The regulatory landscape for cryptocurrency in 2025 is unfolding rapidly. As institutional acceptance of Bitcoin and Ethereum ETFs surges, attention is now turning to a broader class of assets—specifically altcoins like XRP. With XRP’s legal clarity improving and regulatory frameworks slowly opening, 2025 may be the year XRP-based ETFs become a reality.

XRP’s Legal Clearance: The Catalyst for Institutional Adoption

The U.S. Securities and Exchange Commission (SEC) v. Ripple lawsuit, which had been ongoing since late 2020, took a significant turn in mid-2023 when a federal judge declared that XRP does not qualify as a security in secondary market transactions. This decision provided long-awaited regulatory clarity. By 2025, further developments, including SEC silence on appeal and growing bipartisan pressure for crypto legislation, solidified XRP’s legal standing for ETF consideration.

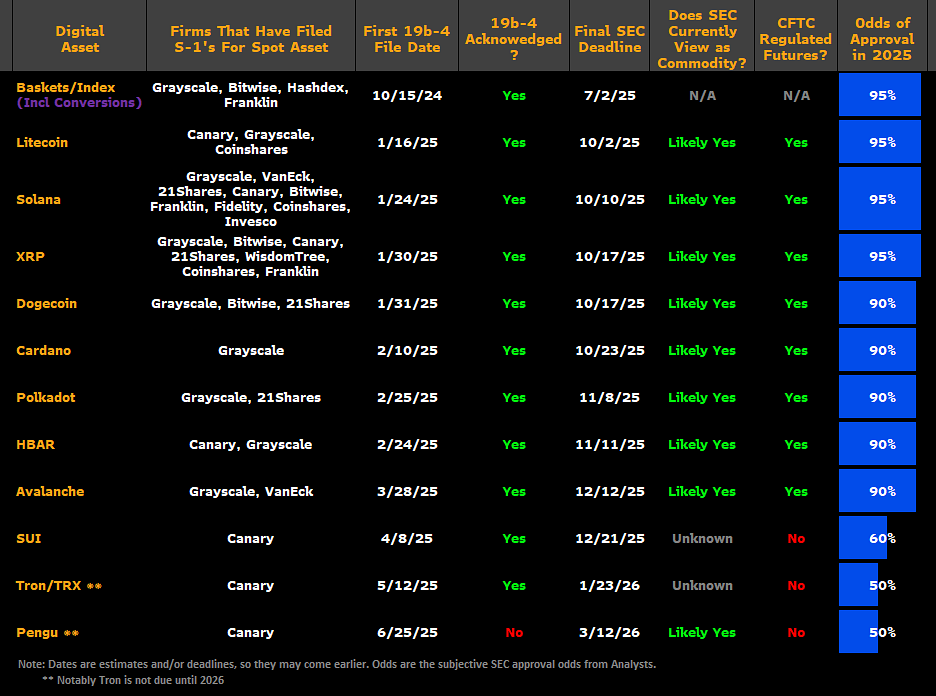

Having largely resolved the legal uncertainty, issuers such as Bitwise, VanEck, and 21Shares have filed for spot XRP ETFs. Industry analysts now estimate that approval odds for an XRP ETF are above 90% by Q4 2025, according to a report by Coinpedia and forecasts from Bloomberg ETF strategist James Seyffart.

For more: Analyzing the Boom of Crypto ETFs in 2025

From Demand-Side Mechanics, Who Would Buy XRP ETFs?

XRP remains one of the most transacted assets globally, often ranking in the top 10 by 24-hour volume. It has carved a niche as a bridge currency for cross-border settlement. RippleNet has clients in over 70 countries. Yet, XRP’s integration into regulated portfolios has been constrained by legal ambiguity—until now.

Should a spot XRP ETF be approved, it is expected to attract significant inflows from institutional allocators, managed portfolios, and thematic ETF wrappers. In Q2 2025 alone, over $22.7 billion in net new assets flowed into crypto ETFs, according to CoinShares. If XRP captures 5–10% of that pipeline post-launch, it could see early inflows of $1.1 to $2.2 billion.

Ethereum spot ETFs launched in May 2025 and accumulated $1.3 billion in AUM within the first 60 days, per The Block Research.

