Are you looking for a simple way to invest in cryptocurrencies? If you answered yes, then investing in the crypto ETFs may be what you’re looking for. Since the US SEC approved spot Bitcoin and spot Ethereum ETFs, a flood of investors has joined the crypto space.

If you’re wondering about the best crypto ETF to buy now, we have you covered. This guide will help you choose the best ETF 2025 and help you find a successful crypto investment.

Types of Crypto ETFs

There are two basic types of cryptocurrency ETFs in the market, namely spot crypto ETFs and crypto futures ETFs. These two track the price of cryptocurrencies in different ways:

Spot Crypto ETFs

- The ETF tracks the real-time price movement of an actual cryptocurrency traded in marketplaces.

- Spot ETFs issue shares based on the amount of crypto in their funds and market demand for the ETF shares.

- They give investors direct exposure to the digital asset compared to other ETFs

- Spot ETFs are ideal for long-term investors seeking an easy way to invest in cryptocurrencies without owning and storing them.

Crypto Futures ETFs

- Crypto futures ETFs track the prices of futures contracts rather than the underlying digital assets.

- The contract involves an agreement between parties to trade crypto at a given price on a predetermined future date.

- The prices of futures ETFs could differ from the actual market price of the underlying cryptocurrency.

List of Cryptocurrency ETFs

- iShares Bitcoin Trust ETF (IBIT): Best for investors seeking convenient exposure to Bitcoin through an ETF product.

- Fidelity Wise Origin Bitcoin Fund (FBTC): Ideal for investors with a high risk appetite solely in Bitcoin.

- Grayscale Bitcoin Mini Trust ETF (BTC): Designed for investors interested in Bitcoin exposure within their investment accounts.

- iShares Ethereum Trust ETF (ETHA): The most popular and liquid of all ETH-based ETFs.

- Global X Blockchain ETF (BKCH): Offers tailor-made portfolio solutions for individual investors.

- ProShares Bitcoin Strategy ETF (BITO): Ideal for investors interested in BTC’s price movement via a regulated ETF structure.

- Global X Bitcoin Covered Call ETF (BCCC): Best for producing high yields in volatile moments and periodic distributions.

- ProShares Ether ETF (EETH): Known for objectively managing Ethereum exposure through futures contracts.

- Volatility Shares 2x Solana ETF (SOLT): Ideal for tactical traders who can amplify risks associated with leveraged exposure on Solana.

- Evolve Cryptocurrencies ETF (TSX: ETX): Ideal for investors seeking daily exposure to price movements of Bitcoin and Ethereum.

