana’s future potential is tied to continued ecosystem expansion, institutional partnerships, and improvements in network stability. As more real world applications move on chain, Solana’s ability to support high throughput at low cost strengthens its appeal for those learning how to invest in altcoins with long term conviction.

4. Polygon (POL)

When you’re trying to use Ethereum apps without paying high fees, Polygon often becomes the quiet solution working in the background. Polygon is built to help Ethereum scale, so you can trade NFTs, play blockchain games, or use DeFi apps with faster confirmations and lower costs. Instead of asking you to move to a new ecosystem, Polygon lets you stay connected to Ethereum while improving the experience. That’s why many developers and brands choose it for consumer-facing apps.

In 2026, Polygon holds a market cap of about $7.5 billion, supported by strong daily trading activity and wide exchange availability. It’s accepted across DeFi platforms, gaming projects, loyalty programs, and enterprise pilots. This level of adoption shows that Polygon isn’t just experimental infrastructure.

As an investor, Polygon appeals if you want exposure to growth without chasing hype. It’s often mentioned among the best cheap altcoins to buy because of its lower price point and strong utility. You can trade POL on major platforms with ease. Its focus on scaling and partnerships gives it long-term relevance as blockchain use expands.

5. Chainlink (LINK)

Have you ever wondered how DeFi apps know the price of crypto in real time? Chainlink solves that problem by delivering reliable data to blockchains so smart contracts can work properly. Without accurate price feeds and external data, many decentralized apps simply wouldn’t function. That invisible role makes Chainlink one of the most important pieces of crypto infrastructure.

To understand what is chain link, think of it as the bridge between blockchains and the real world. In January 2026, Chainlink carried a market cap of roughly $9.4 billion, backed by consistent demand across hundreds of protocols. It’s supported by most major blockchains and trusted by developers who need secure data. This wide acceptance reduces reliance on any single ecosystem.

For investors who care about function, Chainlink stands out as the best altcoin for utility rather than speculation. You can buy LINK on leading exchanges and hold it as exposure to core crypto infrastructure. Its value grows as DeFi, tokenized assets, and cross-chain tools expand. That practical demand helps it hold relevance over time.

6. Cardano (ADA)

Becoming an investor in Cardano often means valuing patience and structure. Cardano is a third-generation blockchain platform that focuses on sustainability, scalability, and real-world applications. Launched in 2017 by Ethereum co-founder Charles Hoskinson, Cardano is built on peer-reviewed research and aims to provide a secure and scalable infrastructure for dApps and smart contracts. Its unique proof-of-stake consensus mechanism, Ouroboros, sets it apart as an energy-efficient blockchain.

ADA is widely supported on major exchanges, making it easy for you to buy, hold, or trade. Many projects on Cardano focus on identity systems, governance tools, and financial inclusion. That practical direction gives it a unique role in the ecosystem.

Cardano often appears among top altcoins for long term investors who want durability. It doesn’t chase trends, and that’s intentional. If you’re comfortable holding through slower development cycles, it offers a different kind of confidence. That contrast helps you weigh it against faster-moving chains.

7. Arbitrum (ARB)

As you trade or use DeFi apps, you may already be using Arbitrum without realizing it. It helps Ethereum handle more transactions while keeping fees low and performance smooth. You don’t need new wallets or tools, which makes adoption easy. Many popular DeFi platforms support it by default.

In 2026, Arbitrum holds a market cap near $1.71B billion, supported by strong activity across decentralized exchanges and lending protocols. Its token, ARB, is used mainly for governance and ecosystem incentives. Developers favor Arbitrum because it balances cost savings with Ethereum compatibility. That combination keeps users and builders engaged.

If you’re learning how to invest in altcoins, Arbitrum offers a clear value case tied directly to Ethereum’s growth. You can access ARB on major exchanges with solid liquidity. Its success depends on usage, not marketing narratives. That makes it easier for you to evaluate.

8. XRP (XRP)

XRP, the native cryptocurrency of the Ripple network is designed for fast and low-cost cross-border payments. Launched in 2012, XRP aims to revolutionize international money transfers by providing a more efficient alternative to traditional systems like SWIFT. Its ability to settle transactions in seconds with minimal fees makes it a popular choice for financial institutions.

XRP’s market cap is approximately $127.01 billion, with a 24-hour trading volume of $1.9 billion. Its circulating supply is around 50 billion XRP tokens. The recent legal clarity following Ripple’s case with the SEC has improved investor sentiment, positioning XRP as a reliable option for cross-border payments.

For those exploring what altcoins are, XRP stands out for its real-world utility and strong market presence. It’s available on major exchanges like Binance and Bitstamp, making it accessible for global investors. With its focus on financial innovation and growing adoption, XRP remains a high-potential altcoin for 2026.

9. Polkadot (DOT)

Have you noticed how fragmented blockchains feel today? Polkadot was built to connect different networks so they can share data and value. Instead of forcing one chain to handle everything, it coordinates many specialized blockchains. This structure gives developers flexibility while keeping security strong.