For more: The Impact of Ethereum ETFs on ETH Price

What Happens When ETFs Buy XRP?

Unlike futures ETFs that derive exposure via derivatives, spot ETFs require custodians to buy and hold actual XRP. This means that ETF inflows represent real market demand, pulling liquidity from exchanges and tightening supply.

XRP’s current circulating supply is approximately 54 billion tokens, with about 2 billion in daily liquidity across major centralized exchanges. If ETFs collectively accumulate just 1.5% of the supply (800 million XRP), this could materially reduce sell-side pressure.

Much like what occurred with Bitcoin ETFs—where IBIT and FBTC absorbed over 300,000 BTC, creating what analysts describe as a “soft floor” under the price—XRP ETFs could anchor the asset in institutional-grade custody, thereby dampening volatility and reducing speculative churn.

Derivatives Markets Price in Volatility and Direction

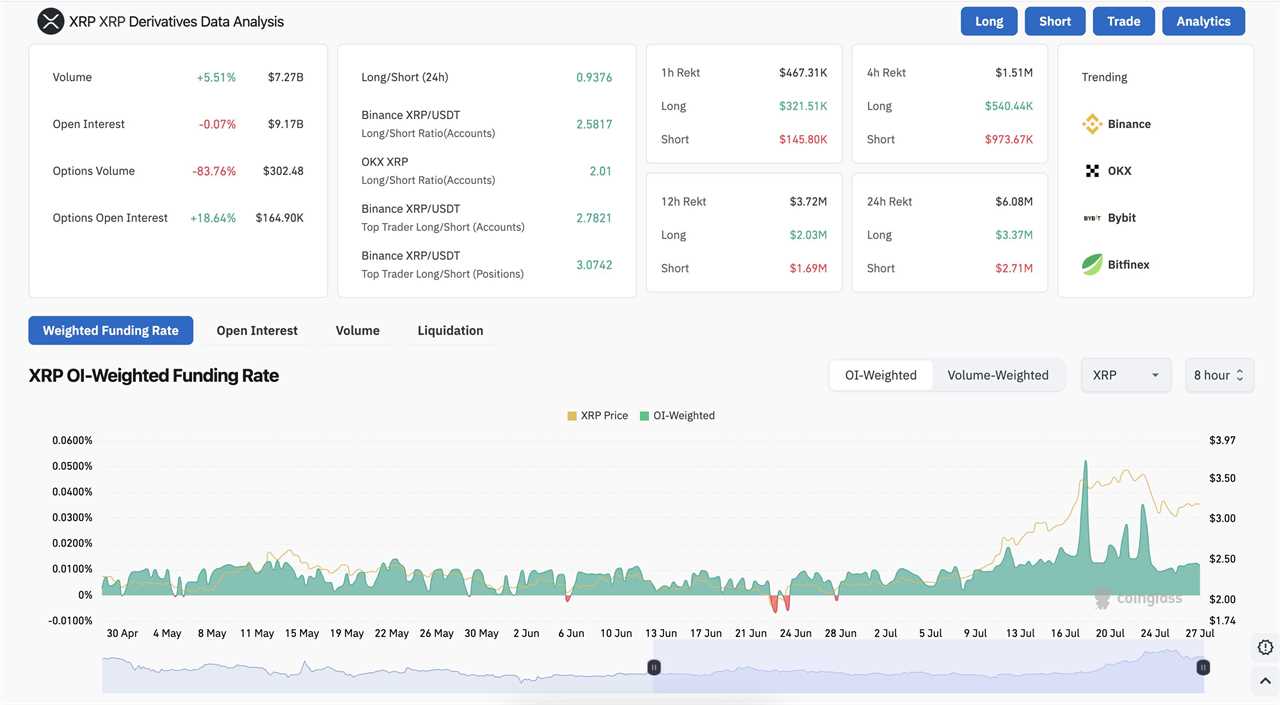

Beyond regulatory filings, the “smart money” in the derivatives market is placing unambiguous bets. According to leading crypto derivatives analytics firm CoinGlass, Futures Open Interest—the total value of all outstanding XRP futures contracts—has surged to a two-year high of $1.8 billion. Crucially, this rise in open interest has been accompanied by a rising XRP price, a classic indicator of new, bullish capital entering the market.