10 Best Cryptocurrency ETFs to Buy Now

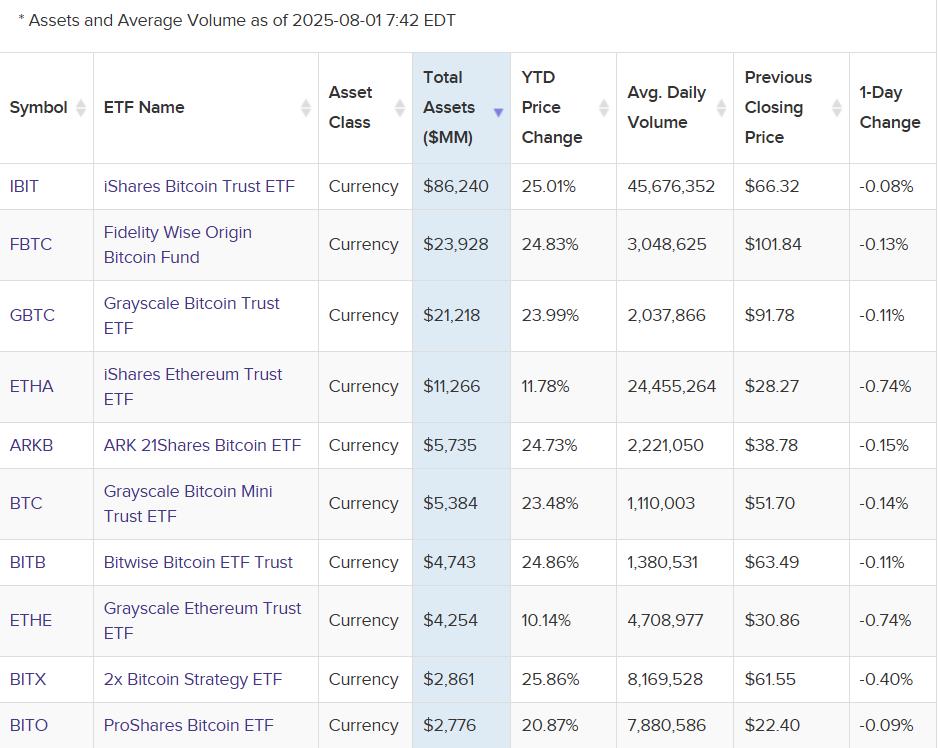

Source: etfdb.com

1. iShares Bitcoin Trust ETF (IBIT)

The iShares Bitcoin Trust ETF (IBIT) is ranked as the best-performing Bitcoin ETF in the history of cryptocurrency ETFs. This is no mean achievement considering SPDR Gold Shares (GLD) needed over 20 years to achieve a similar feat. IBIT is designed to track the New York Variant Index of the CME CF Bitcoin Reference Rate. The fund’s use of Coinbase Prime as its custodian has further added to its appeal among users.

Since its approval by the US Securities and Exchange Commission (SEC), IBIT has given investors an additional investment option. Users can buy or sell their IBIT shares and have access to staggered weekly increments. As a result, investors have access to income-generating opportunities like cash-secured puts and covered calls. The iShares Bitcoin Trust ETF manages over $83.2 billion in assets at 0.25% fees and a 30-day median bid-ask spread of 0.03%

2. Fidelity Wise Origin Bitcoin Fund (FBTC)

Fidelity, a firm with an excellent reputation in the mutual funds and brokerage service sector, operates the Fidelity Wise Origin Bitcoin Fund (FBTC). Like all other Bitcoin-based ETFs, FBTC operates as a grantor trust tracking Fidelity’s bitcoin benchmark complete return index.

Similar to most bitcoin ETFs, it operates as a grantor trust and follows Fidelity’s own Bitcoin Benchmark Total Return Index. The fund provides cryptocurrency exposure and all the fundamentals associated with a typical Bitcoin ETF. The Fidelity Wise Origin Bitcoin Fund manages assets worth over $24.4 billion and charges 0.25% in fees. The product is subject to a 30-day median bid-ask spread of 0.05%

3. Grayscale Bitcoin Mini Trust ETF (BTC)

Since its launch, the Grayscale Bitcoin Mini Trust ETF (BTC) has become a reasonably priced alternative to the Grayscale Bitcoin Trust (GBTC). With assets worth over $5.3 billion under its management, BTC runs a 30-day median bid-ask spread of 0.02% with a service fee of 0.15%. The launch of BTC steadied the outflow, resulting from the high 1.5% expense ratio that saw investors searching for affordability.

To address the challenge, Grayscale used 10% of its GBTC’s assets to create the BTC subsidiary and offered the 0.15% expense ratio. Grayscale Bitcoin Mini Trust ETF manages the same underlying asset as GBTC and tracks the value of Bitcoin. The fund employs state-of-the-art custody and cold storage solutions to secure the crypto assets.

4. iShares Ethereum Trust ETF (ETHA)

If you’re looking for the best crypto ETFs from the world’s second-largest cryptocurrency, then consider the iShares Ethereum Trust ETF. ETHA was in the initial crypto ETF list approved by the SEC and is the largest by assets under management (AUM).