In 2026, Polkadot carries a market cap close to $13 billion with active governance participation. DOT holders can vote on upgrades, which keeps decisions community-driven. Its ecosystem supports finance, identity, and data-focused projects. That diversity strengthens its long-term use case.

Polkadot is often mentioned among the best altcoins to invest in if you believe interoperability matters. You can trade DOT on major platforms with ease. Its role depends on collaboration, not competition alone. That positioning gives it a unique edge.

10. Dogecoin (DOGE)

Dogecoin, originally created as a joke in 2013, has evolved into one of the most popular cryptocurrencies. Known for its vibrant community and meme-driven culture, Dogecoin is widely used for tipping, payments, and charitable donations. Its fast transaction speed and low fees make it a practical choice for microtransactions.

Dogecoin’s market cap is approximately $25 billion, with a 24-hour trading volume of $1.2 billion. Its circulating supply is around 140 billion DOGE tokens. While primarily a meme coin, Dogecoin’s adoption by companies like Tesla and its integration into platforms like X (formerly Twitter) highlight its real-world utility.

When people look for the best cheap altcoins to buy, Dogecoin often comes up because of its familiarity. It doesn’t promise complex features, and that’s part of its appeal. For casual use and brand recognition, it fills a clear role. That simplicity helps you decide where it fits in your portfolio.

What Are Altcoins?

What are altcoins is a common question when you move beyond Bitcoin and start exploring the wider crypto market. Altcoins are simply cryptocurrencies that are not Bitcoin, and they were created to improve, expand, or offer alternatives to what Bitcoin does. Examples include Ethereum for smart contracts, Solana for fast transactions, Chainlink for data feeds, and XRP for global payments. Each altcoin is built with a specific purpose in mind, which is why no two projects function exactly the same.

Altcoins work using blockchain technology, but their mechanisms vary depending on their goals. Some use proof of stake to secure the network and reward users for staking tokens, while others focus on speed, scalability, or interoperability between blockchains. When you interact with altcoins, you might be trading, staking, voting on governance proposals, or using decentralized apps. Understanding how each altcoin functions helps you choose assets that match your goals, whether that’s payments, long-term investing, or using blockchain-based services.

Key Factors to Consider Before Buying Altcoins

Before you put money into any altcoin, it helps to slow down and look beyond what past performance shows and social media noise. Every altcoin behaves differently, and small details often make the biggest difference over time. When you’re deciding where to allocate your capital, focusing on fundamentals can protect you from emotional trades. The factors below will help you judge whether an altcoin fits your goals and risk level.

Market Cap and Trading Volume

Market cap helps you understand how large and established a project is, while trading volume shows how active it is. When you’re buying an altcoin with healthy daily volume, it’s easier to enter and exit positions without sharp price swings. For example, a token with a strong market cap but low volume may look stable but can be hard to sell quickly. Looking at both together helps you avoid assets that are popular on paper but illiquid in practice.

Use Case and Utility

An altcoin’s value often comes from what you can actually do with it. Tokens used for payments, smart contracts, or data services tend to hold demand better than those driven purely by speculation. If you’re using a network to trade, stake, or access apps, that activity supports long-term value. Practical utility gives an altcoin a reason to exist beyond short-term price movements.

Team, Roadmap, and Community

Behind every altcoin is a team making decisions and a community supporting the project. A clear roadmap shows you where the project is headed and how it plans to grow. Active communities help with adoption, testing, and feedback, which can accelerate development. When teams communicate openly, it’s easier for you to trust the project’s direction.

Tokenomics and Supply

Tokenomics explains how a token is issued, distributed, and managed over time. A fixed or slowly reducing supply can support price stability, while the unlimited supply may dilute value if demand doesn’t grow. For instance, tokens with burn mechanisms reduce supply as usage increases, which can support long-term holding. Understanding supply dynamics helps you judge whether growth is sustainable or purely speculative.

Where to Buy Altcoins Safely

Knowing where to buy altcoins safely matters just as much as knowing which ones to pick. You should focus on platforms with strong security and clear regulations. Whether you’re hunting for altcoins under $1 or looking at some of the best cheap altcoins to buy, the exchange you use can impact your experience, cost, and even your profits. Here’s how to pick the right platform to trade altcoins with confidence and minimal risk.

Reputable Centralized Exchanges (CEXs)

These platforms are user-friendly and have high liquidity, which helps you trade quickly and securely. Examples include:

- Binance – Offers tons of tokens and strong security features, ideal for both beginners and active traders.

- Coinbase – Known for regulatory compliance and simplicity, great for first-time buyers.

- Kraken – Strong reputation for safety and a wide selection of altcoins.

Decentralized Exchanges (DEXs)

DEXs let you trade directly from your wallet without handing control of your funds to a third party. Popular options:

- Uniswap – Huge range of Ethereum-based tokens, good if you use MetaMask or similar wallets.

- PancakeSwap – Works on BNB Chain and offers many low-priced tokens.