Further evidence from CoinGlass shows the XRP Options Put/Call Ratio has fallen to 0.68, meaning traders are buying significantly more call options (bets on a price increase) than put options. Perhaps most tellingly, options data platform Laevitas reports that Implied Volatility (IV) for contracts expiring around the Q4 SEC decision deadlines has spiked to 95%, indicating that the market is bracing for a massive price move contingent on the news.

Technical and Institutional Drivers Supporting XRP ETF Growth

Regulatory signals, including the pending resolution in the Ripple lawsuit and shifting SEC posture under new leadership, have bolstered confidence in future XRP ETF approvals. XRP prices have rallied as speculators priced in ETF potential and broader mainstream acceptance. Technical analysis shows XRP surpassing key resistance levels, drawing fresh institutional interest.

Additionally, financial media reports highlight multiple filings by 21Shares, Bitwise, WisdomTree, and Canary Capital for spot or futures XRP ETFs—indicating robust institutional positioning ahead of potential approvals. These movements mirror earlier waves that preceded Bitcoin and Ethereum ETF launches.

For more: Altcoin ETFs After Solana – XRP, ADA, AVAX Next in Line

Are XRP ETFs Inevitable?

In late June 2025, the SEC quietly allowed Bitwise’s 10 Crypto Index Fund (BITW), which includes XRP, to convert into an ETF before temporarily halting it for procedural review. Although XRP’s ETF eligibility is not yet live for trading, this approval effectively recognised it. Further, the SEC has shown increasing openness under new leadership and political pressure from Congress to modernize financial innovation frameworks.

Source: James

International regulators are also making moves. Canada’s OSC and Singapore’s MAS are reviewing multiple filings for altcoin ETFs that include XRP, Solana, and Avalanche. If the U.S. leads with XRP ETF approval in Q4 2025, global fund passporting rules may accelerate adoption abroad.

JUST IN: Purpose Investments may have received its final prospectus receipt, potentially clearing the way to launch its $XRP ETF. pic.twitter.com/P3uZx81w7V— John Squire (@TheCryptoSquire) June 16, 2025

Comparative Valuation: XRP vs BTC and ETH ETFs

| Metric | Bitcoin (IBIT) | Ethereum (FBETH) | Hypothetical XRP |

| Launch AUM (90 days) | $55B | $1.3B | Est. $2B |

| Avg. Daily Volume | $1.2B | $220M | Est. $300M |

| Volatility Index | 34% | 42% | 58% |

| Fee Range | 0.20–0.25% | 0.25–0.30% | 0.25–0.35% (est) |

While XRP ETFs are likely to launch with higher volatility and slightly higher fees, they may outperform during bull phases due to asymmetry in upward price elasticity.

XRP ETFs Signal the Next Phase of Crypto Financialization

To summarize, XRP ETF approval appears imminent. Regulatory momentum from SEC guidance and pending legal resolution crops new opportunities. Institutional filings by major investment firms, formal SEC approvals for index products including XRP, and bullish market signals all point toward an official launch later in 2025.

If approved, XRP ETFs are expected to draw substantial capital, tighten circulating supply, and introduce price-stabilizing mechanisms into XRP markets. For investors, these ETFs would combine regulatory security, mainstream access, and thematic exposure—all structured within regulated frameworks similar to Bitcoin and Ethereum.

Given the current environment, XRP ETF approval would not only shape the future of XRP’s own price and adoption but could also pave the way for broader altcoin ETF products. As with BTC and ETH, spots now appear set for a relative mainstream rise—not just digital speculation.

The post Analyzing the Incoming Wave of XRP ETFs in 2025 appeared first on NFT Evening.

Read MoreBy: Liam Miller

Title: Analyzing the Incoming Wave of XRP ETFs in 2025

Sourced From: nftevening.com/xrp-etfs/?utm_source=rss&utm_medium=rss&utm_campaign=xrp-etfs

Published Date: Tue, 29 Jul 2025 10:01:19 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/treehouse-tree-will-be-listed-on-binance-hodler-airdrop

.png)