That fund, which also ranks as 100% invested in Ethereum, is offered on a 0.25% expense ratio that ties with most similar funds. Nonetheless, it has the advantage of a reduced fee of 0.12% for the initial $2.5 billion in fund assets. The fee reduction has been running for 12 months, beginning July 2024.

5. Global X Blockchain ETF (BKCH)

The Global X Blockchain ETF (BKCH) leverages the increasing adoption of blockchain technology to invest in leading companies. The target companies include firms in blockchain and cryptocurrency transactions, cryptocurrency mining, and blockchain applications. The fund also targets firms undertaking blockchain and cryptocurrency hardware as well as those involved in digital asset integration.

The BKCH ETF aims to deliver investment results aligned to the target firm’s price and yield performance. The firm currently manages assets worth $191.8 million with an expense ratio of 0.50%. The Global X Blockchain ETF operates on a 30-Day Median Bid-Ask Spread of 0.48%.

6. ProShares Bitcoin Strategy ETF (BITO)

BITO tracks a portfolio of CME-traded Bitcoin futures contracts that are fully backed by collateralized US Treasury bills. The product was initially intended to act as a stop-gap solution before the 2024 licensing of spot Bitcoin ETFs. Before the licensing of crypto ETFs, investors relied on some BITO products to generate cash flow from Bitcoin.

ProShares Bitcoin Strategy ETF stands out because of its monthly income distribution strategy. The monthly payments accrue from profits realized whenever the fund rolls the futures contracts during bull markets. BITO distributes taxable income once a year, leading to the high monthly yields. Nonetheless, the payouts can vary depending on prevailing market conditions.

7. Global X Bitcoin Covered Call ETF (BCCC)

The Global X Bitcoin Covered Call ETF enables users to gain exposure to the real-time price of BTC. The fund prioritizes high-income potential and offers periodic distributions of earnings. BCCC employs a synthetic covered call strategy that traces US-listed futures and spot-based Bitcoin futures.

The fund operates a buy-write or covered-call strategy that exposes users to Bitcoin exchange-traded products (ETPs). The fund then “writes” or “sells” corresponding call options on the bitcoin ETPs. BCCC primarily aims to provide current income to users, besides offering exposure to the ROI of more Bitcoin ETPs.

8. ProShares Ether ETF (EETH)

The ProShares Ether ETF (EETH) invests in ETH futures contracts, where it mirrors the cryptocurrency’s performance. It does this via standard futures contracts on the Chicago Mercantile Exchange (CME). The fund invests using USD cash-settled Ether future contracts based on back-month contracts.

EETH maintains its exposure to ETH by constantly replacing expired futures contracts with new ones with future expiration dates. The fund also uses proceeds accruing from reverse purchase agreements as leverage to ensure it meets the targeted level of exposure. New investments into the fund are capped at 25% at the end of every quarter.

9. Volatility Shares 2x Solana ETF (SOLT)

Volatility Shares 2x Solana ETF (SOLT) achieves the fund’s investment objective by offering exposure to SOL futures contracts. The fund targets contracts trading on exchanges that are duly registered with the Commodity Futures Trading Commission (CFTC).

SOLT trades using cash, cash-like instruments, and high-level securities serving as collateral to its futures contracts. The fund is a leveraged ETF that seeks results that align with a daily performance score of over 200% of the Solana network. SOLT’s total expense ratio is 1.85% and it pays a dividend once annually.

10. Evolve Cryptocurrencies ETF (TSX: ETX)

Evolve Cryptocurrencies ETF is a Canadian-based fund that manages assets worth over C$61.35 million. Launched in 2021, it became among the first ETFs to combine Bitcoin and Ether exposure under one roof. The fund allows investors to diversify their portfolios easily and offers exposure to both cryptocurrencies.

Users are allowed to make choices based on market capitalization, and they can switch portfolios monthly. The fund doesn’t charge management fees. However, the underlying funds holding the assets charge a 0.75% fee plus applicable taxes.