Risks of Investing in Altcoins

Before you invest in altcoins, it’s important to balance opportunity with realism. While altcoins can deliver strong returns, they also come with risks that don’t always show up during bullish periods. The following are the risks to know:

Volatility and Rug Pulls

Altcoins are known for sharp price swings that can happen within hours or even minutes. When prices move this fast, gains can disappear just as quickly if market sentiment shifts. Rug pulls add another layer of risk, where developers abandon a project after attracting investors, leaving the token worthless. You reduce this risk by focusing on established projects with transparent teams and active communities.

Regulatory Uncertainty

Crypto regulations continue to evolve, and altcoins often feel the impact first. Changes in laws or enforcement can limit trading access, delist tokens, or affect how projects operate. Even strong projects can face sudden price drops due to regulatory headlines. Staying informed helps you react before policy shifts catch you off guard.

Illiquidity or Low Volume

Some altcoins look promising but lack enough trading activity to support smooth buying and selling. Low volume can lead to wide price spreads and delayed order execution. When you try to exit a position, you may struggle to find buyers at fair prices. Checking liquidity before investing helps you avoid getting stuck in hard-to-sell assets.

Expert Tips for Altcoin Investing in 2026

Investing in altcoins can be rewarding, but it requires a strategic approach to navigate the market’s volatility and maximize returns. By adopting proven investment strategies, you can reduce risks and make more informed decisions. Here are some expert tips to help you succeed in altcoin investing in 2026.

1. Portfolio Diversification

Diversifying your portfolio is essential to managing risk in the unpredictable altcoin market. Instead of putting all your funds into a single altcoin, spread your investments across multiple projects with different use cases and market positions. Combining established crypto coins like Ethereum with emerging projects in DeFi or gaming can balance stability and growth potential. Diversification helps protect your portfolio from significant losses if one asset underperforms.

2. Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a strategy where you invest a set amount at regular intervals, regardless of price fluctuations or market conditions.

This strategy reduces the impact of market volatility and eliminates the need to time the market. For instance, investing $100 weekly into a promising altcoin allows you to accumulate more tokens when prices are low and fewer when prices are high, averaging out your cost over time. DCA is particularly effective for long-term investors.

3. Setting Realistic Profit Targets

Establishing clear and achievable profit targets helps you stay disciplined and avoid emotional decision-making. Decide in advance at what price you’ll sell part or all of your holdings to secure profits. For example, if you buy an altcoin at $1, you might set a target to sell 50% of your holdings when it reaches $2. This approach ensures you lock in gains while leaving room for further growth.

Conclusion – Are Altcoins Still Worth Buying in 2026?

Altcoins can still be worth buying in 2026, but only if you approach them with clear expectations and discipline. The market has matured, and many projects now offer real products, active users, and measurable demand rather than just promises. At the same time, not every altcoin will survive, which means careful selection matters more than chasing quick gains.

If you focus on utility, liquidity, and long-term relevance, altcoins can complement a broader crypto portfolio rather than replace it. Established networks like Ethereum or Solana offer stability, while smaller projects may provide growth at higher risk. Your decision should reflect your risk tolerance, time horizon, and willingness to stay informed as conditions change. Altcoins are no longer about betting on everything and hoping something works. In 2026, they reward investors who research deeply, manage risk, and think long term. If that approach fits you, altcoins can still play a meaningful role in your investment strategy.

FAQs

The best altcoins to buy right now depend on your investment goals and risk tolerance. Established projects like Ethereum, Solana, and Cardano are often considered strong choices due to their utility and market presence. For those seeking emerging opportunities, researching altcoins with innovative use cases in DeFi, gaming, or AI can uncover high-potential investments.

The safest altcoin to invest in is typically one with a strong track record, robust utility, and widespread adoption. Ethereum is often regarded as a safer option due to its dominance in smart contracts and decentralized applications. However, no investment is entirely risk-free, so always diversify and conduct thorough research.

Altcoins with the most upside potential are often those addressing real-world problems or innovating within the blockchain space. Projects like Chainlink, which connects smart contracts to external data, or Polkadot, which focuses on blockchain interoperability, are examples of altcoins with significant growth potential. Keep an eye on emerging trends to identify promising projects.

Yes, altcoins can outperform Bitcoin in terms of percentage gains, especially during bull markets. However, they are generally more volatile and carry higher risks. While Bitcoin remains the market leader, altcoins often see larger price swings, offering both higher rewards and greater risks.

How much you should invest in altcoins depends on your financial situation, risk tolerance, and investment strategy. A common approach is to allocate a small percentage of your portfolio, such as 10-20%, to altcoins while keeping the majority in more stable assets like Bitcoin or traditional investments. Always invest only what you can afford to lose.

The post Best Altcoins to Buy in 2026: Top Crypto Picks & Tips appeared first on NFT Plazas.

Read MoreBy: Michael Sacchitello

Title: Best Altcoins to Buy in 2026: Top Crypto Picks & Tips

Sourced From: nftplazas.com/exchange/best-altcoins-to-buy/

Published Date: Thu, 15 Jan 2026 17:03:34 +0000

----------------------------

.png)