Comparison of Top Crypto ETFs

| ETF Name | Ticker | Exposure | Expense ratio |

| iShares Bitcoin Trust ETF | IBIT) | Bitcoin | 0.25% |

| Fidelity Wise Origin Bitcoin Fund | FBTC | Bitcoin | 0.25% |

| Grayscale Bitcoin Mini Trust ETF | BTC | Bitcoin | 0.15%. |

| iShares Ethereum Trust ETF | ETHA | Ether | 0.25% |

| Global X Blockchain ETF | BKCH | Bitcoin | 0.5% |

| ProShares Bitcoin Strategy ETF | BITO | Bitcoin | 0.95% |

| Global X Bitcoin Covered Call ETF | BCCC | Bitcoin | 0.65% |

| ProShares Ether ETF | EETH | Ether | 0.95% |

| Volatility Shares 2x Solana ETF | SOLT | Solana | 1.85% |

| Evolve Cryptocurrencies ETF | TSX: ETX | Bitcoin/Ether | 0.75% |

Conclusion: Are crypto ETFs worth it?

Are you an investor seeking to diversify your portfolio but unwilling to deal with the intricacies of direct crypto investment? Consider crypto ETFs as an alternative way of getting indirect exposure to crypto investments. Because they are highly regulated, investing in crypto ETFs can bring many tangible benefits.

ETFs provide an easy way to invest in cryptocurrencies through trusted traditional platforms. You can choose between ETFs that track single crypto assets or use one that combines multiple cryptocurrencies. The best thing about investing in cryptocurrency exchange-traded funds is the sense of security they offer. You no longer have to worry about managing your wallet or losing private keys.

Since they’re traded on regulated markets, Bitcoin ETFs introduce oversight, transparency, and investor protection. The growth of the segment may well be the missing link to wider cryptocurrency adoption. This may be what has made them so attractive to both retail and institutional investors.

FAQs

What is the best crypto ETF to buy?

IBIT, the world’s largest Bitcoin ETF, is ranked as the best crypto ETF in the market. The funds’ dominance has further grown following the passage of the GENIUS Act in the US.

Which crypto ETF is best in Canada?

Canada was the first country globally to license crypto ETFs back in February 2021. The Purpose Bitcoin ETF and the CI Galaxy Bitcoin ETF are among the most popular funds with Canadian investors.

Is there a 3x leveraged bitcoin ETF?

The Leverage Shares -3x Short Bitcoin BTC ETP operates an exchange-traded note that aims to provide a -3x Leveraged Exposure to Bitcoin. The product holds short positions in BTC futures contracts and a micro-Bitcoin futures contract on the CME.

Does BlackRock have a crypto ETF?

Yes, BlackRock operates the iShares Bitcoin Trust (IBIT), the largest Bitcoin exchange-traded fund on the market.

What is the largest crypto ETF?

BlackRock’s iShares Bitcoin Trust (IBIT) is currently ranked as the largest Bitcoin ETF in the market. The fund manages over $70 billion worth of assets, marking a milestone accomplishment.

Is there a crypto ETF?

There are numerous crypto ETFs, or cryptocurrency exchange-traded funds. They represent a creative way of blending the dynamic world of cryptocurrencies with traditional ETF structures. However, instead of tracking commodities, indices, or baskets of assets, crypto ETFs focus on cryptocurrencies.

The post 10 Best Crypto ETFs to Buy in 2025 appeared first on NFT Evening.

Read MoreBy: Amit Chahar

Title: 10 Best Crypto ETFs to Buy in 2025

Sourced From: nftevening.com/best-crypto-etfs/?utm_source=rss&utm_medium=rss&utm_campaign=best-crypto-etfs

Published Date: Sun, 03 Aug 2025 14:59:47 +0000

----------------------------

Did you miss our previous article...

https://trendingincrypto.com/nft-news/want-passive-income-from-betting-sites-spartans-referral-dashboard-is-built

.png)